Scale Invariance Research: Consolidated Report

Complete End-to-End Analysis with Live Data

Generated: 2025-11-09 20:42:33

Abstract

This report presents a comprehensive scale invariance analysis across multiple assets.

Data Sources:

All financial data downloaded LIVE from Yahoo Finance API

NO hardcoded data points

ALL data cached locally for reproducibility

Total Assets Analyzed: 19

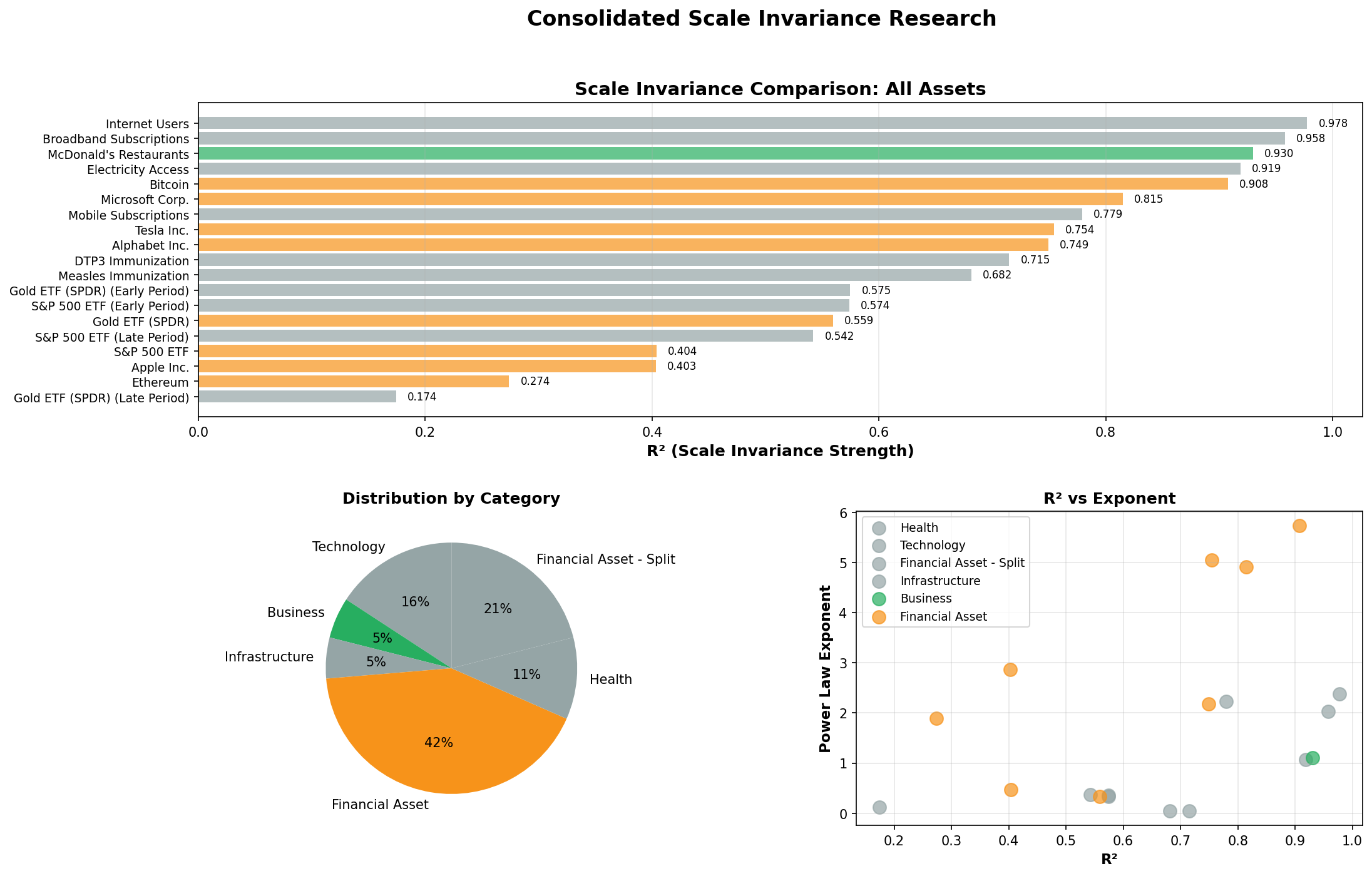

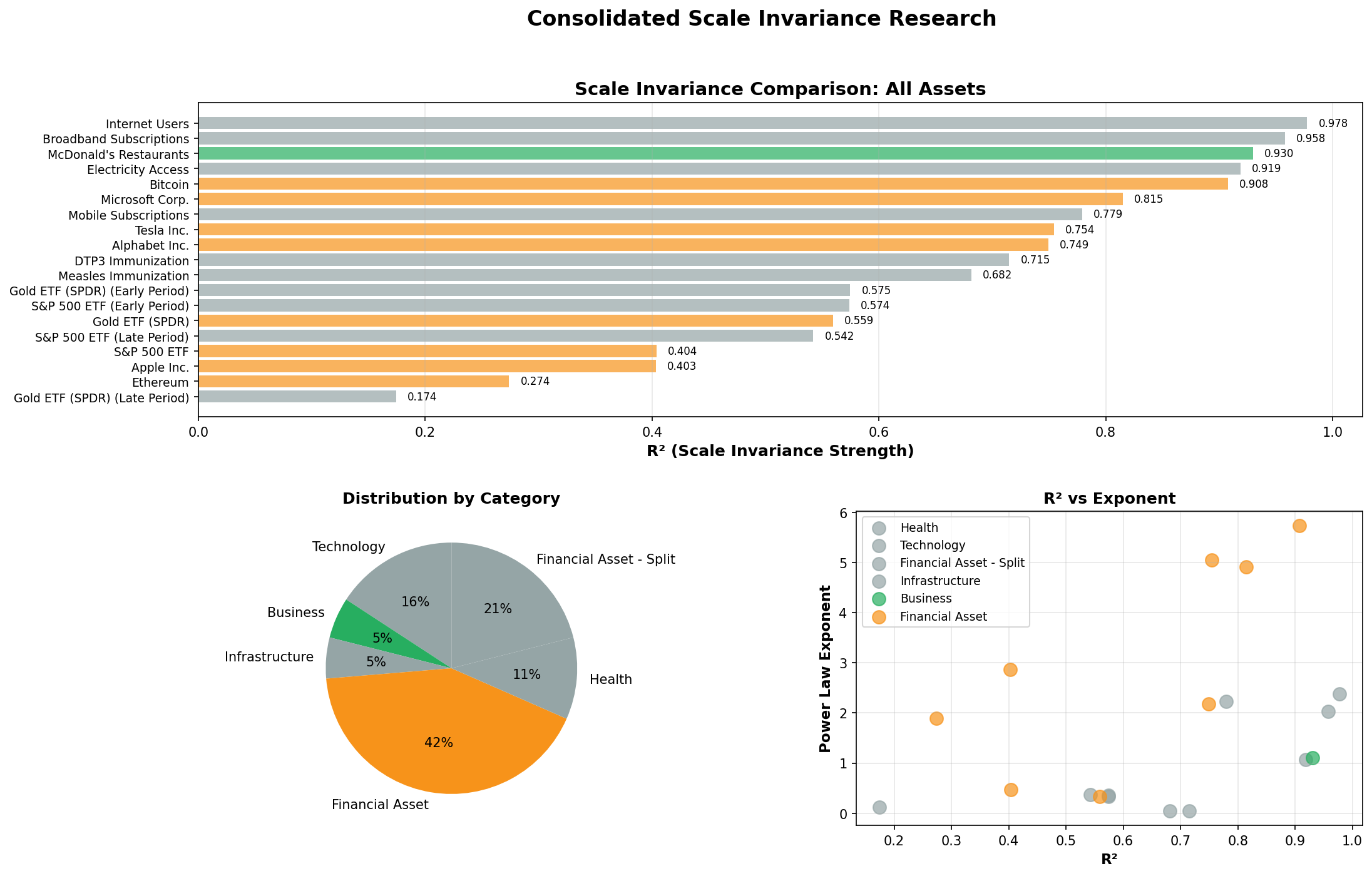

Overall Comparison

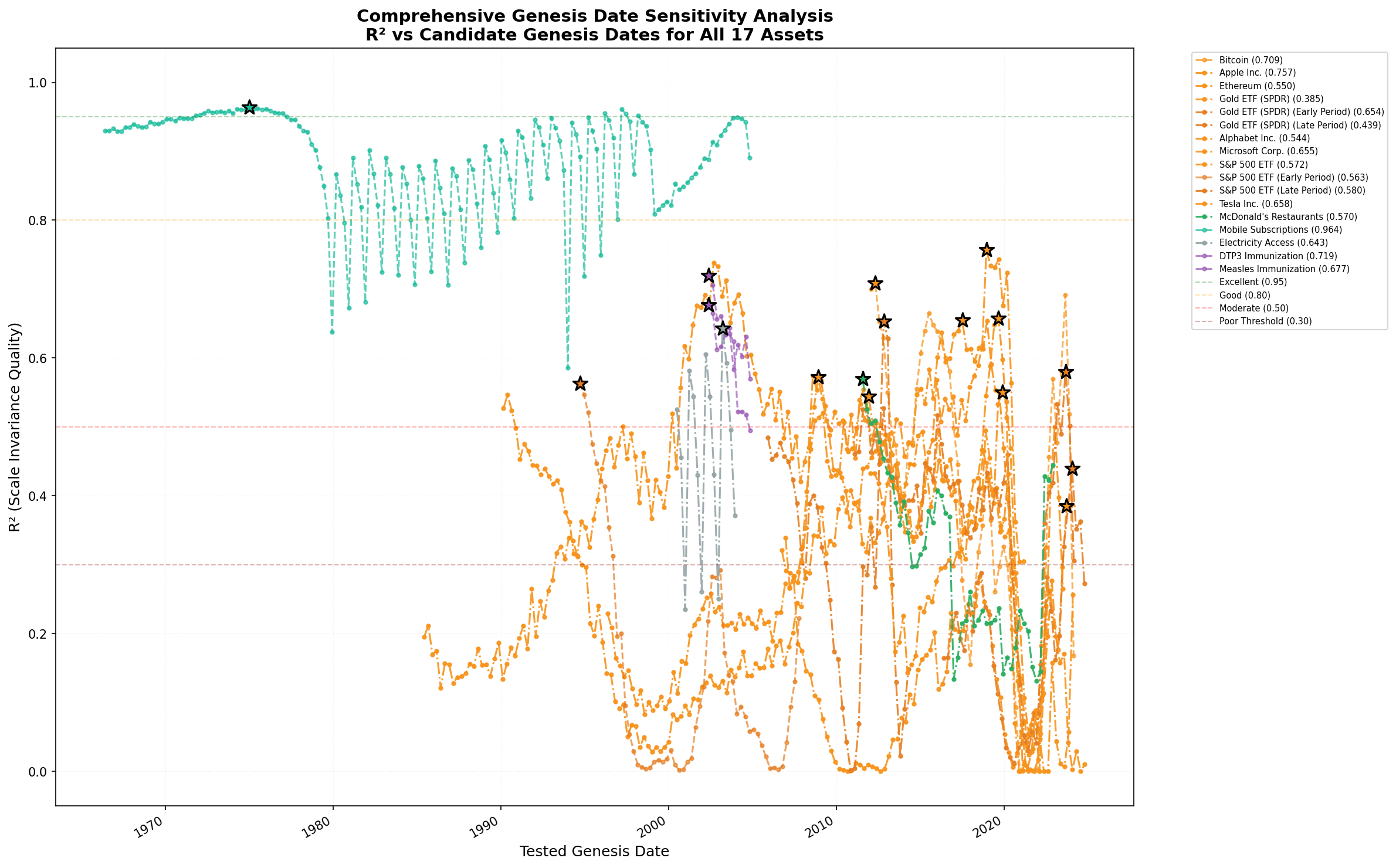

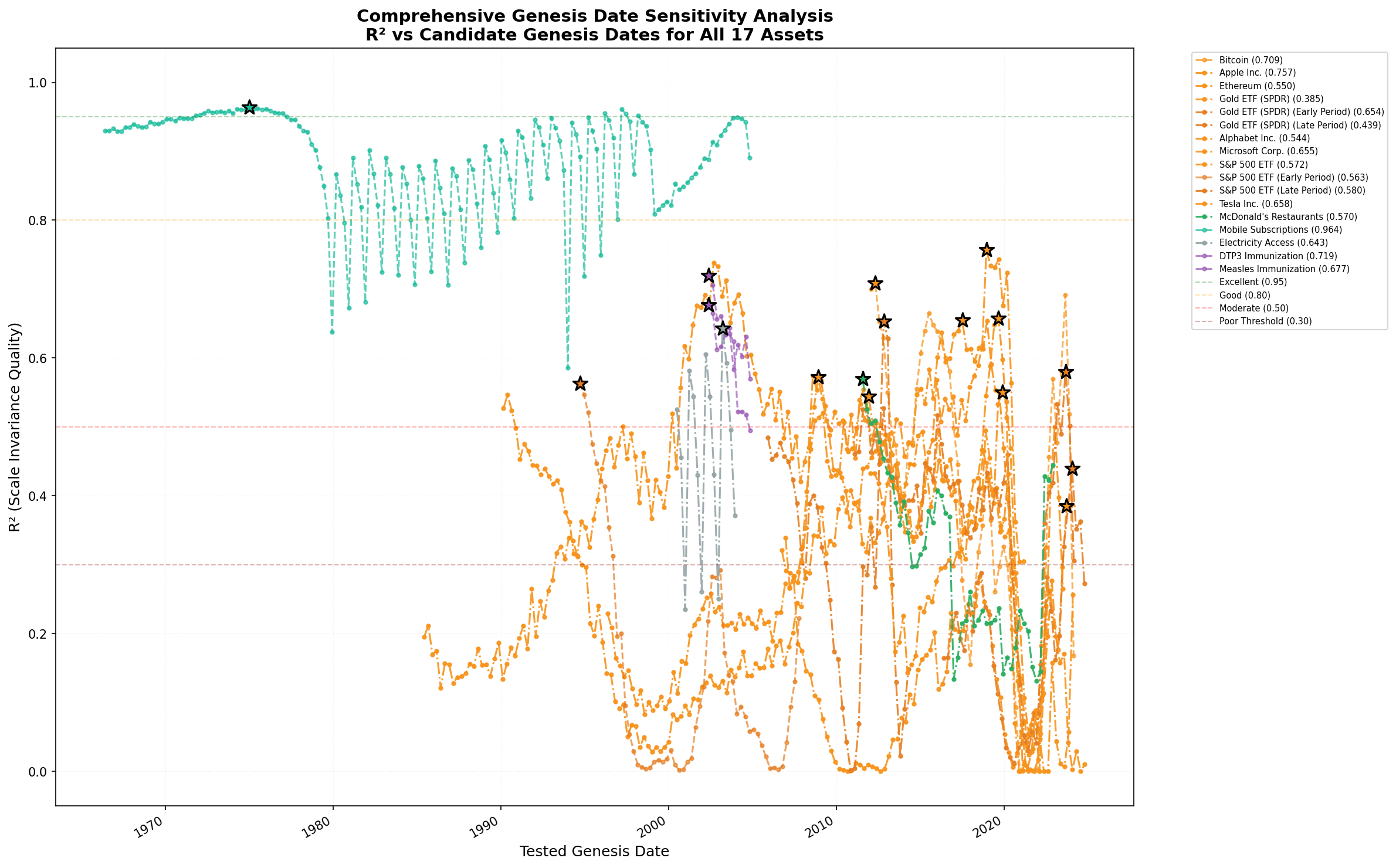

Genesis Sensitivity Overview

Scale invariance strength varies with the assumed genesis date. The chart below shows how R² responds across all tested dates for each asset where genesis optimization was performed.

Summary Table

| Asset |

Category |

R² |

Exponent |

Pattern |

Points |

Date Range |

Genesis |

Source |

| Internet Users |

Technology |

0.9776 |

2.38 |

⚡ Power-law |

20 |

2005-01-01 to 2024-01-01 |

1983-01-01 (Provided) |

World Bank API (IT.NET.USER.ZS) |

| Broadband Subscriptions |

Technology |

0.9580 |

2.03 |

⚡ Power-law |

20 |

2005-01-01 to 2024-01-01 |

1990-01-01 (Provided) |

World Bank API (IT.NET.BBND.P2) |

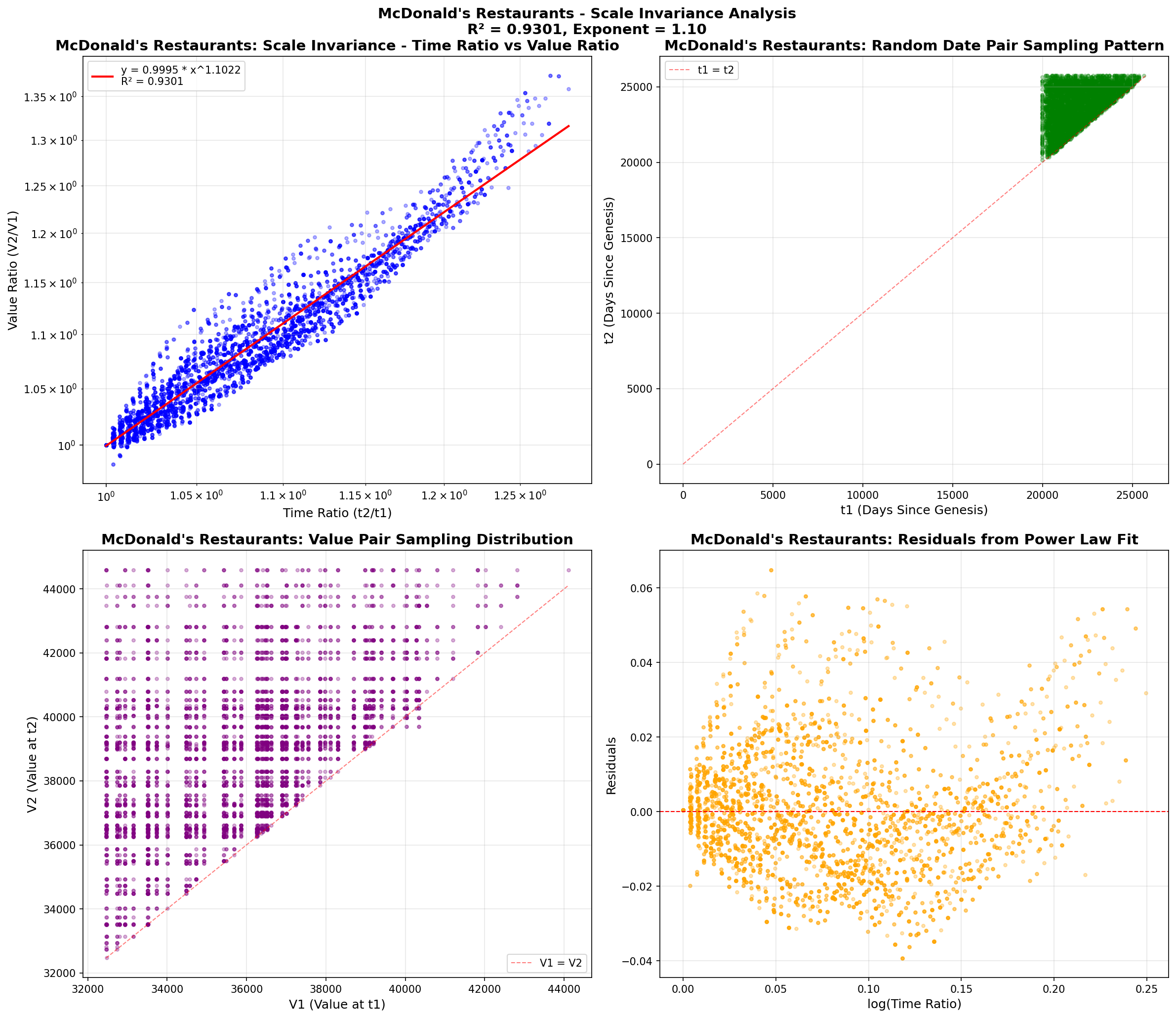

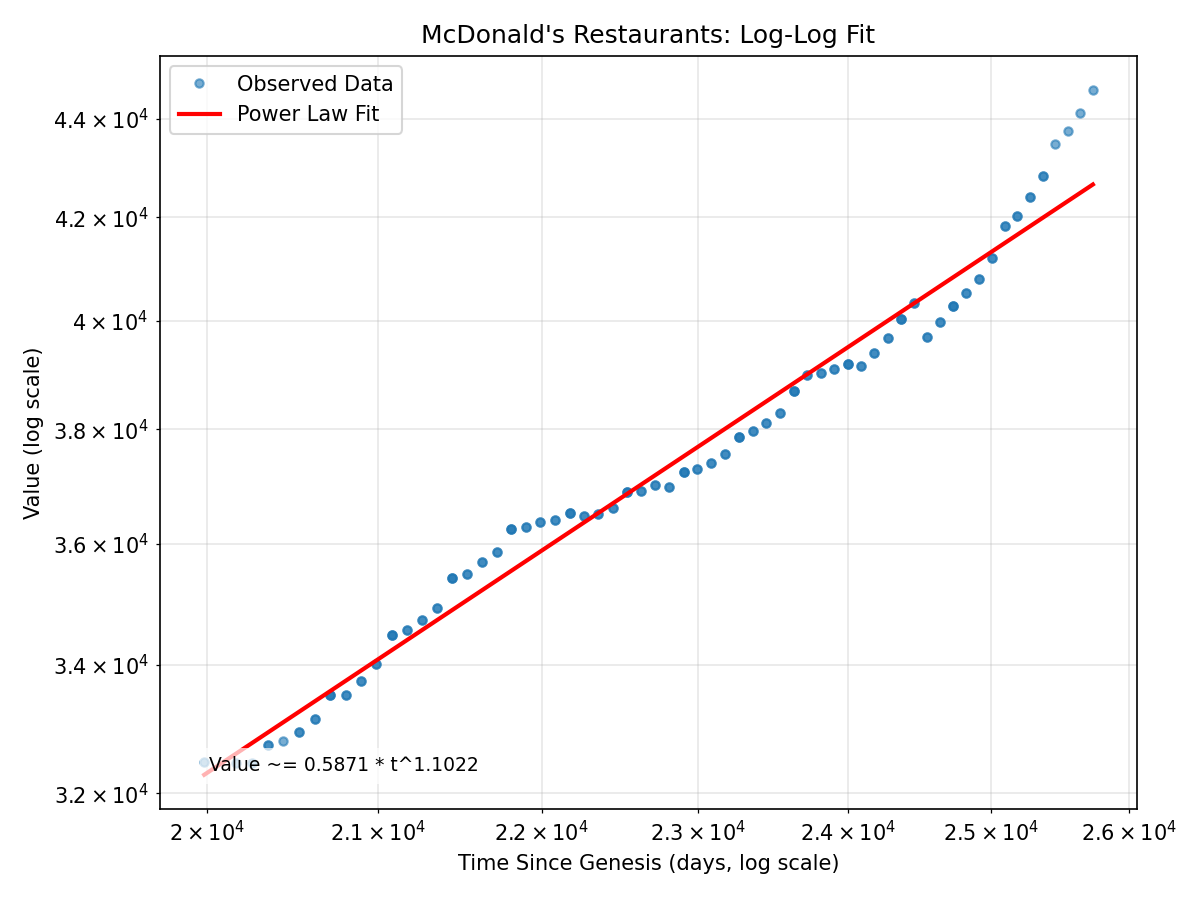

| McDonald's Restaurants |

Business |

0.9301 |

1.10 |

⚡ Power-law |

130 |

2009-12-31 to 2025-09-30 |

1955-04-15 (Provided) |

Downloaded from SEC EDGAR (CIK: 0000063908), us |

| Electricity Access |

Infrastructure |

0.9188 |

1.06 |

⚡ Power-law |

26 |

1998-01-01 to 2023-01-01 |

1880-01-01 (Provided) |

World Bank API (EG.ELC.ACCS.ZS) |

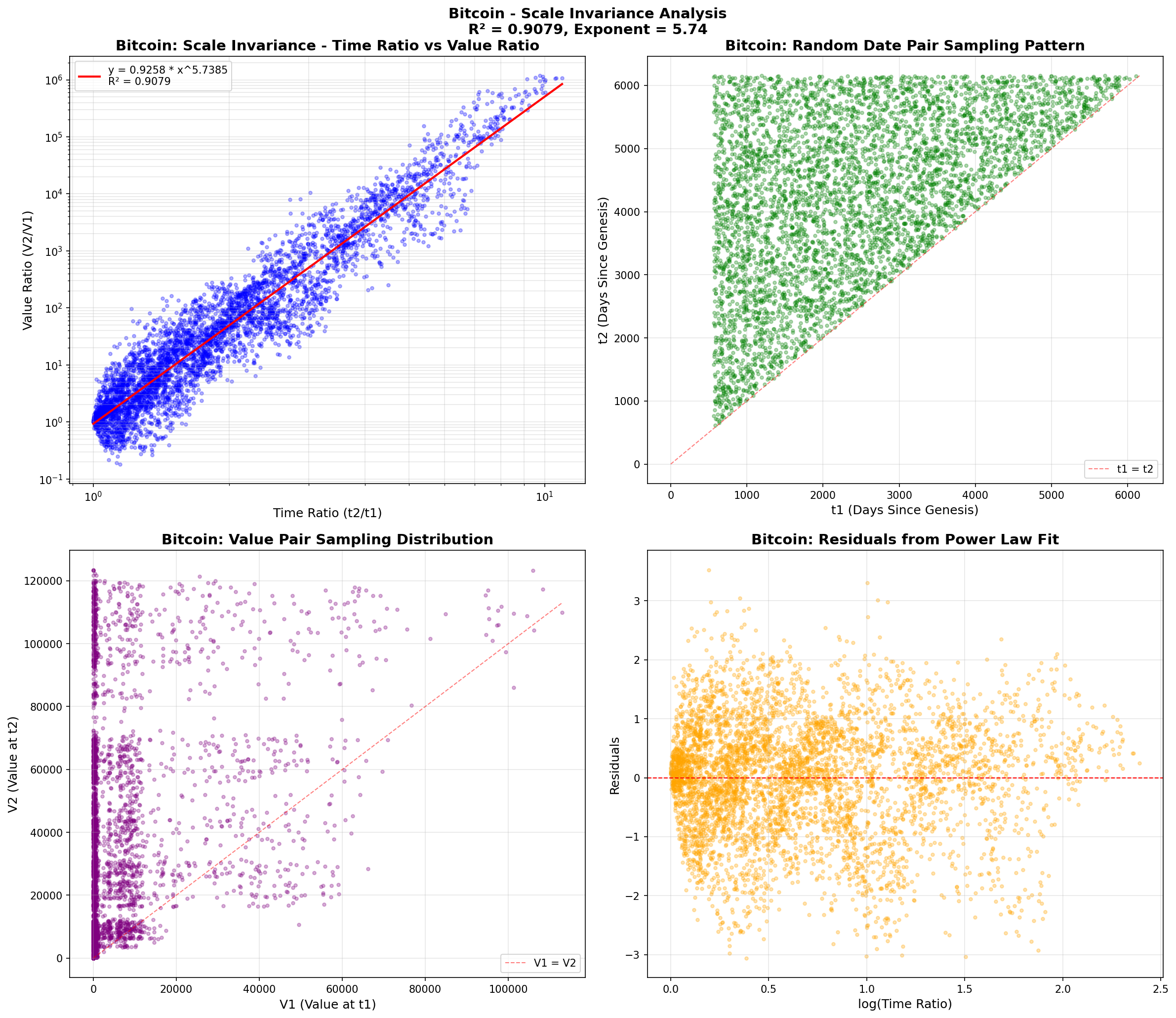

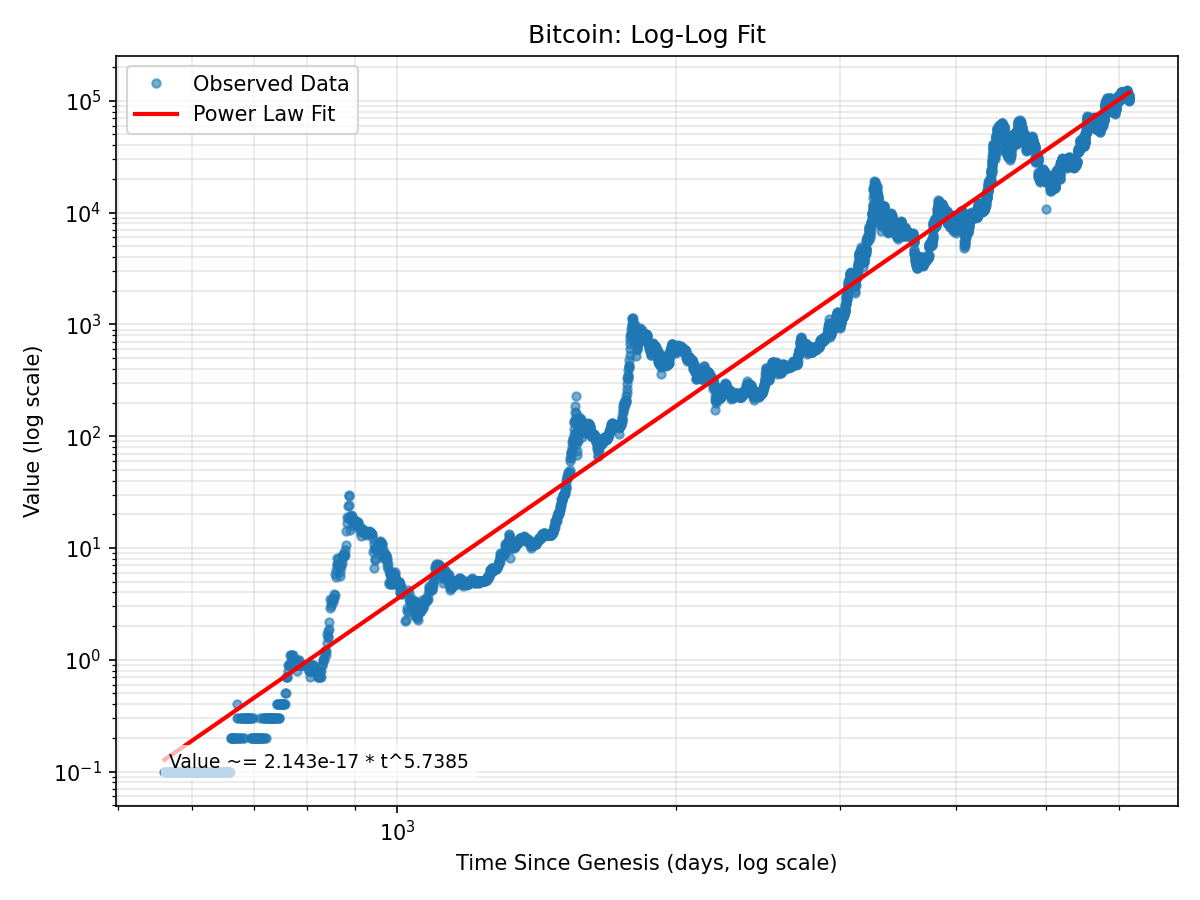

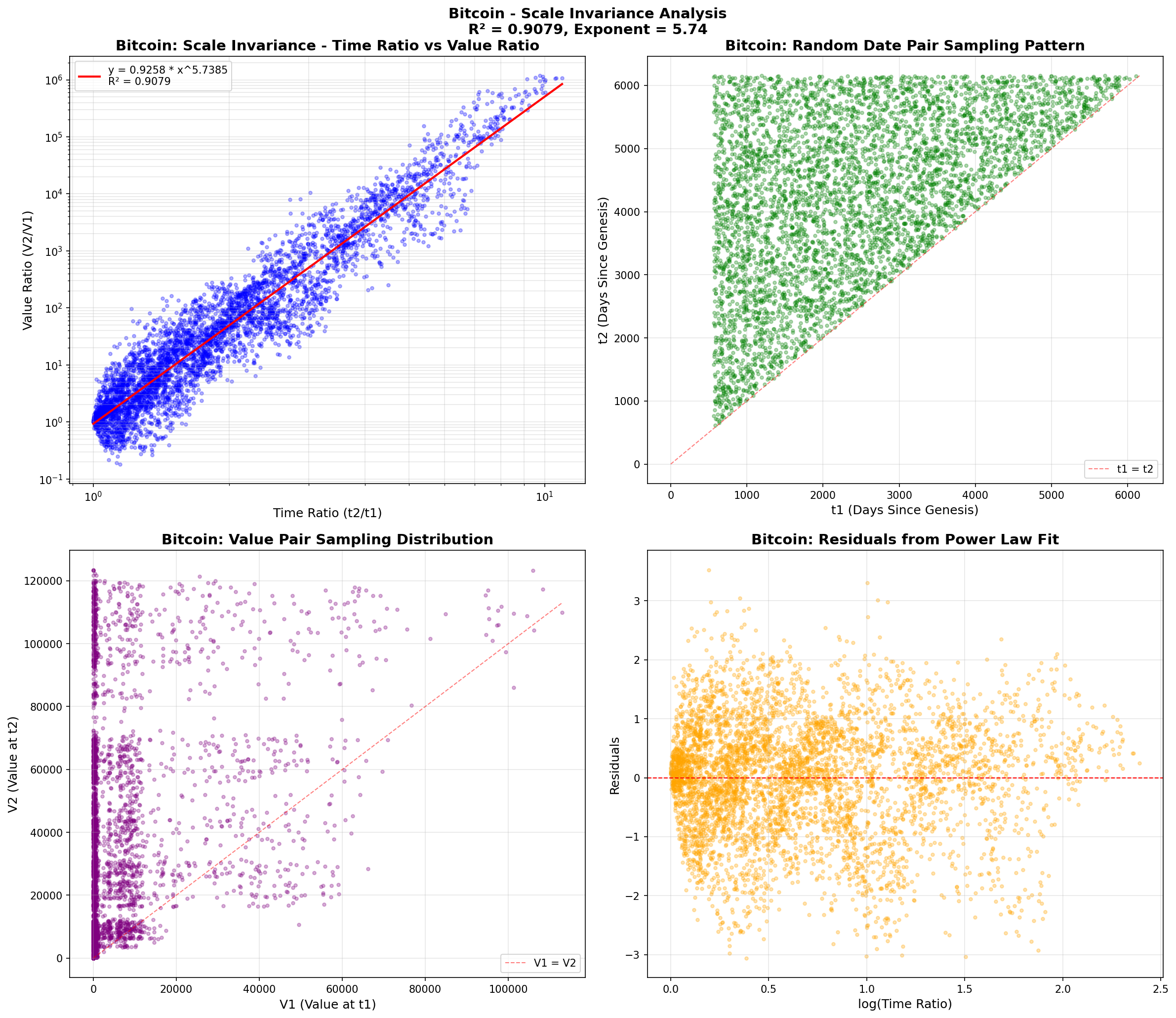

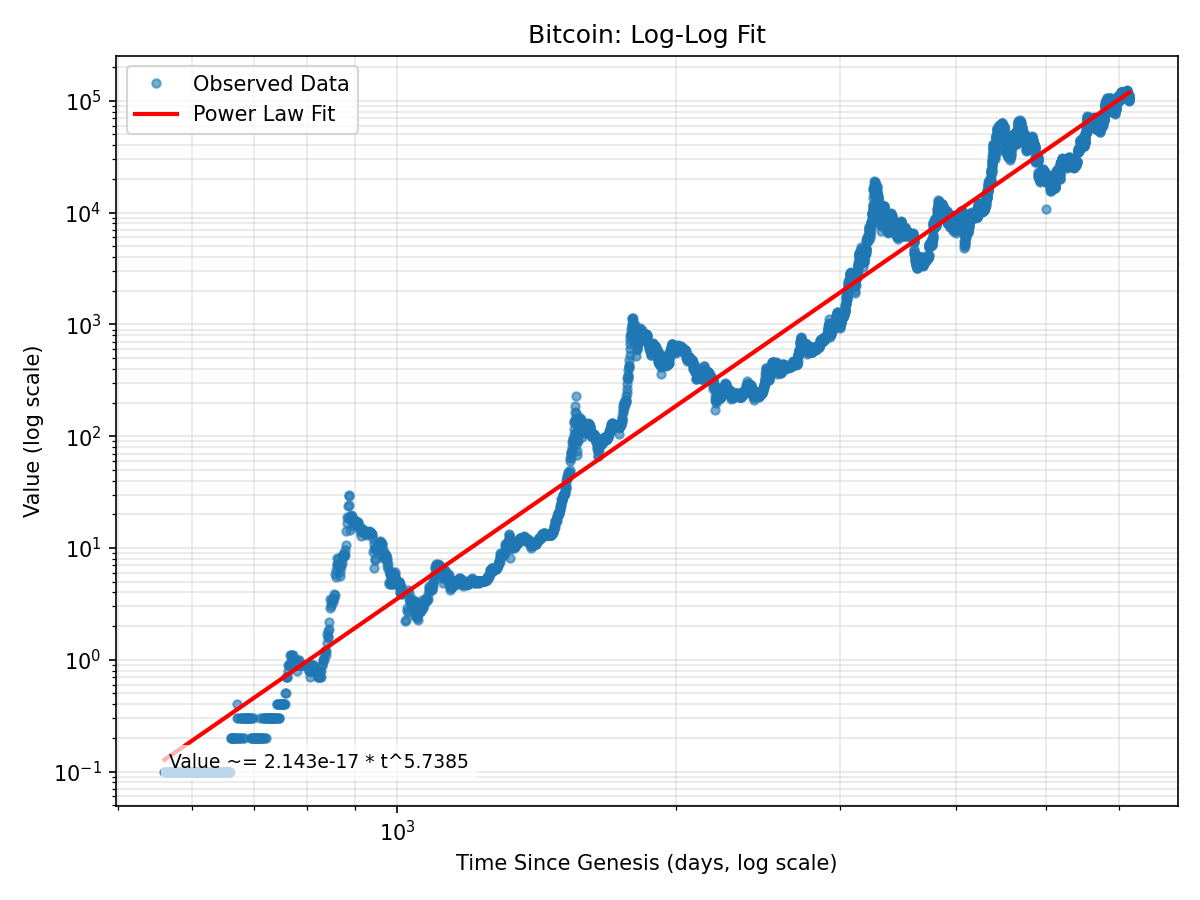

| Bitcoin |

Financial Asset |

0.9079 |

5.74 |

⚡ Power-law |

5566 |

2010-07-18 to 2025-11-09 |

2009-01-03 (Provided) |

btcpricehistory.csv (repository data) |

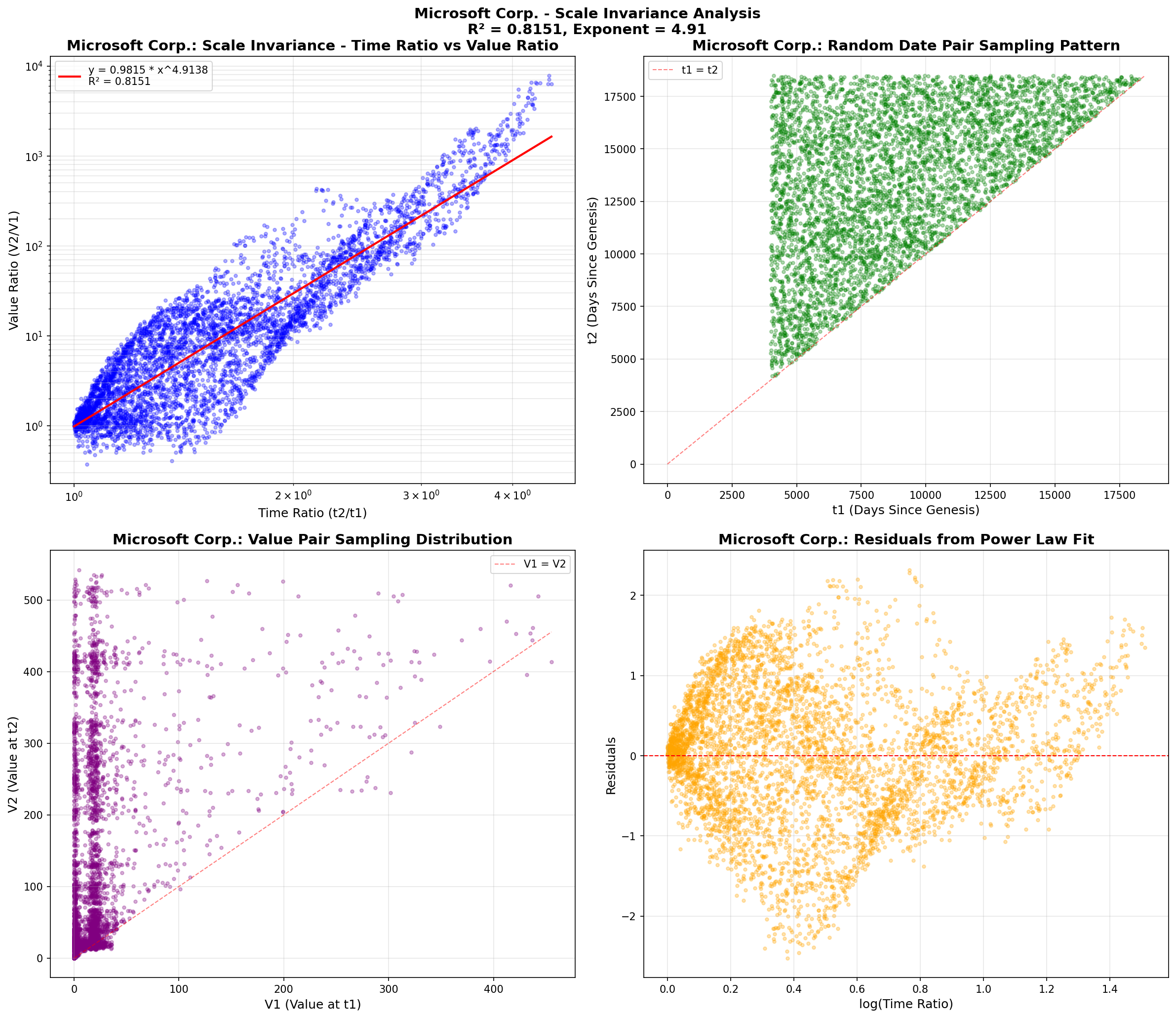

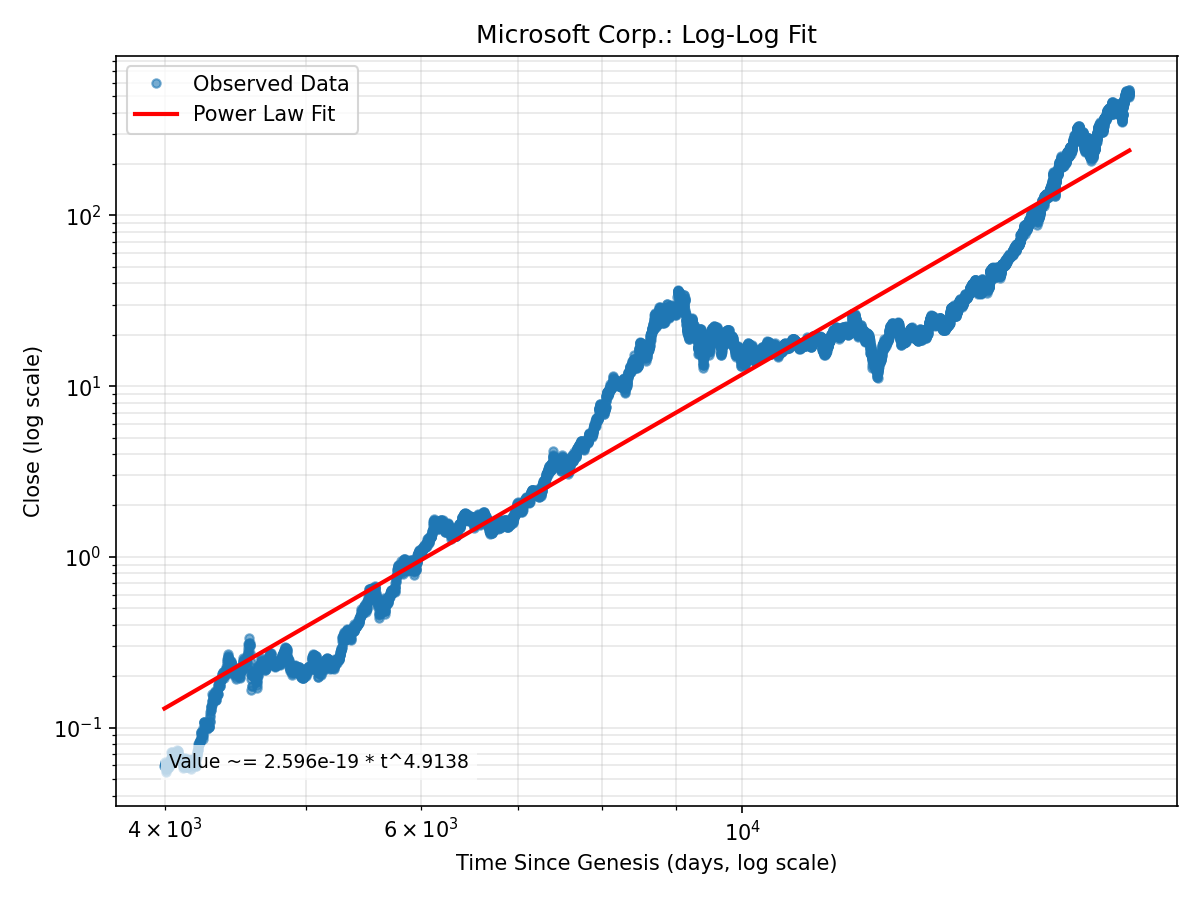

| Microsoft Corp. |

Financial Asset |

0.8151 |

4.91 |

⚡ Power-law |

9993 |

1986-03-13 to 2025-11-07 |

1975-04-04 (Provided) |

Yahoo Finance API (yfinance Python library) |

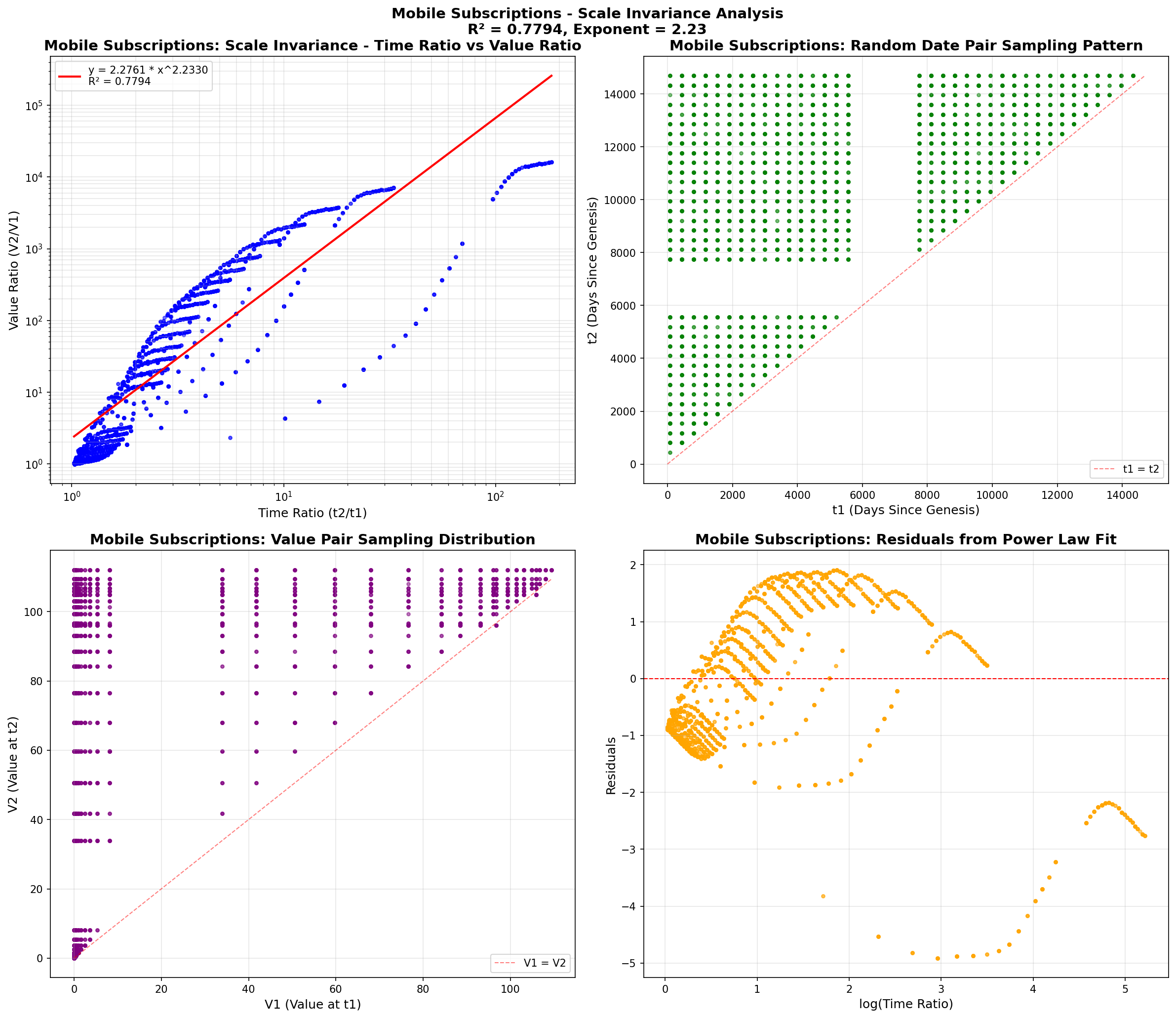

| Mobile Subscriptions |

Technology |

0.7794 |

2.23 |

✅ Saturated (103%) |

36 |

1984-01-01 to 2024-01-01 |

1983-10-13 (Provided) |

World Bank API (IT.CEL.SETS.P2) |

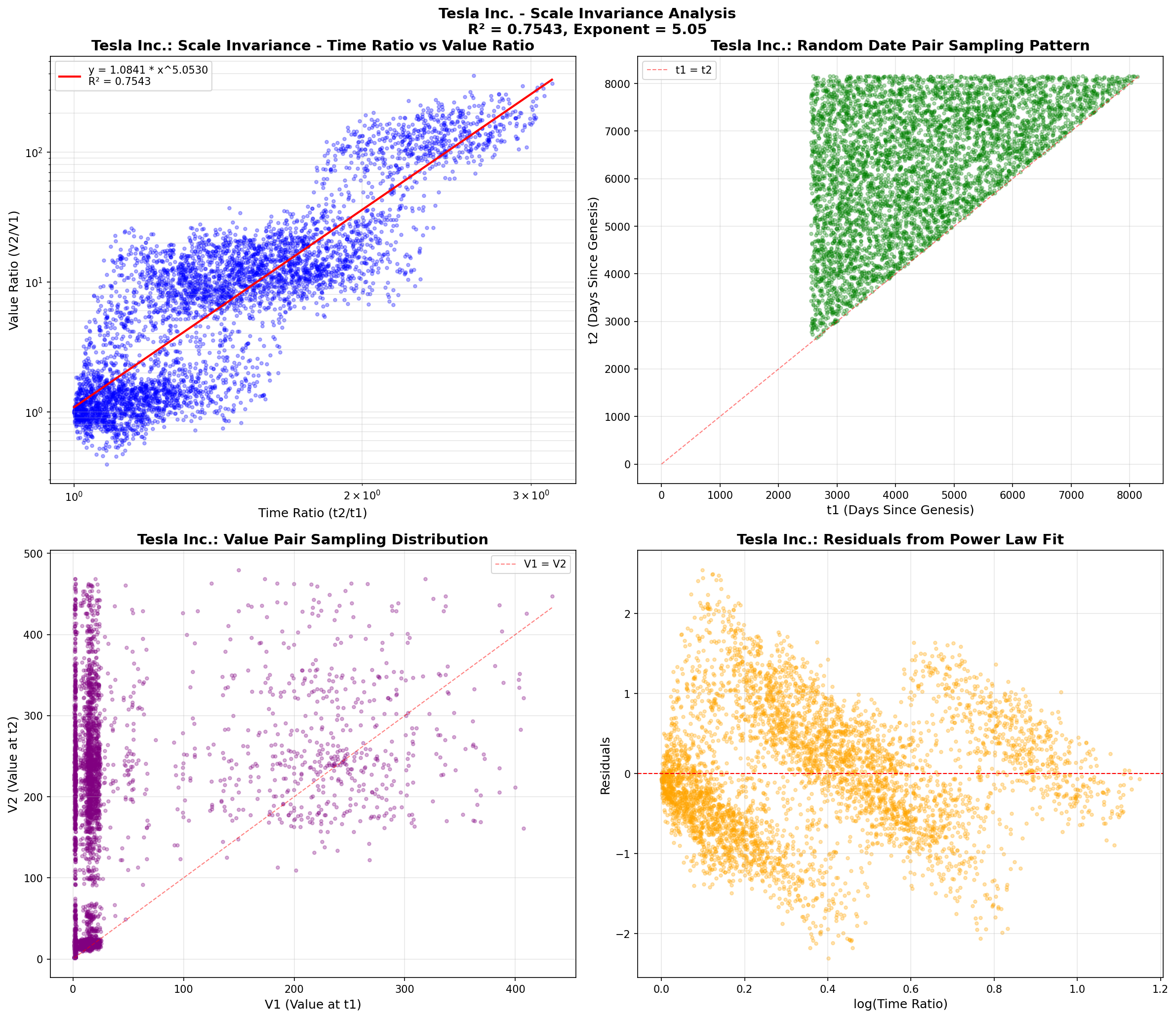

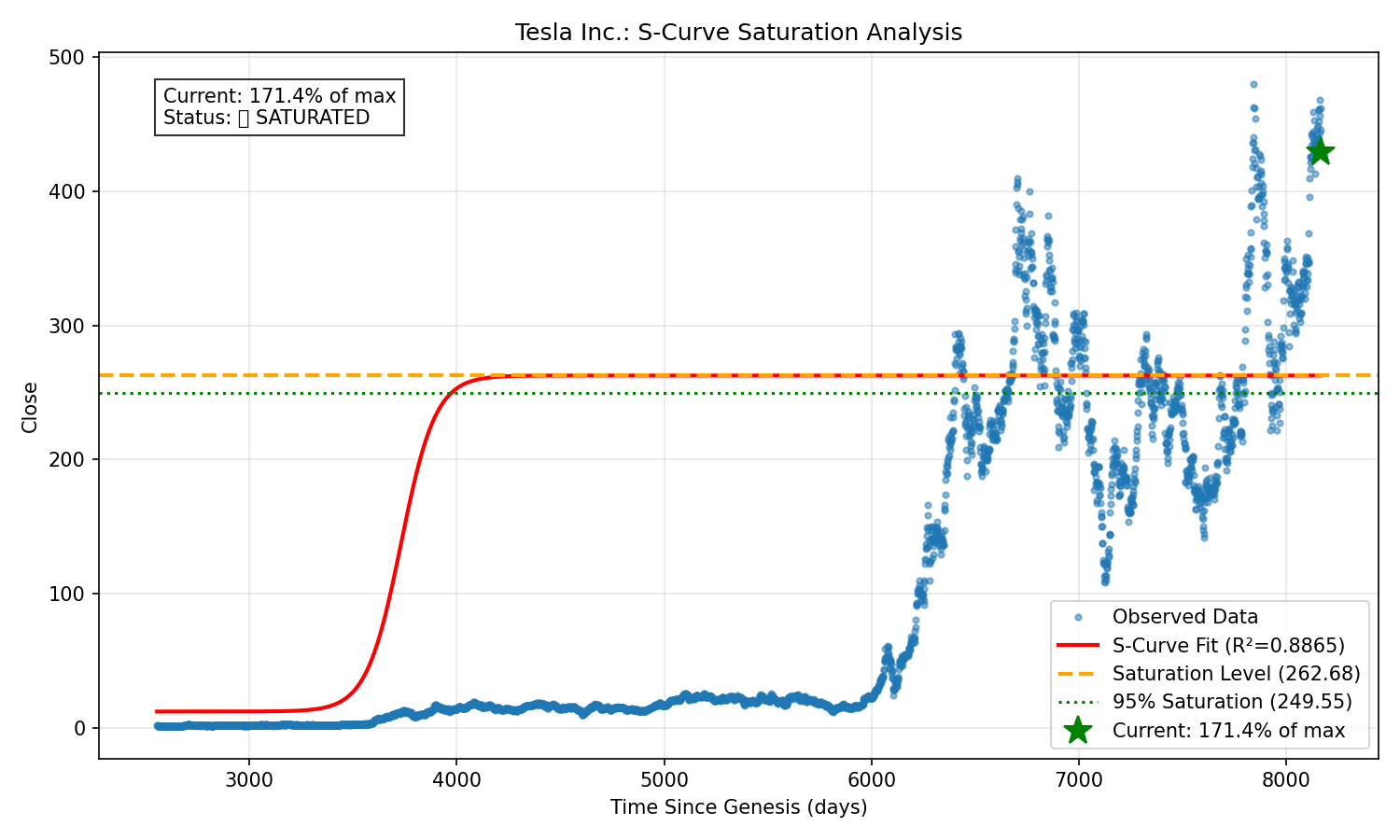

| Tesla Inc. |

Financial Asset |

0.7543 |

5.05 |

✅ Saturated (171%) |

3866 |

2010-06-29 to 2025-11-07 |

2003-07-01 (Provided) |

Yahoo Finance API (yfinance Python library) |

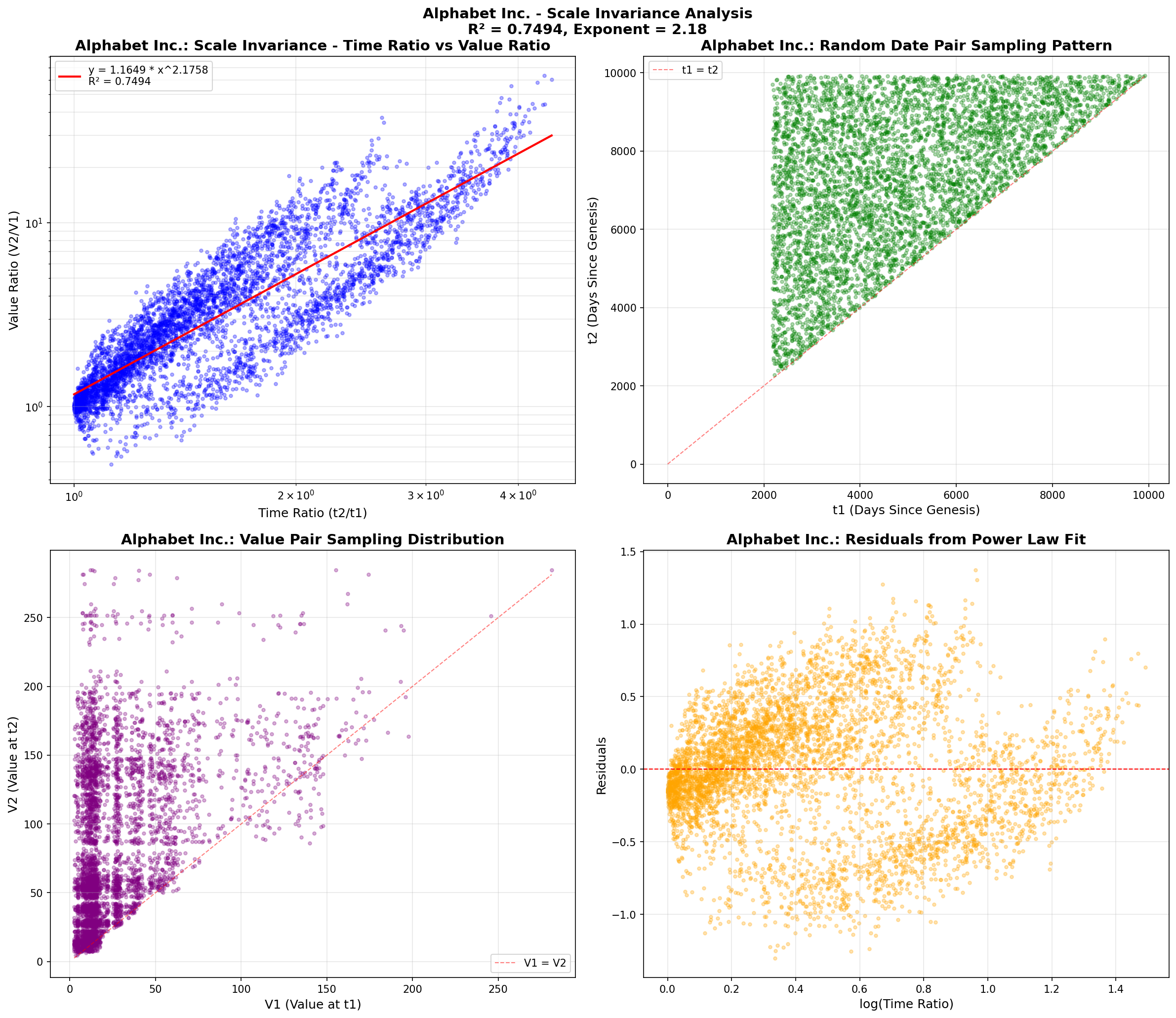

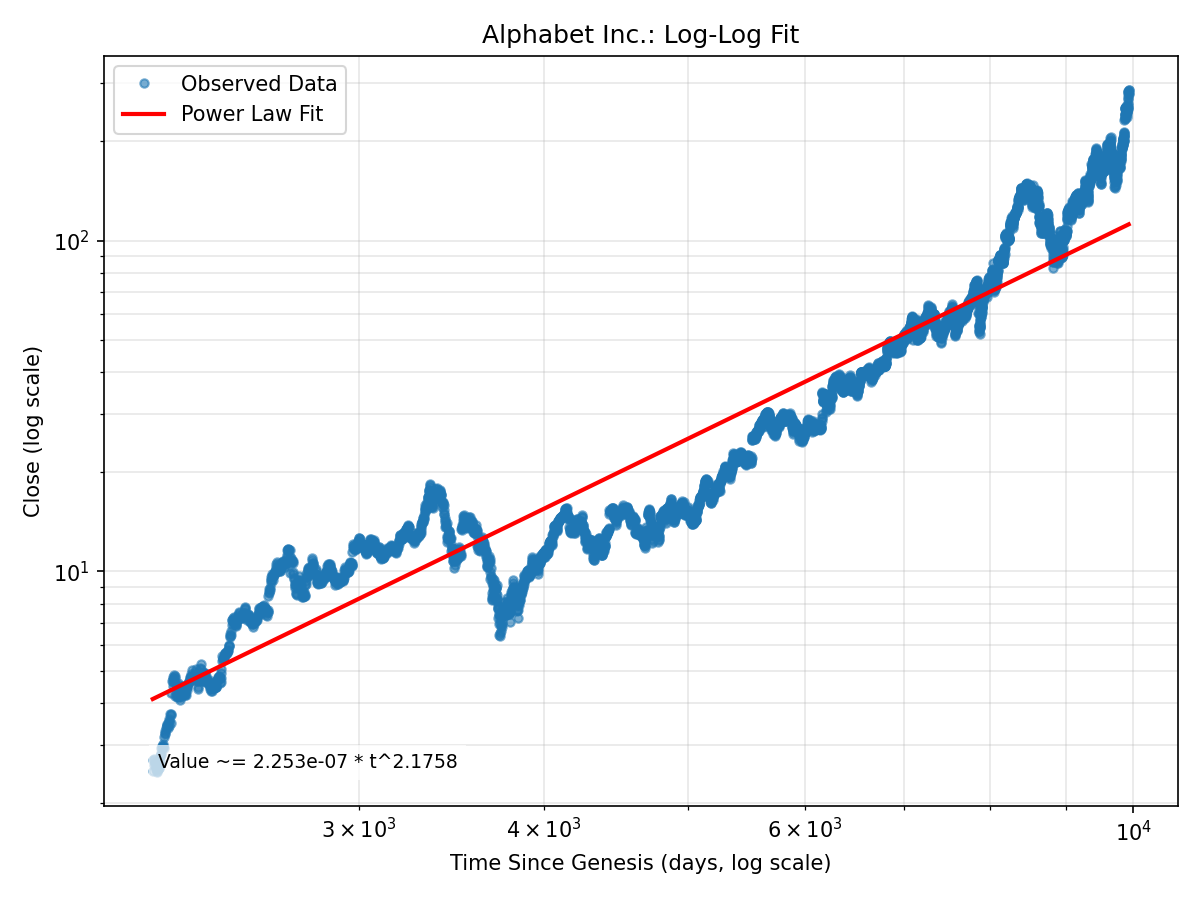

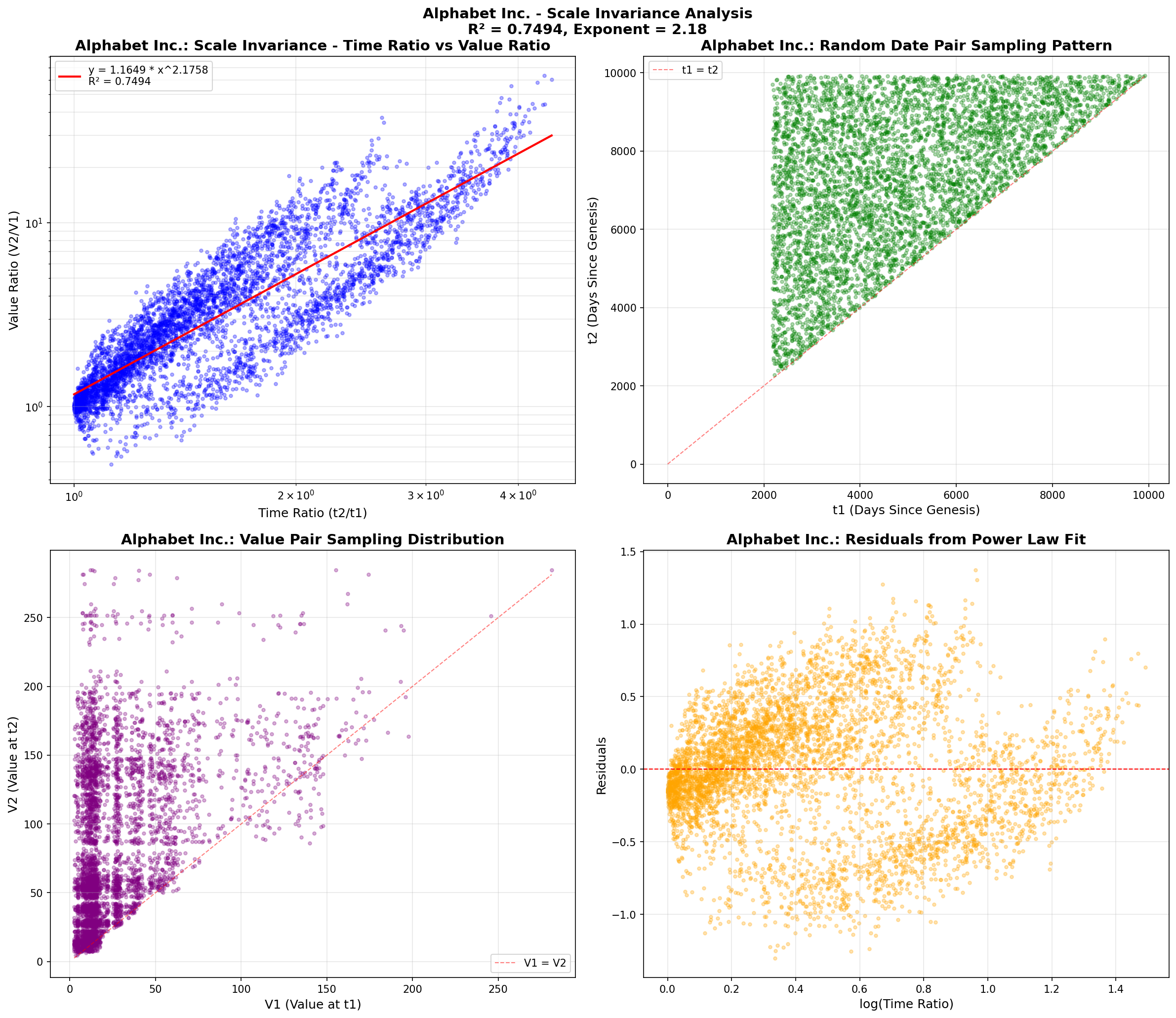

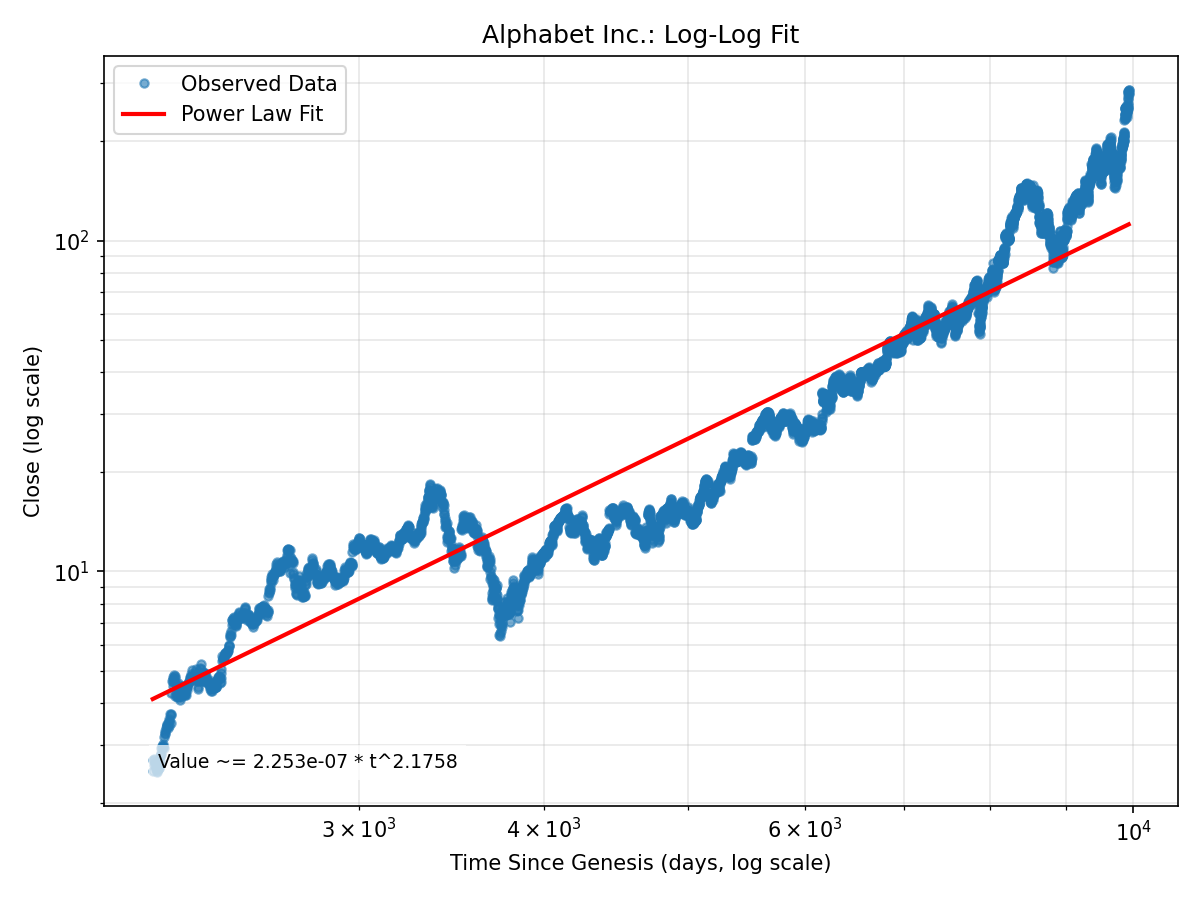

| Alphabet Inc. |

Financial Asset |

0.7494 |

2.18 |

⚡ Power-law |

5341 |

2004-08-19 to 2025-11-07 |

1998-09-04 (Provided) |

Yahoo Finance API (yfinance Python library) |

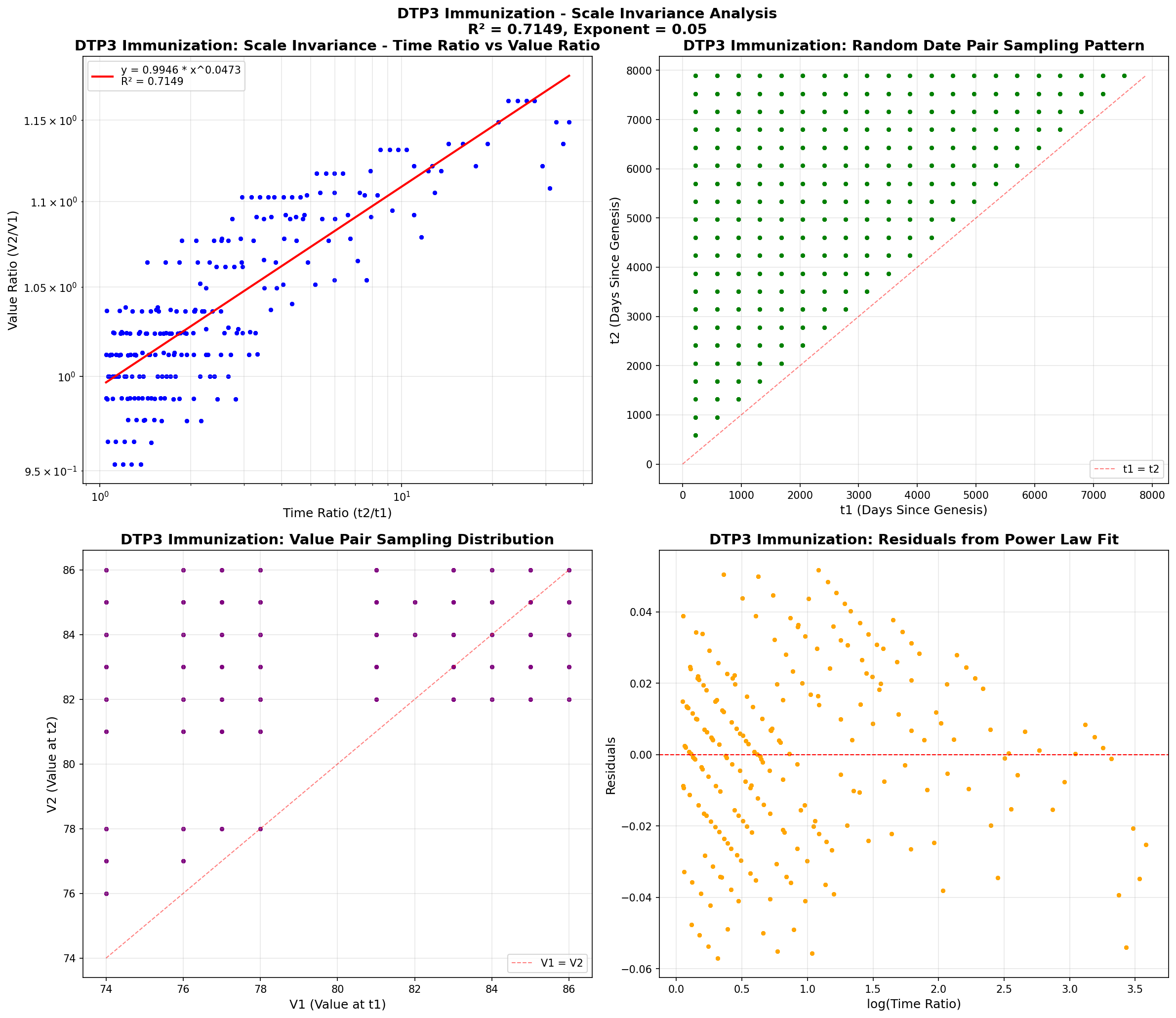

| DTP3 Immunization |

Health |

0.7149 |

0.05 |

✅ Saturated (757%) |

22 |

2003-01-01 to 2024-01-01 |

2002-05-26 (Optimized vs published) |

WHO API (WHS4_100) |

| Measles Immunization |

Health |

0.6815 |

0.04 |

✅ Saturated (735%) |

22 |

2003-01-01 to 2024-01-01 |

2002-05-26 (Optimized vs published) |

WHO API (WHS4_544) |

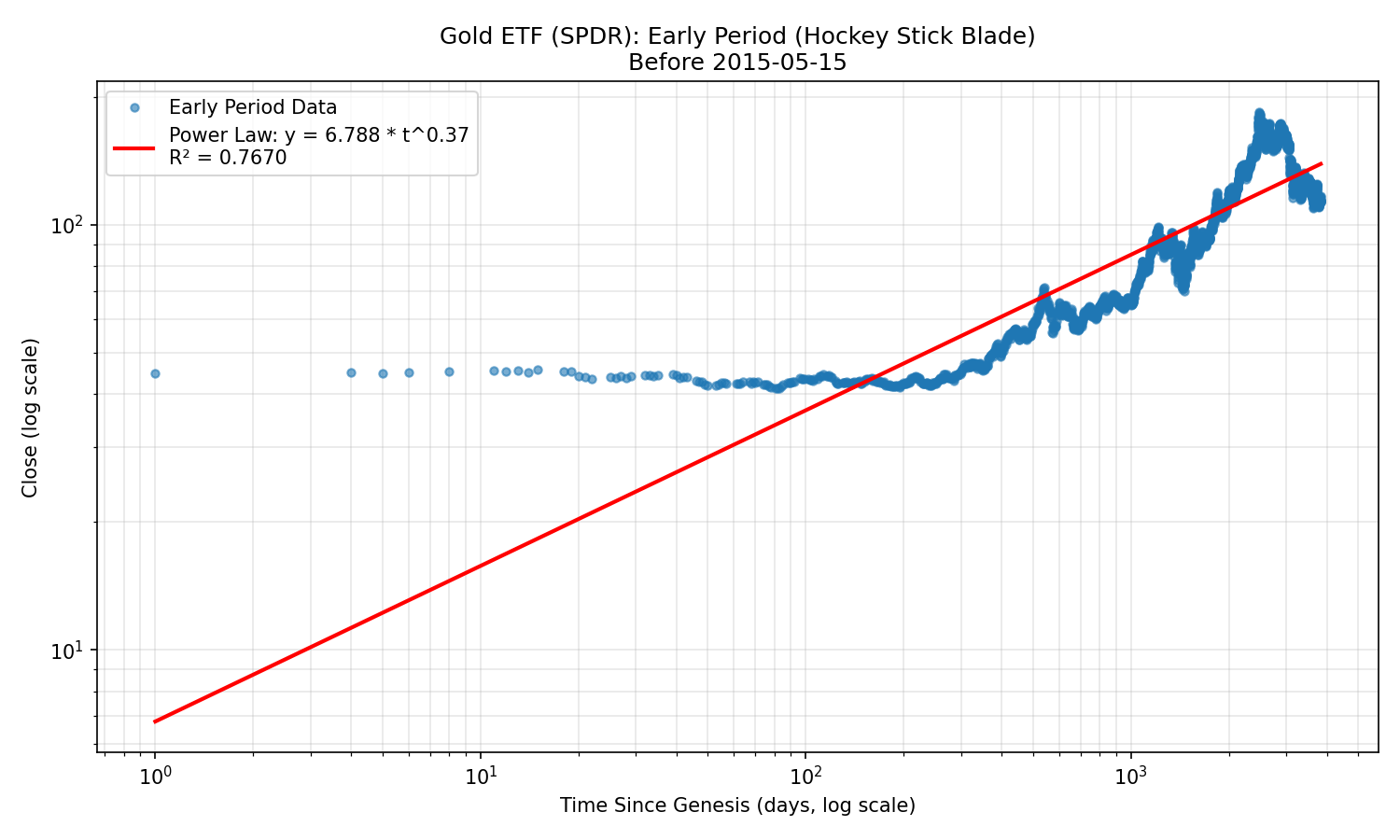

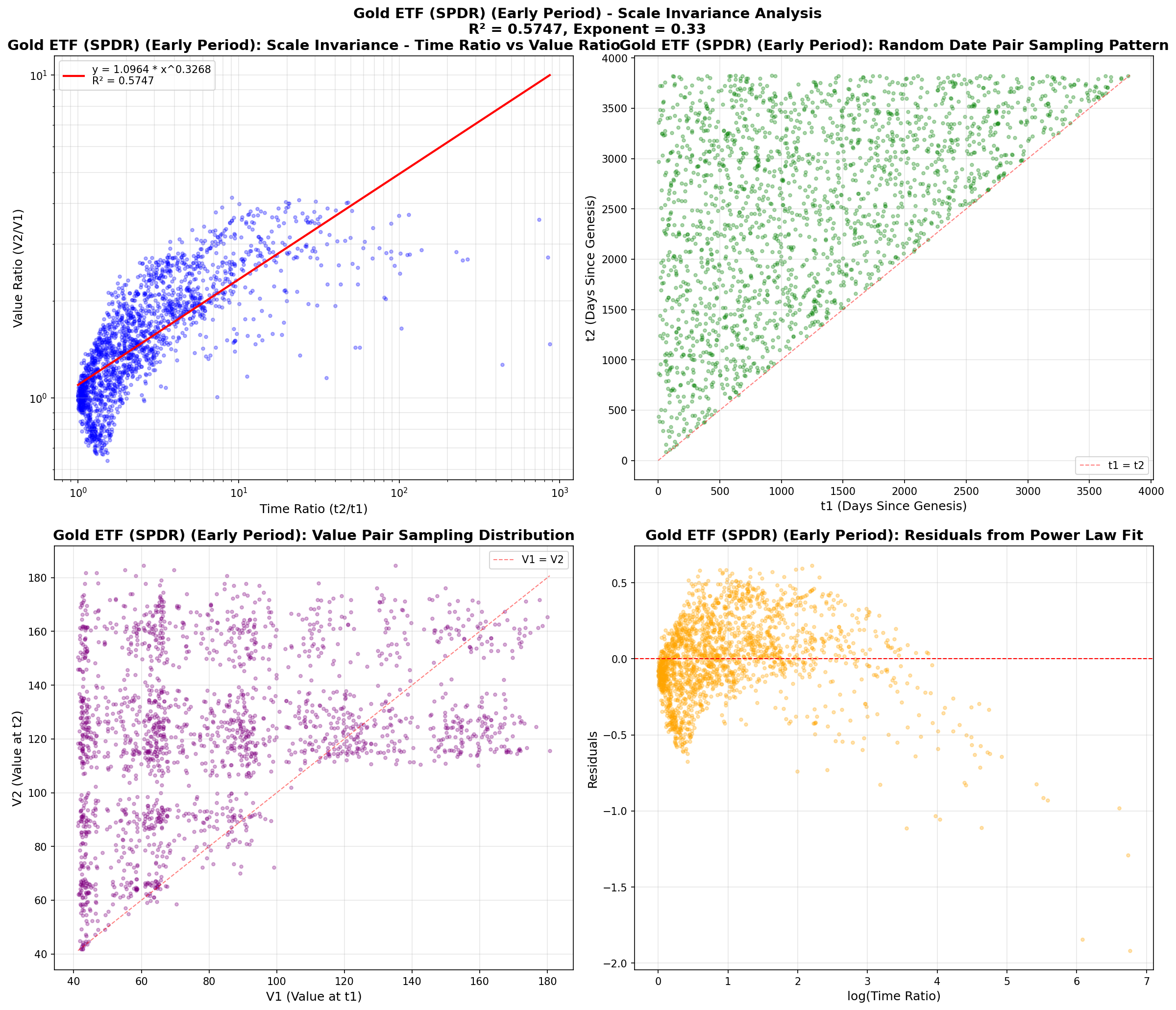

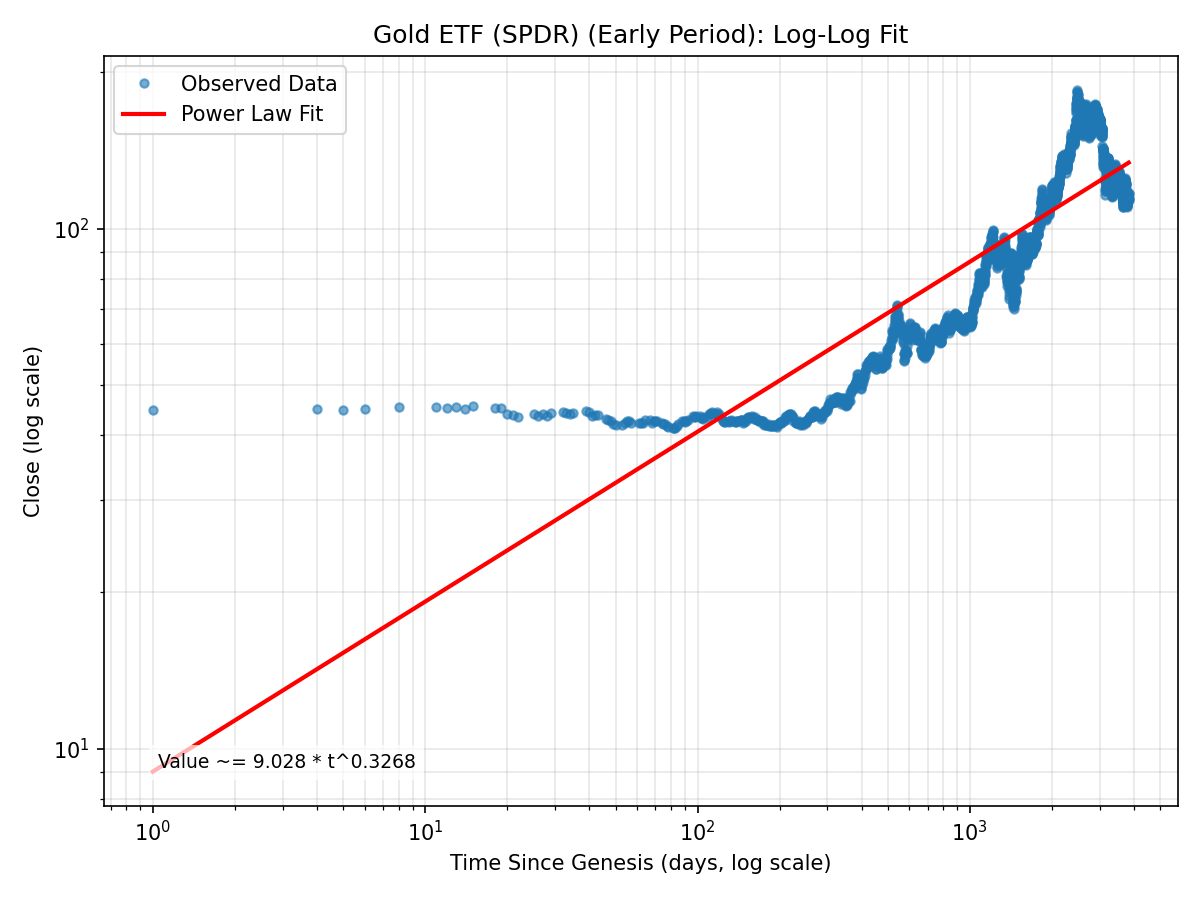

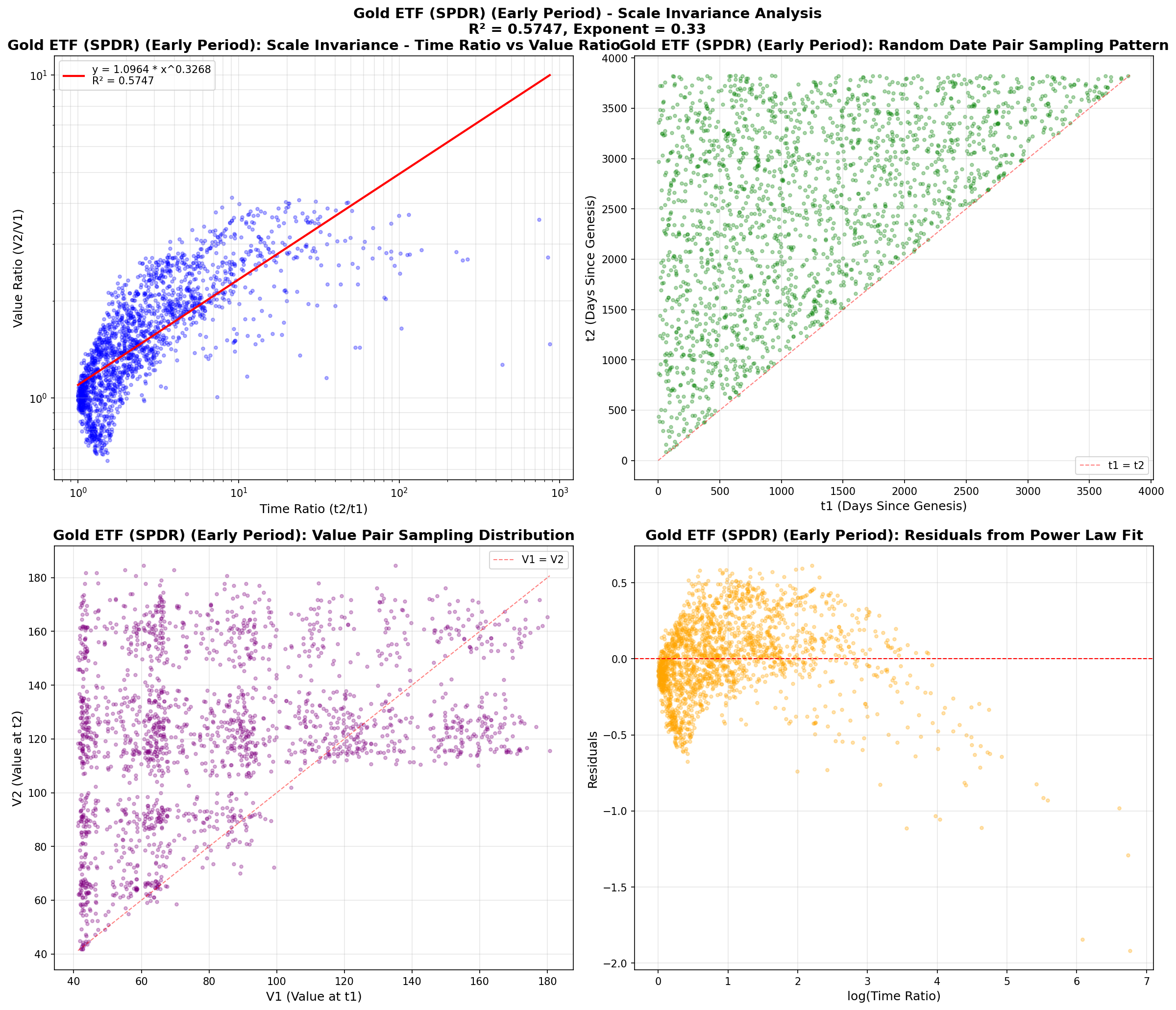

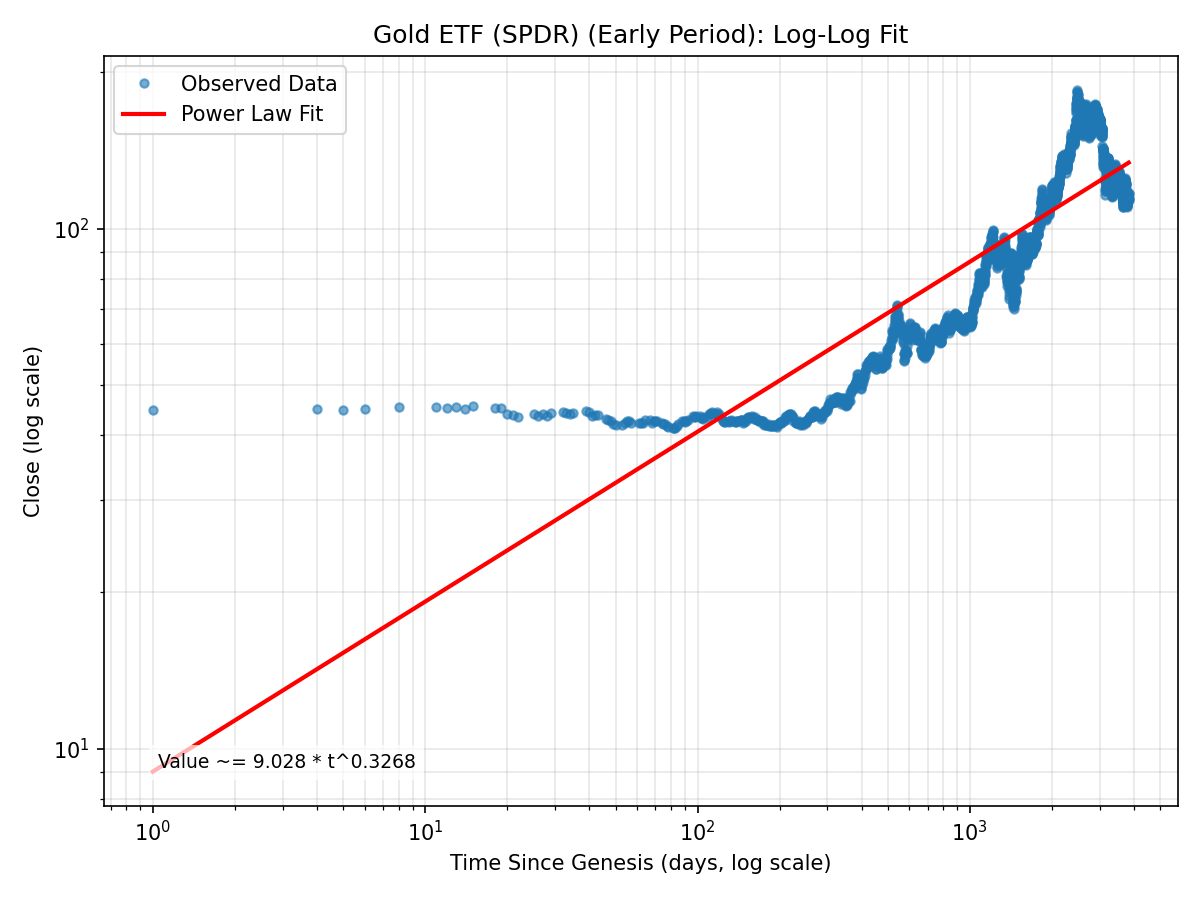

| Gold ETF (SPDR) (Early Period) |

Financial Asset - Split |

0.5747 |

0.33 |

🔹 Early |

2639 |

2004-11-18 to 2015-05-14 |

2004-11-18 (Provided) |

Yahoo Finance API (yfinance Python library) |

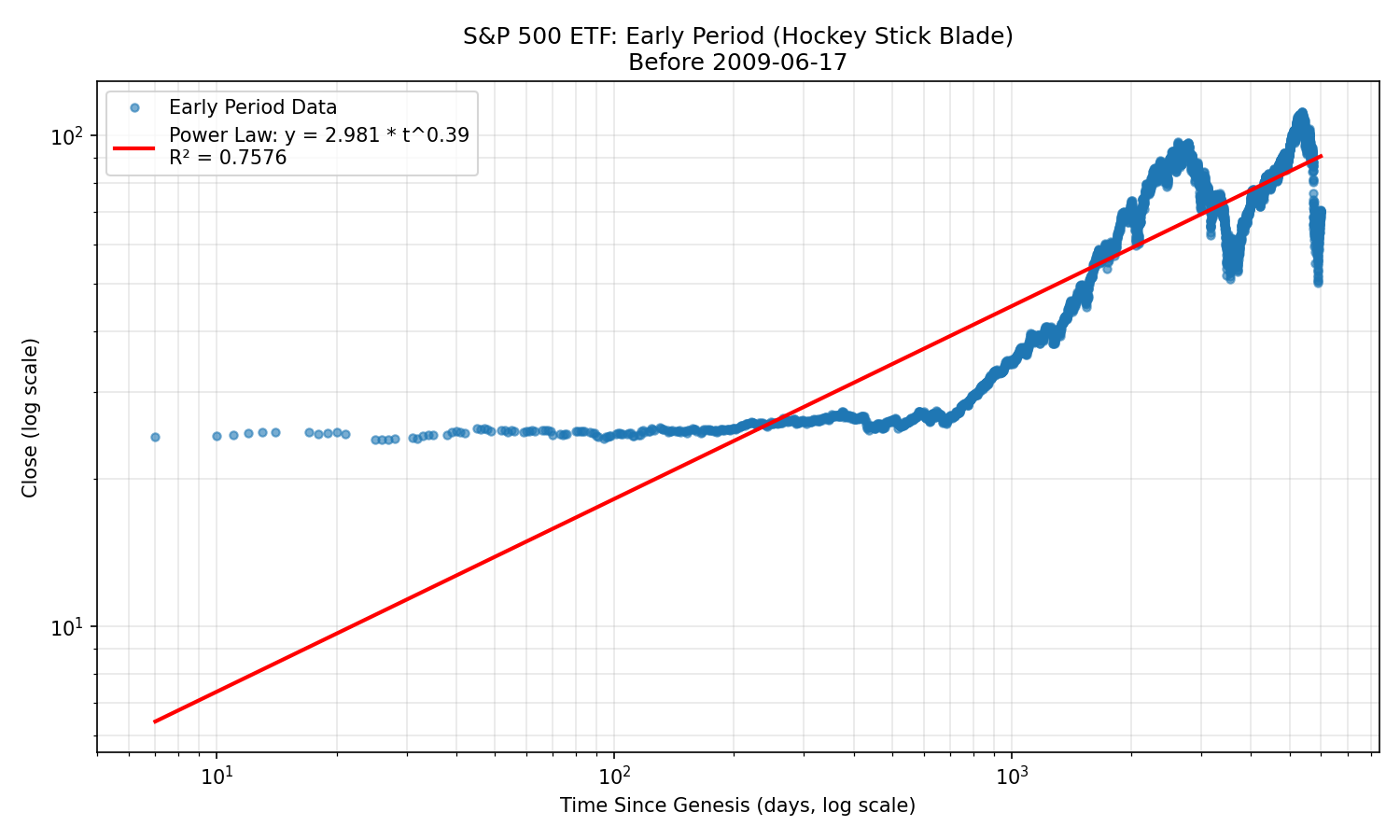

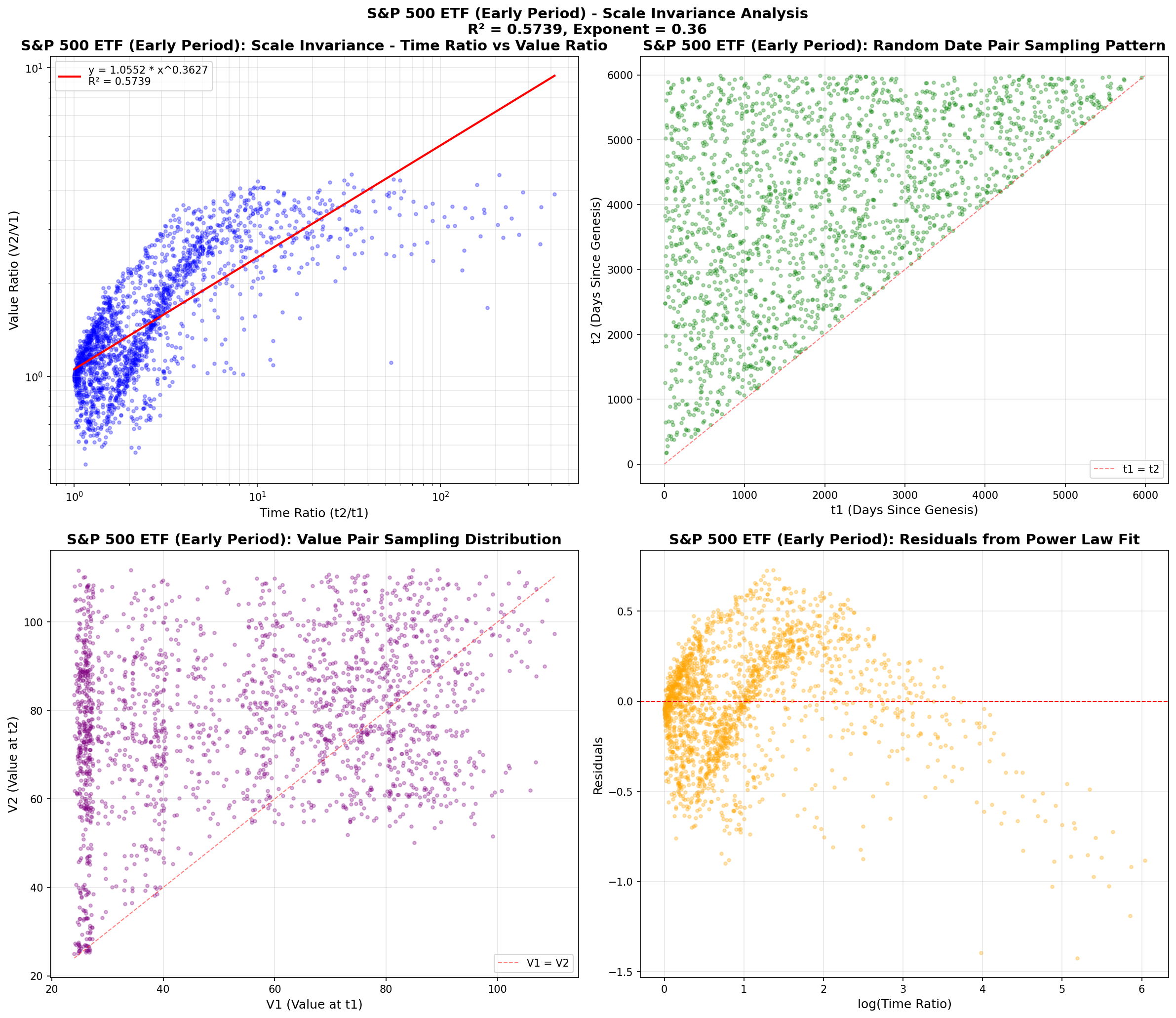

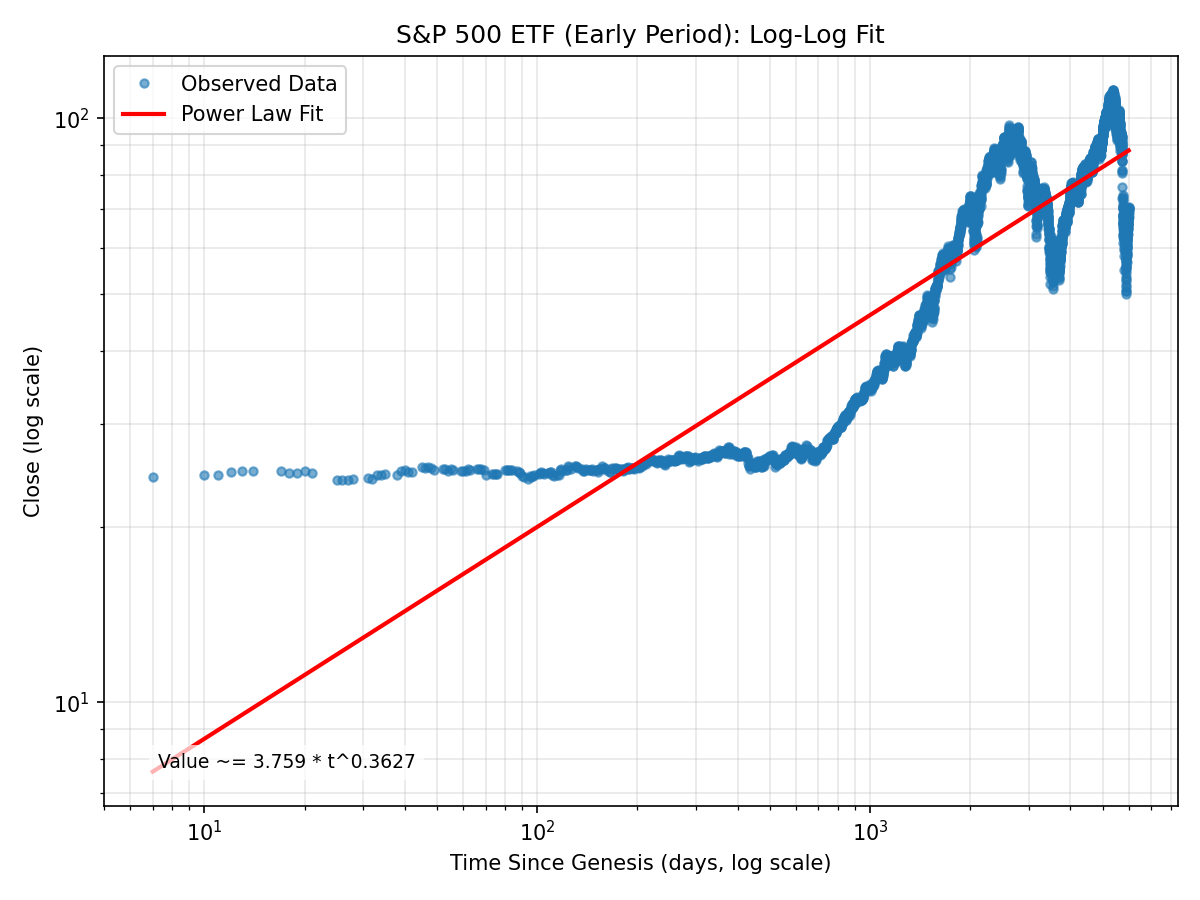

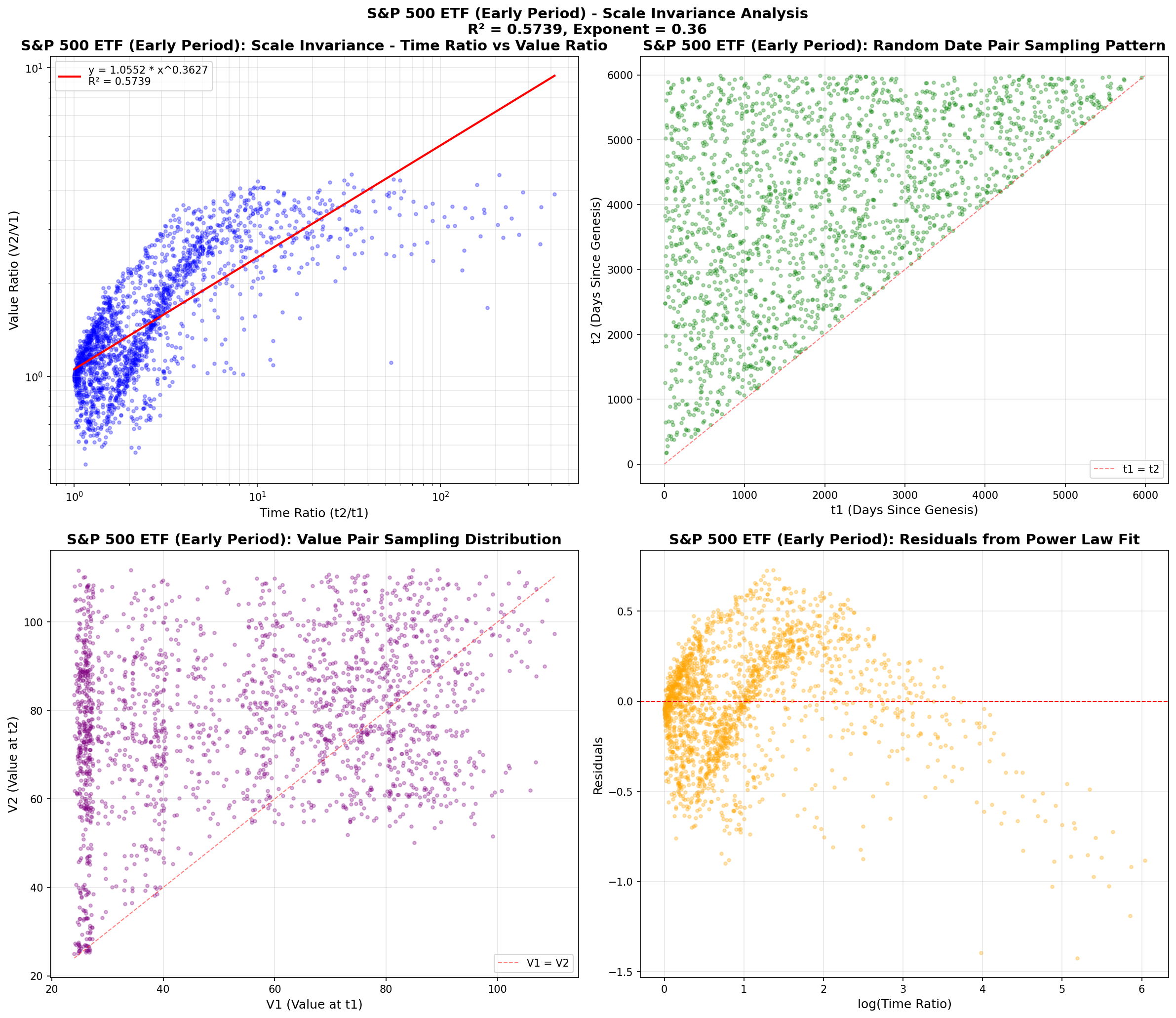

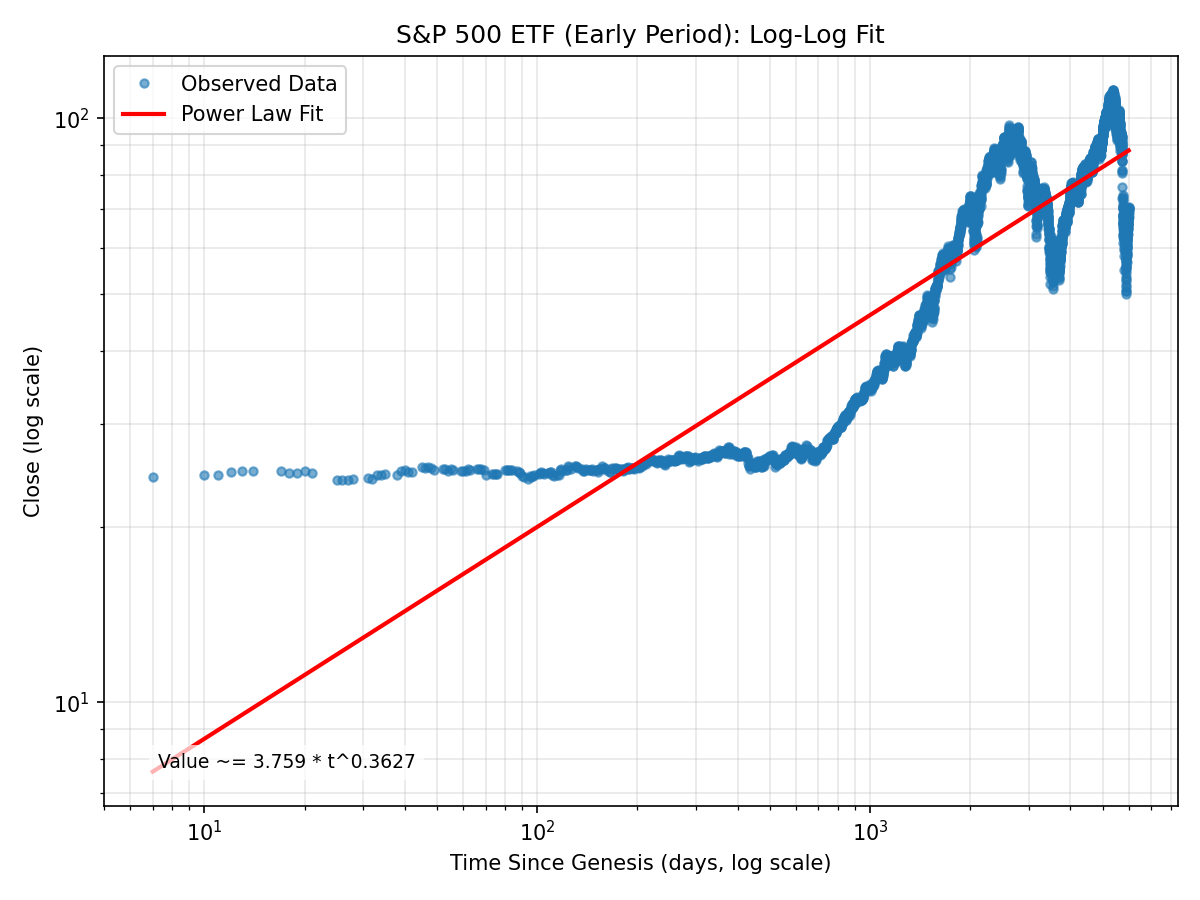

| S&P 500 ETF (Early Period) |

Financial Asset - Split |

0.5739 |

0.36 |

🔹 Early |

4126 |

1993-01-29 to 2009-06-16 |

1993-01-22 (Provided) |

Yahoo Finance API (yfinance Python library) |

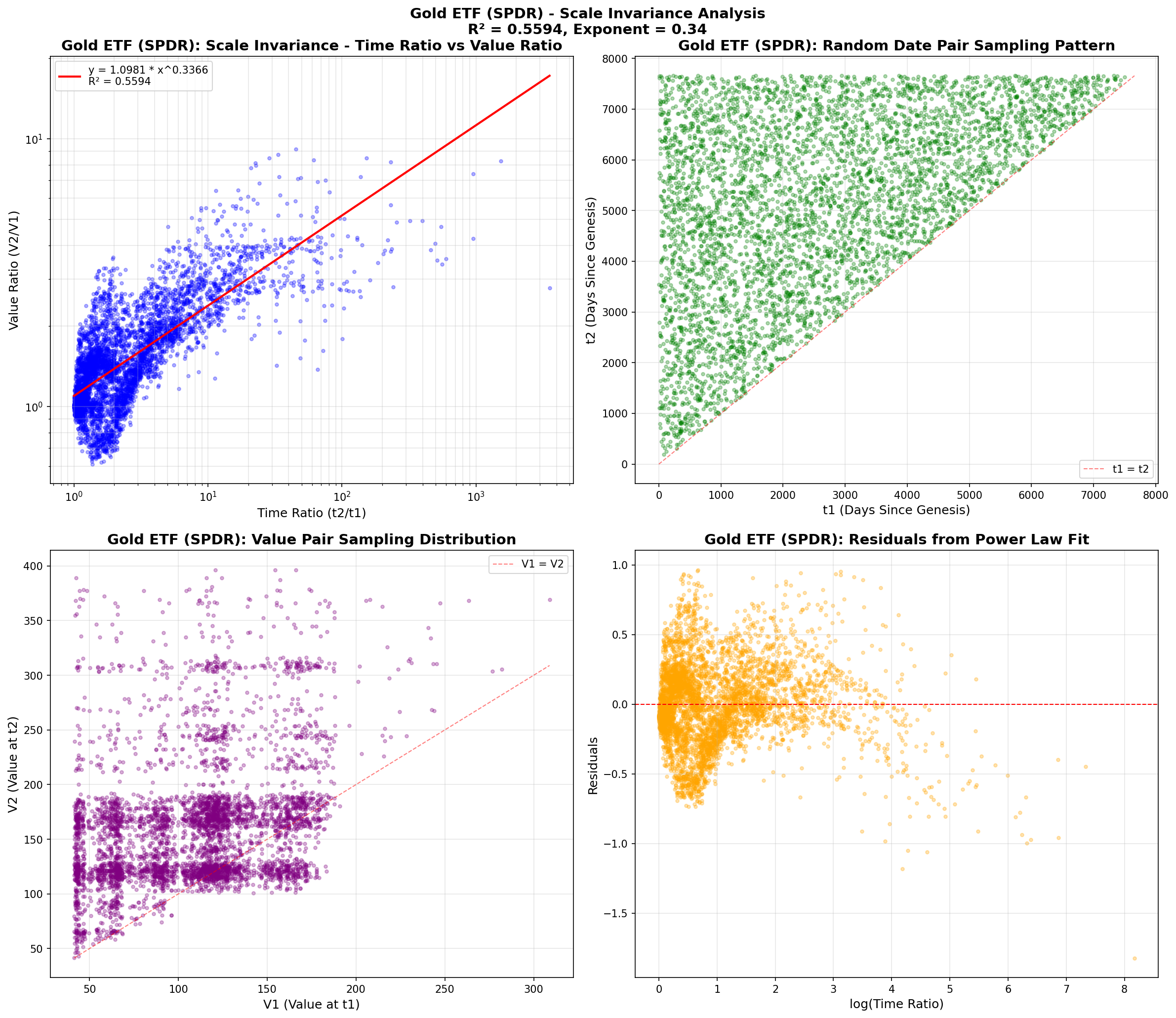

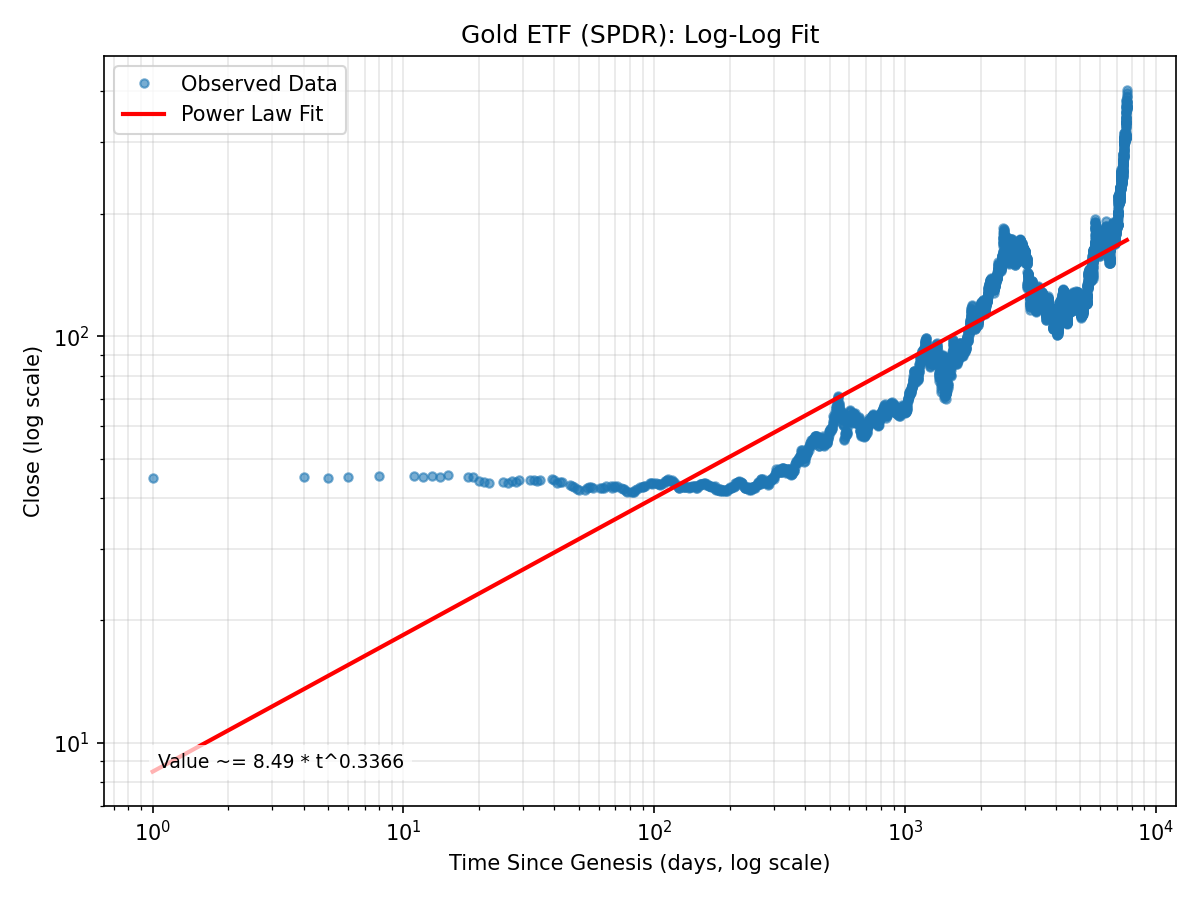

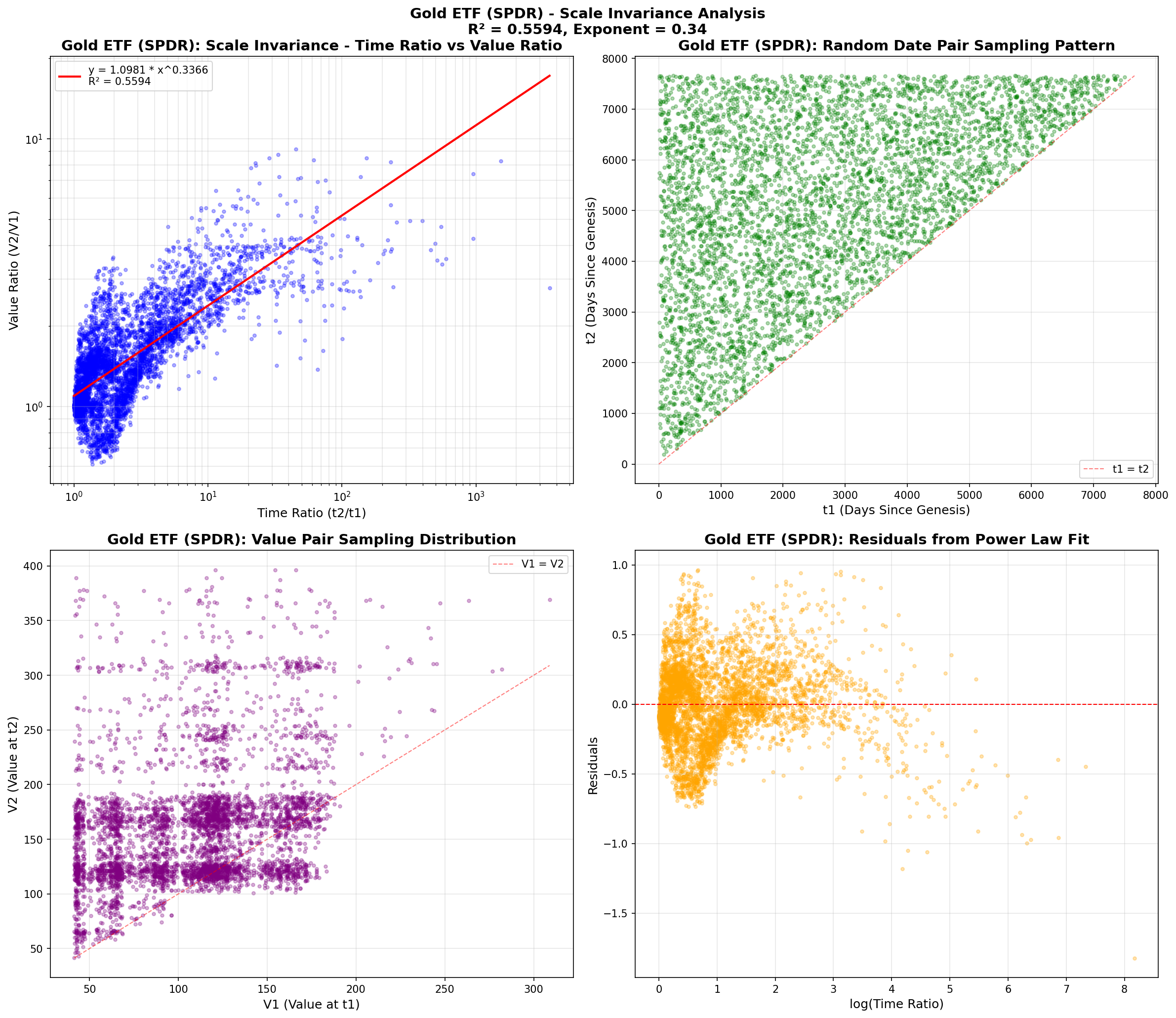

| Gold ETF (SPDR) |

Financial Asset |

0.5594 |

0.34 |

🏒 Hockey (3.6x) |

5277 |

2004-11-18 to 2025-11-07 |

2004-11-18 (Provided) |

Yahoo Finance API (yfinance Python library) |

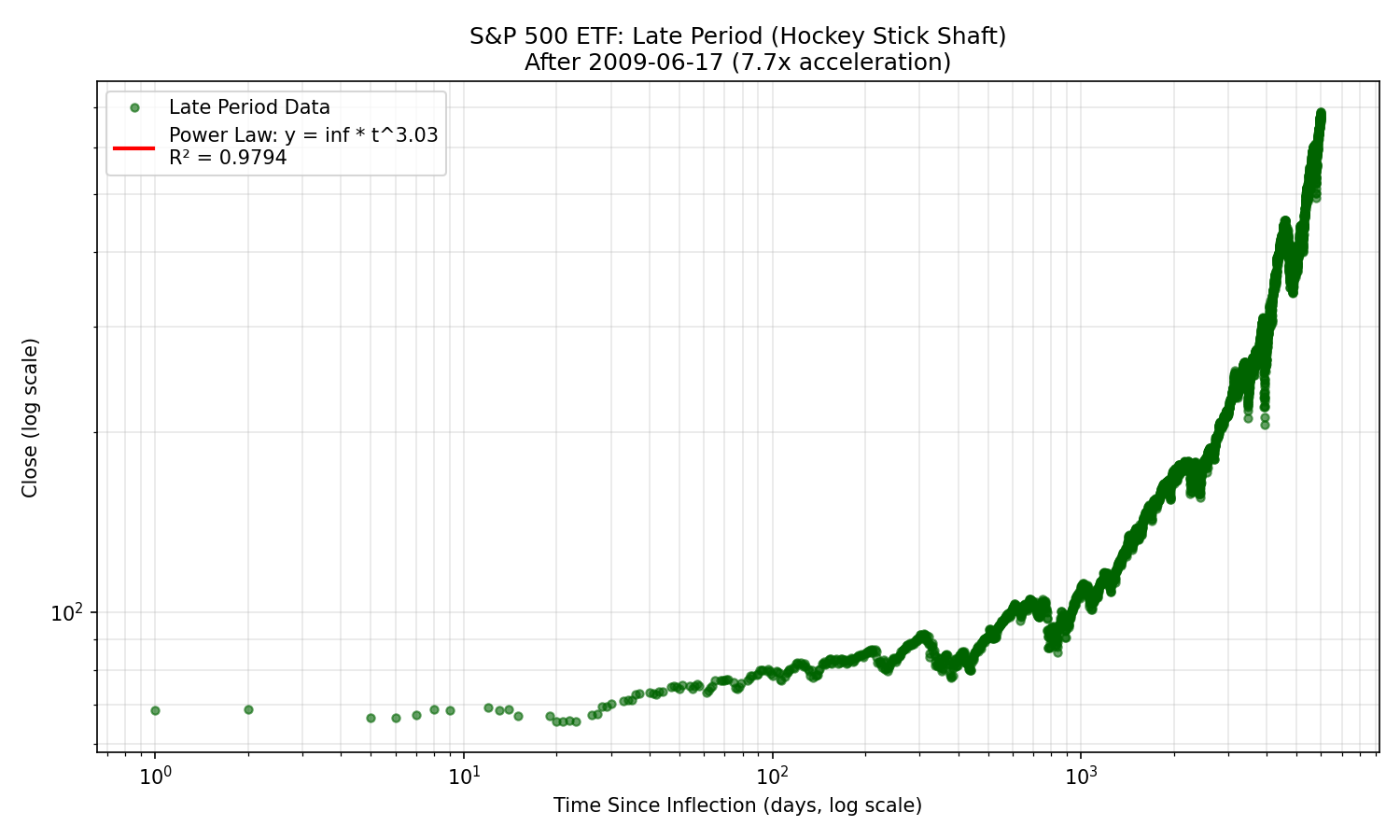

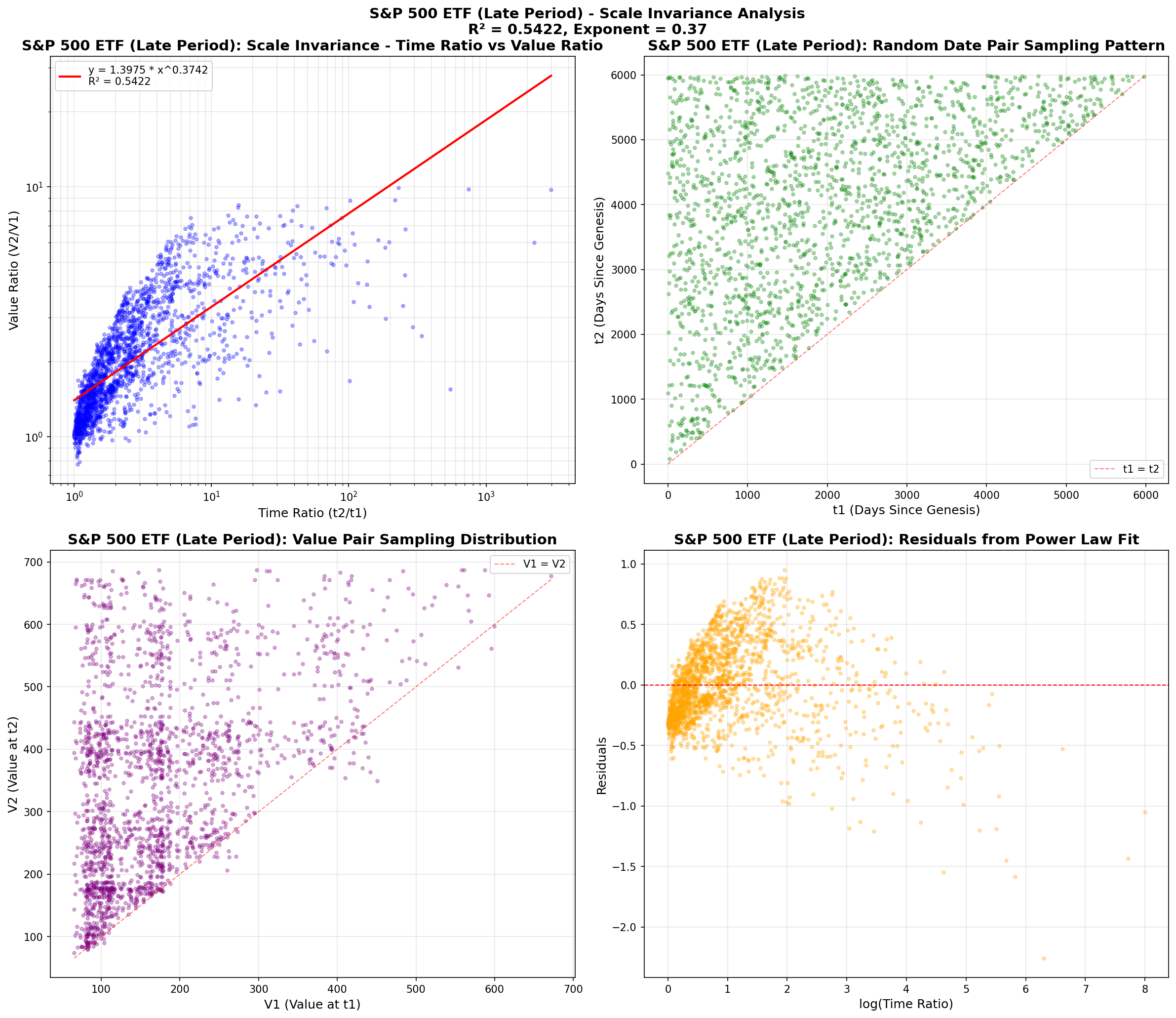

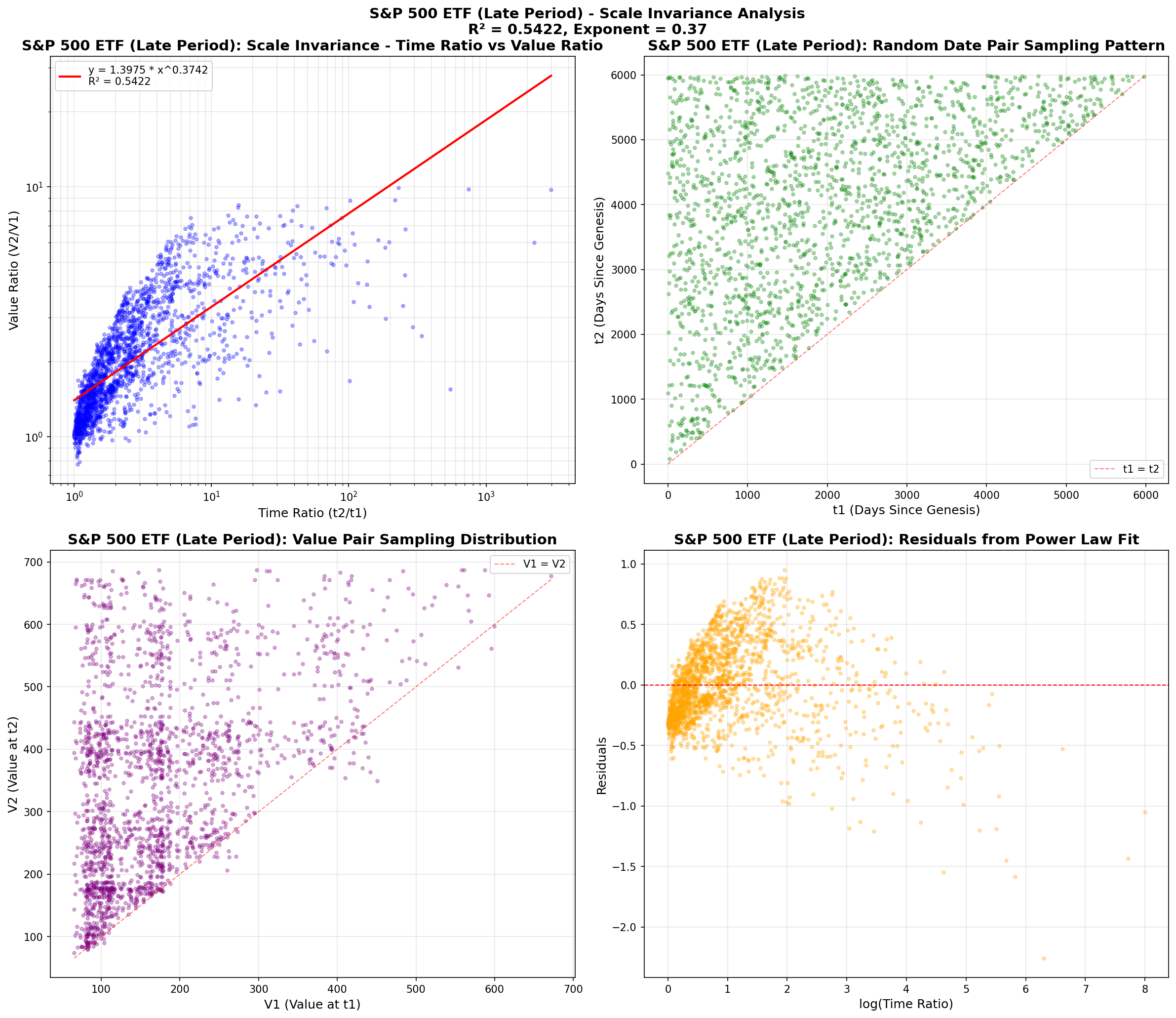

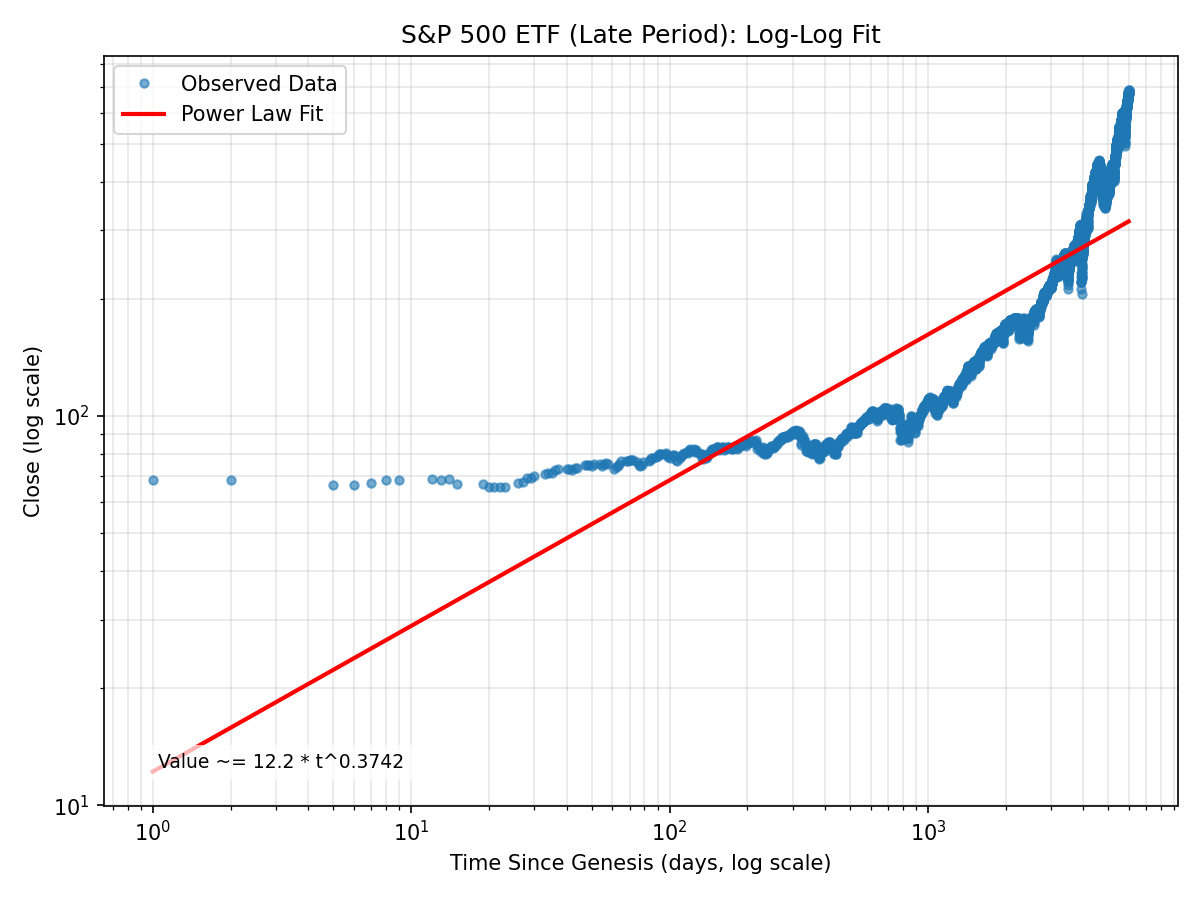

| S&P 500 ETF (Late Period) |

Financial Asset - Split |

0.5422 |

0.37 |

🔹 Late |

4126 |

2009-06-17 to 2025-11-07 |

2009-06-17 (Hockey Stick Inflection) |

Yahoo Finance API (yfinance Python library) |

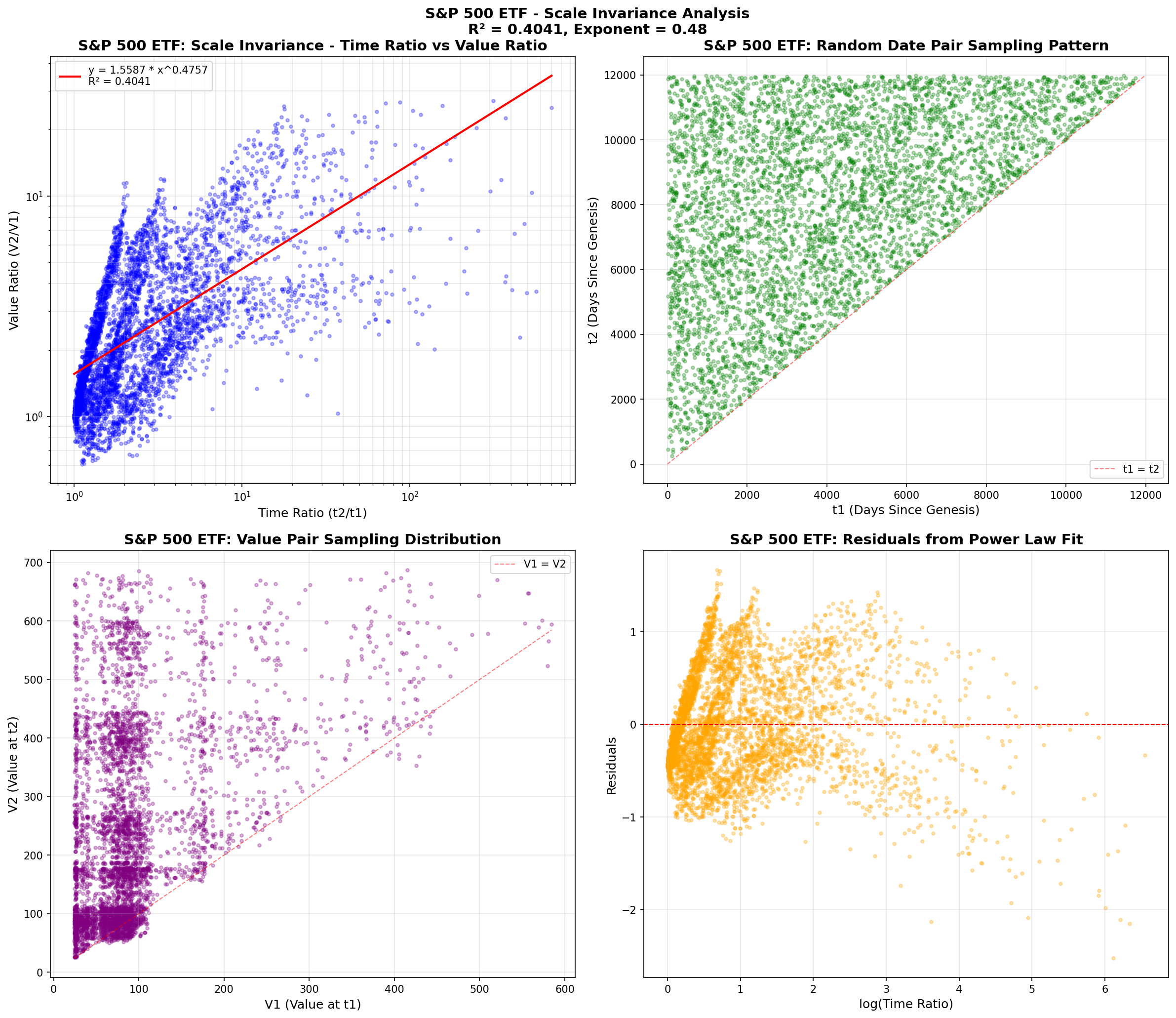

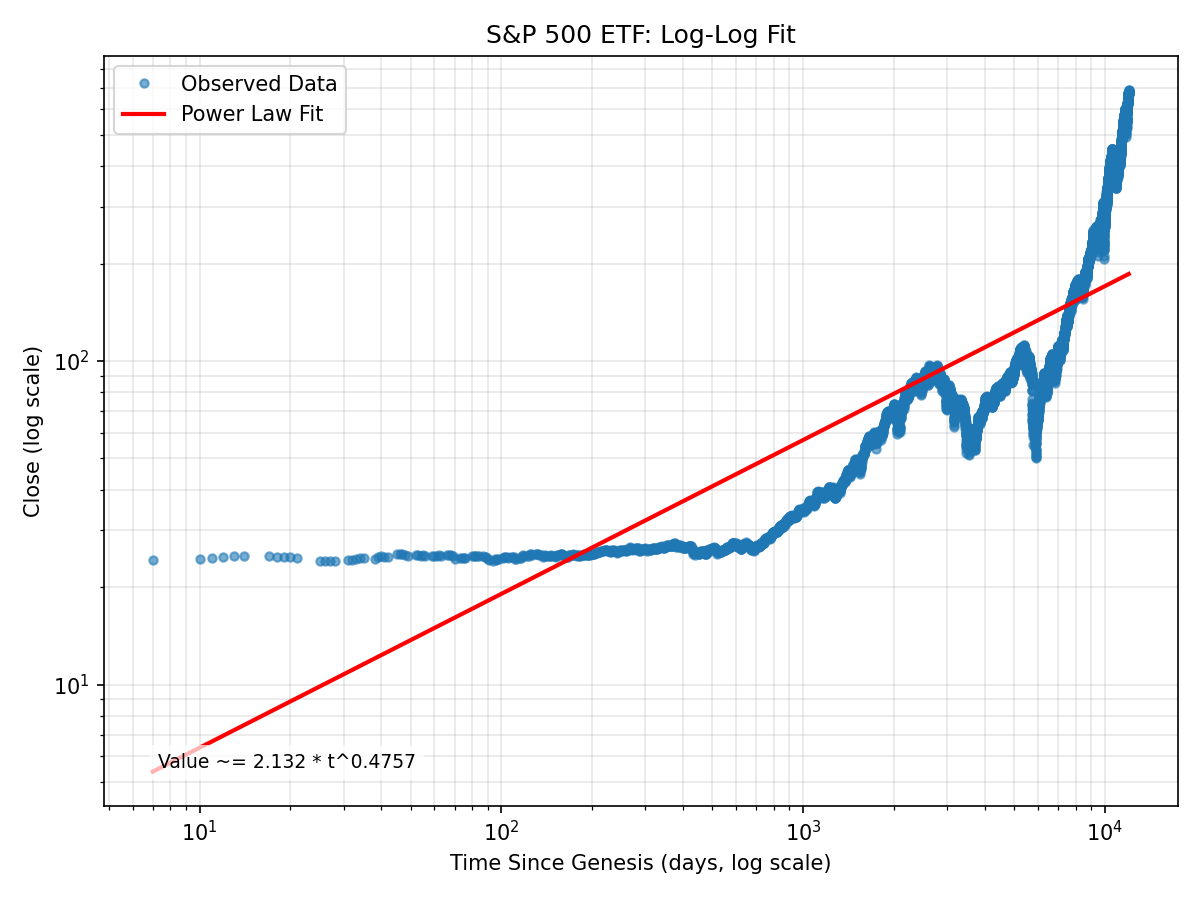

| S&P 500 ETF |

Financial Asset |

0.4041 |

0.48 |

🏒 Hockey (7.7x) |

8252 |

1993-01-29 to 2025-11-07 |

1993-01-22 (Provided) |

Yahoo Finance API (yfinance Python library) |

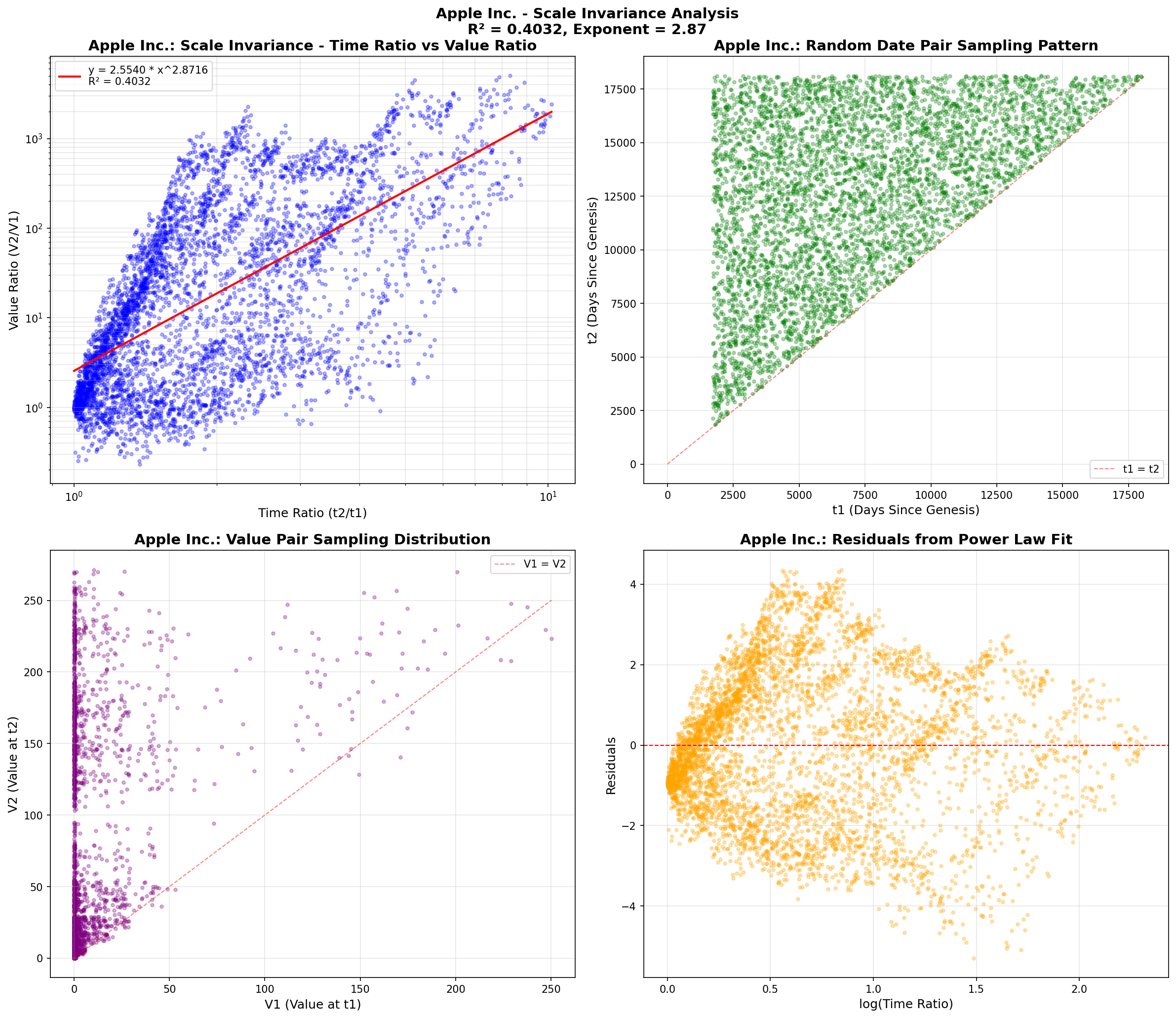

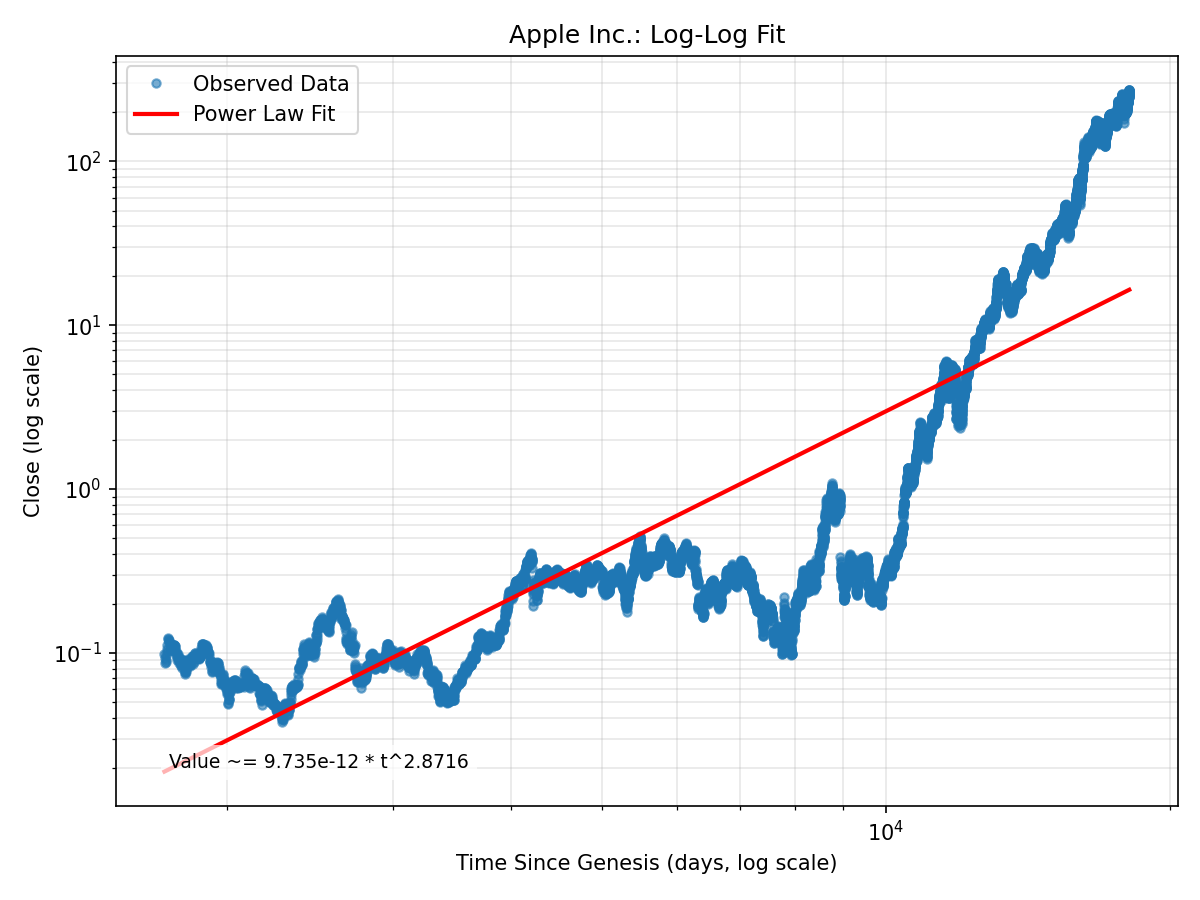

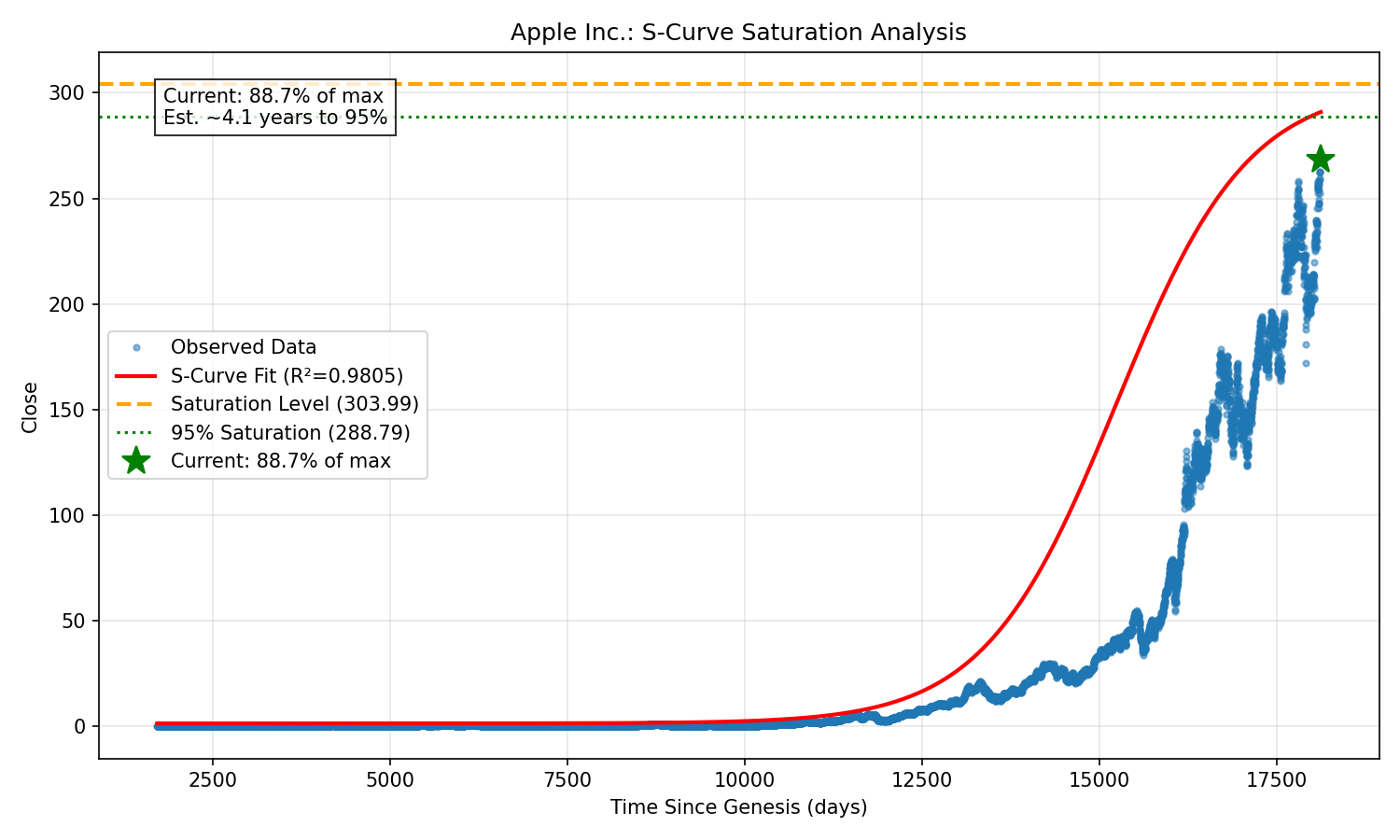

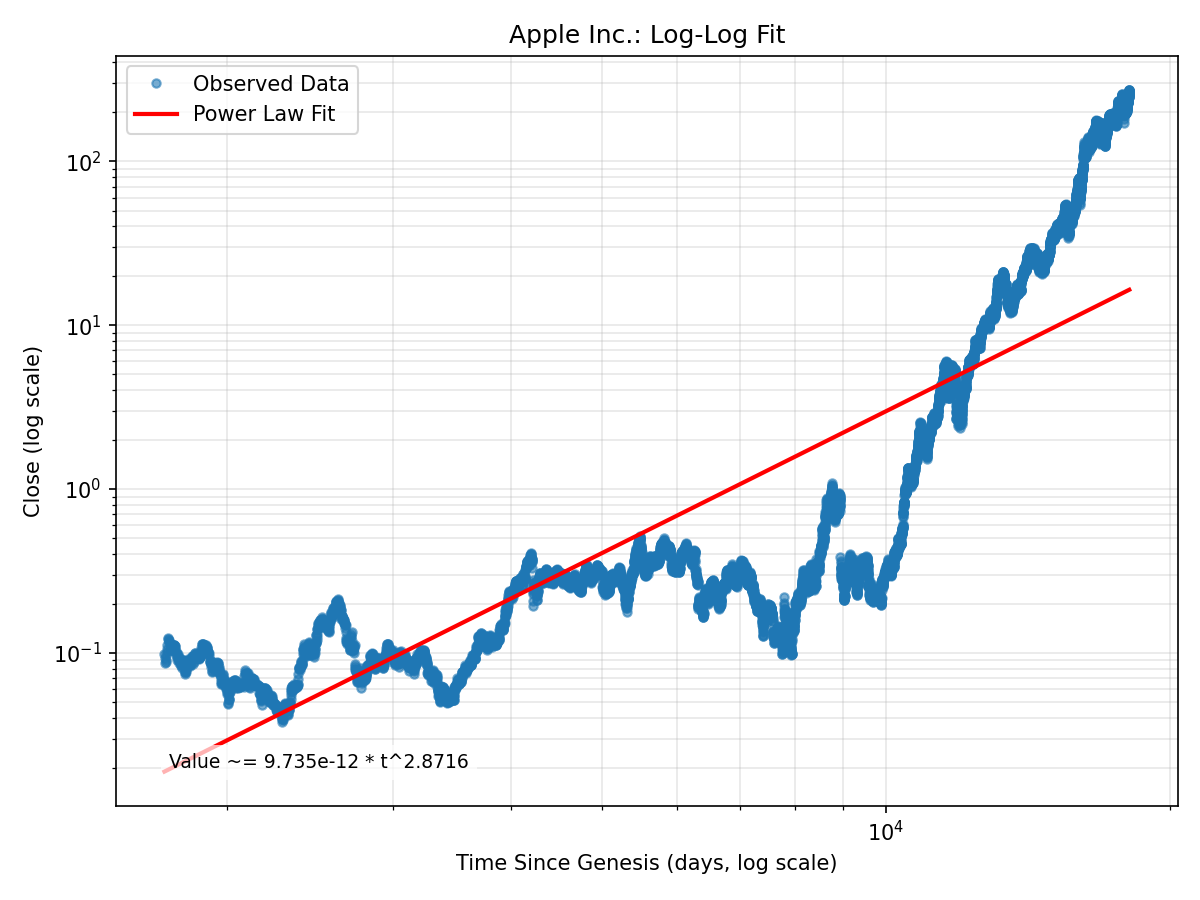

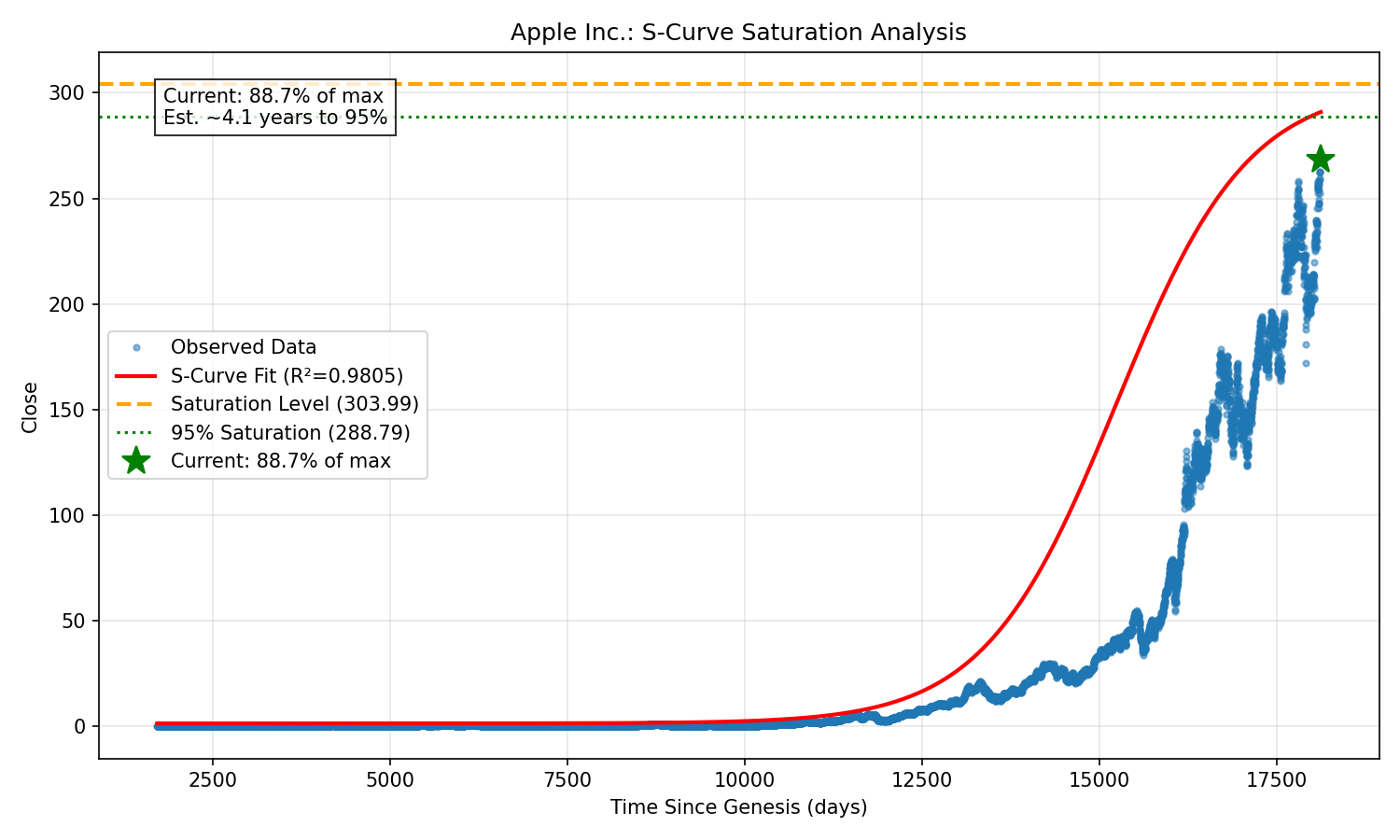

| Apple Inc. |

Financial Asset |

0.4032 |

2.87 |

📈 S-curve (89%) |

11319 |

1980-12-12 to 2025-11-07 |

1976-04-01 (Provided) |

Yahoo Finance API (yfinance Python library) |

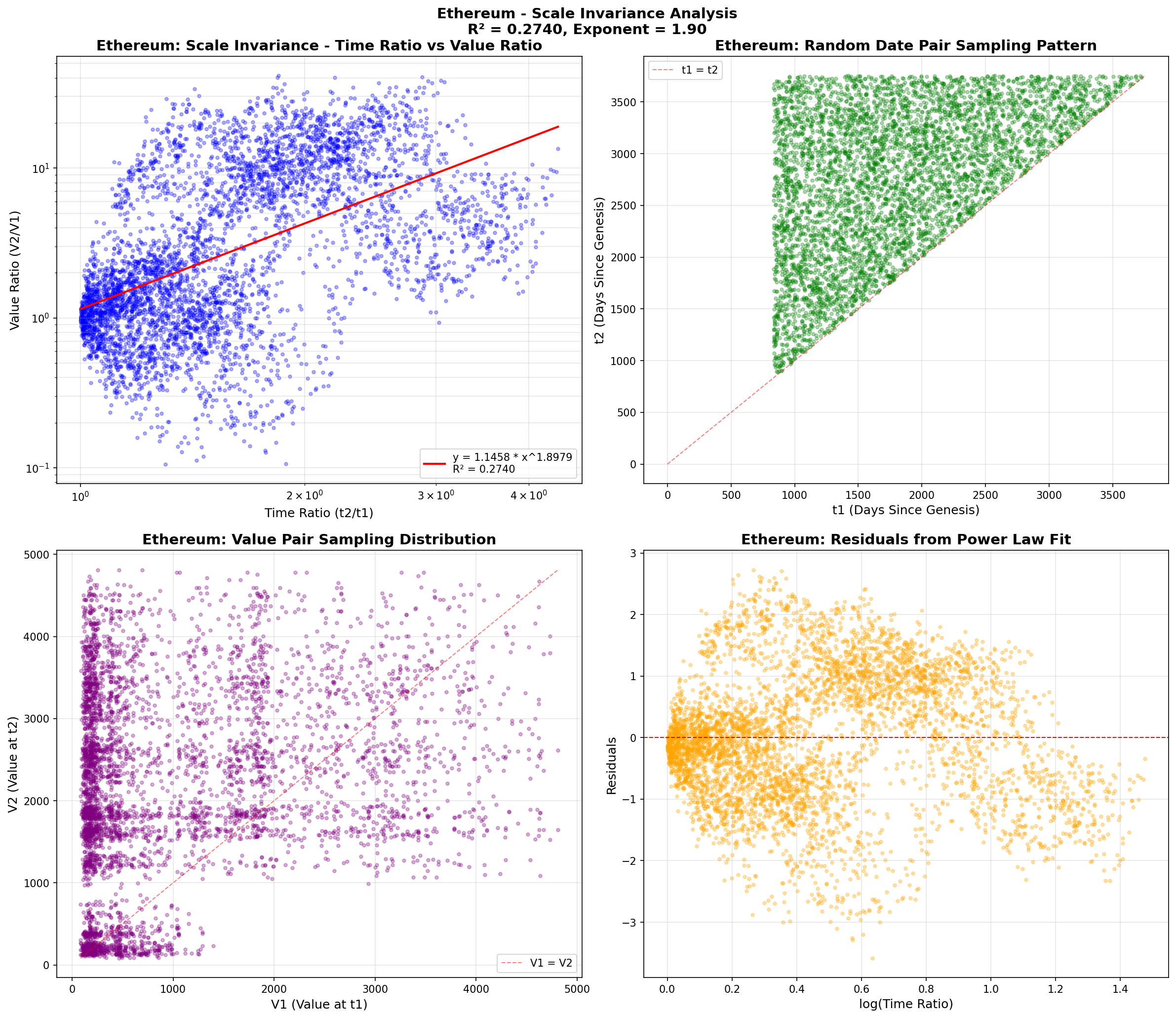

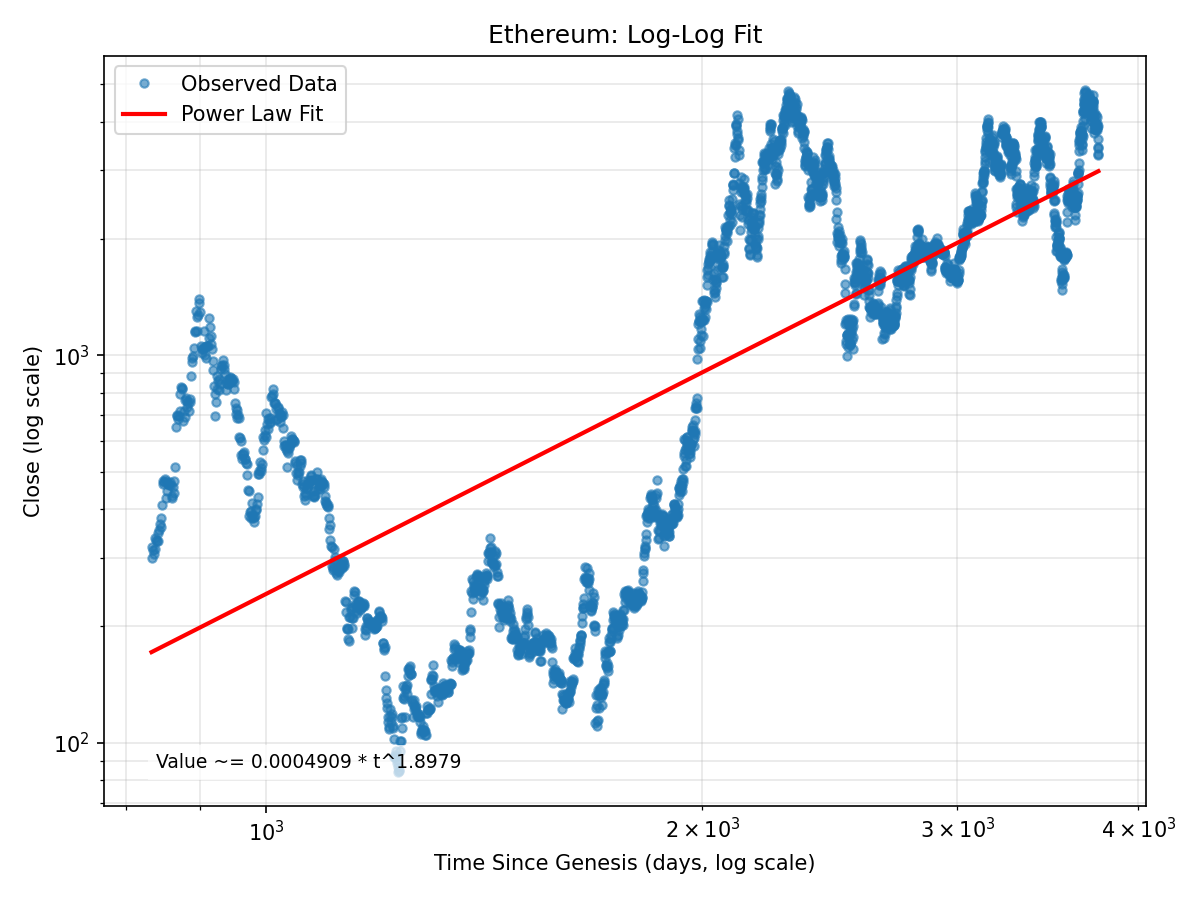

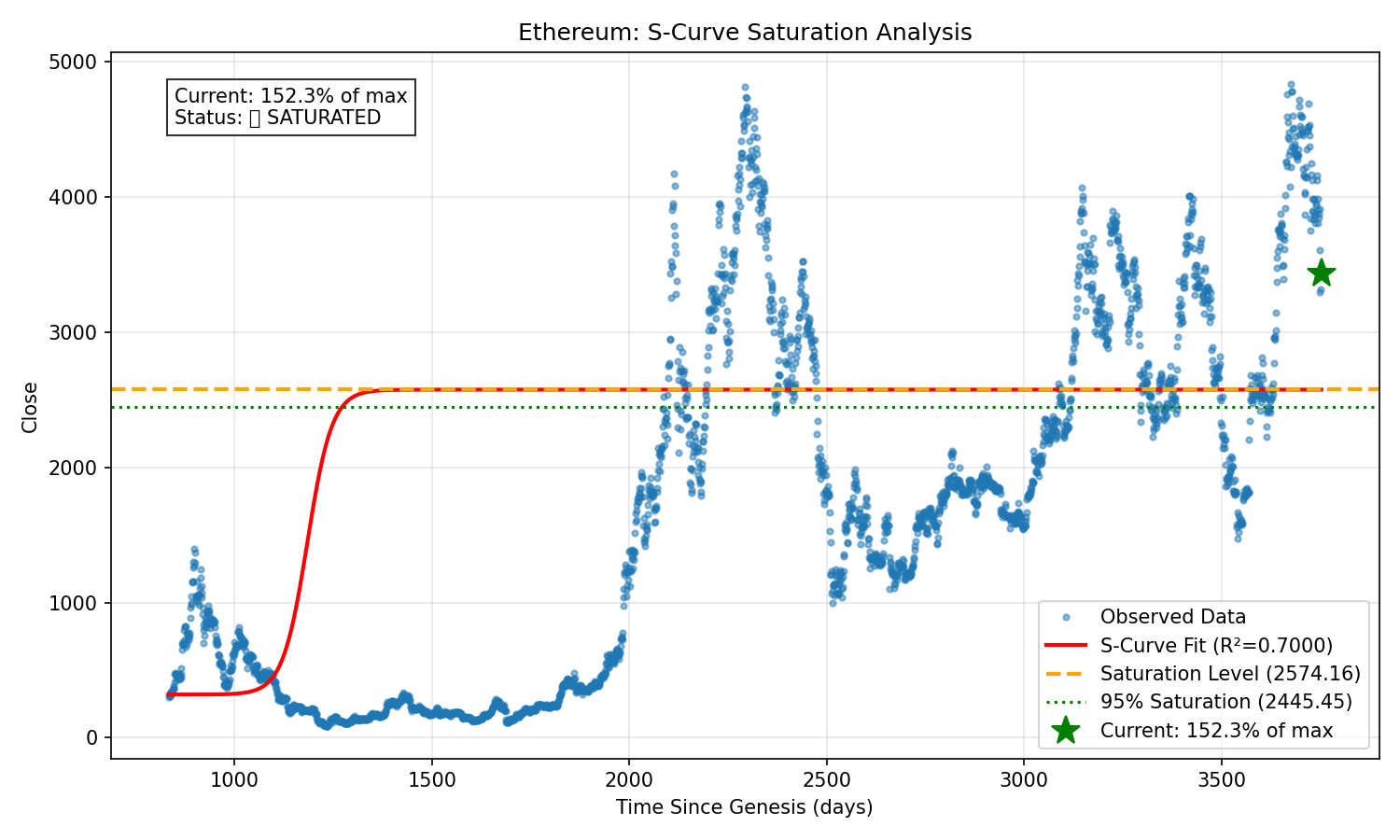

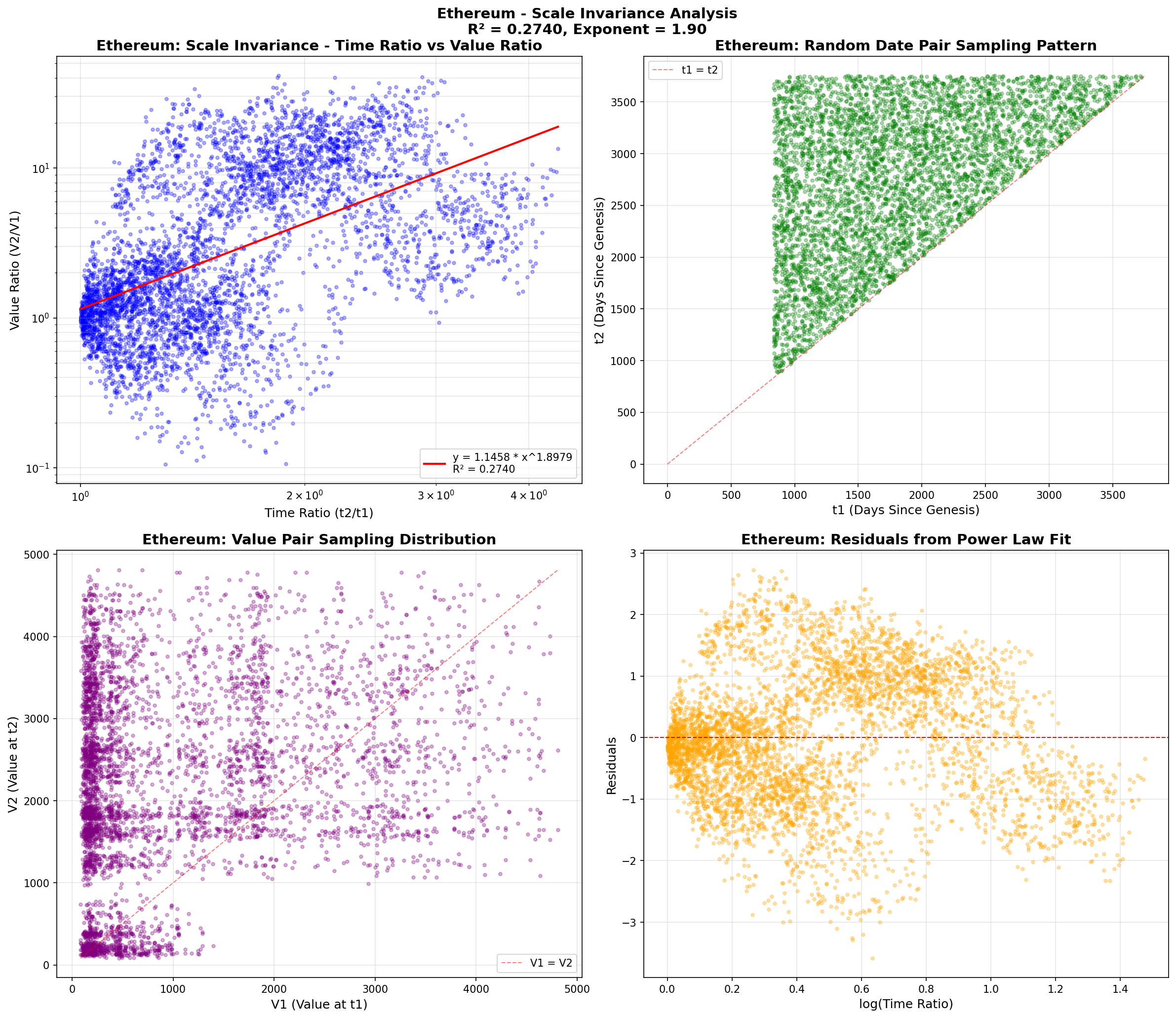

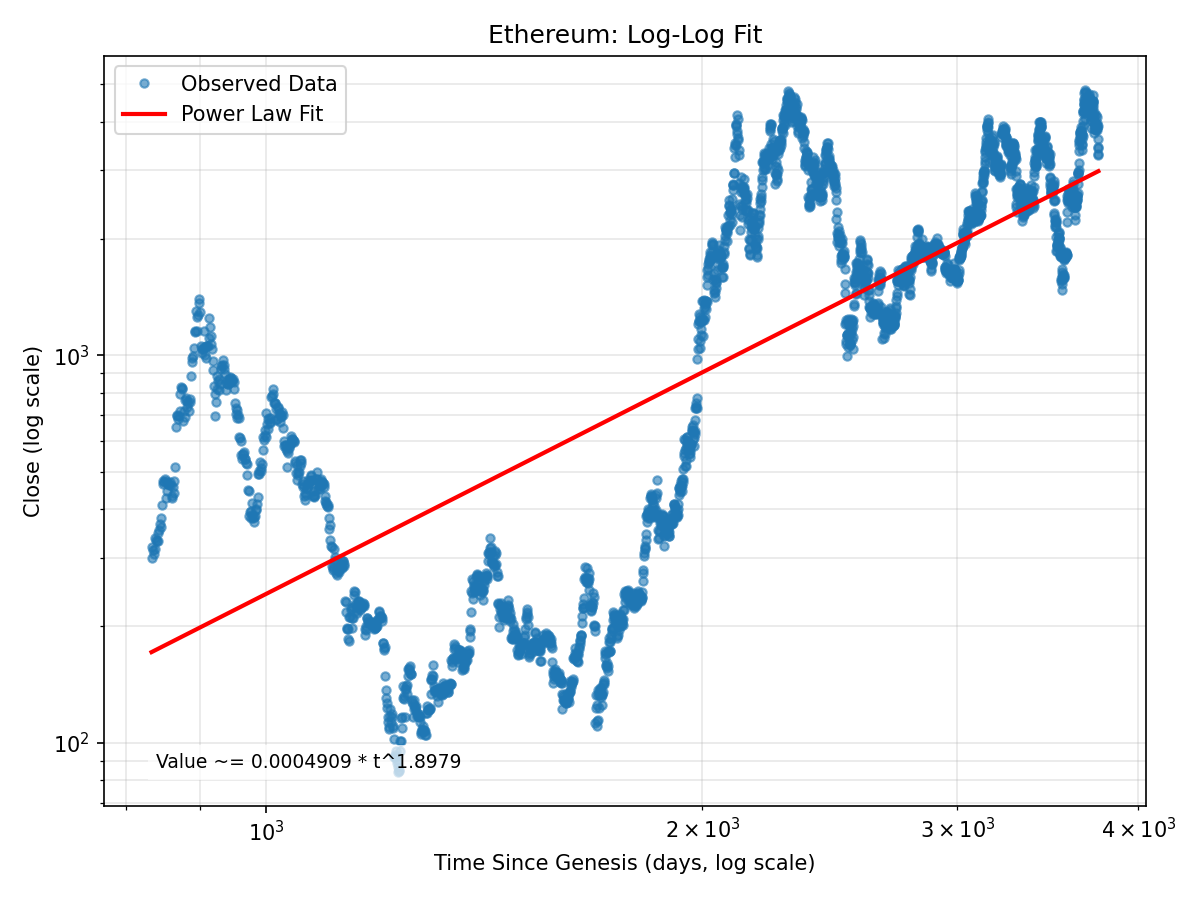

| Ethereum |

Financial Asset |

0.2740 |

1.90 |

✅ Saturated (152%) |

2921 |

2017-11-09 to 2025-11-07 |

2015-07-30 (Provided) |

Yahoo Finance API (yfinance Python library) |

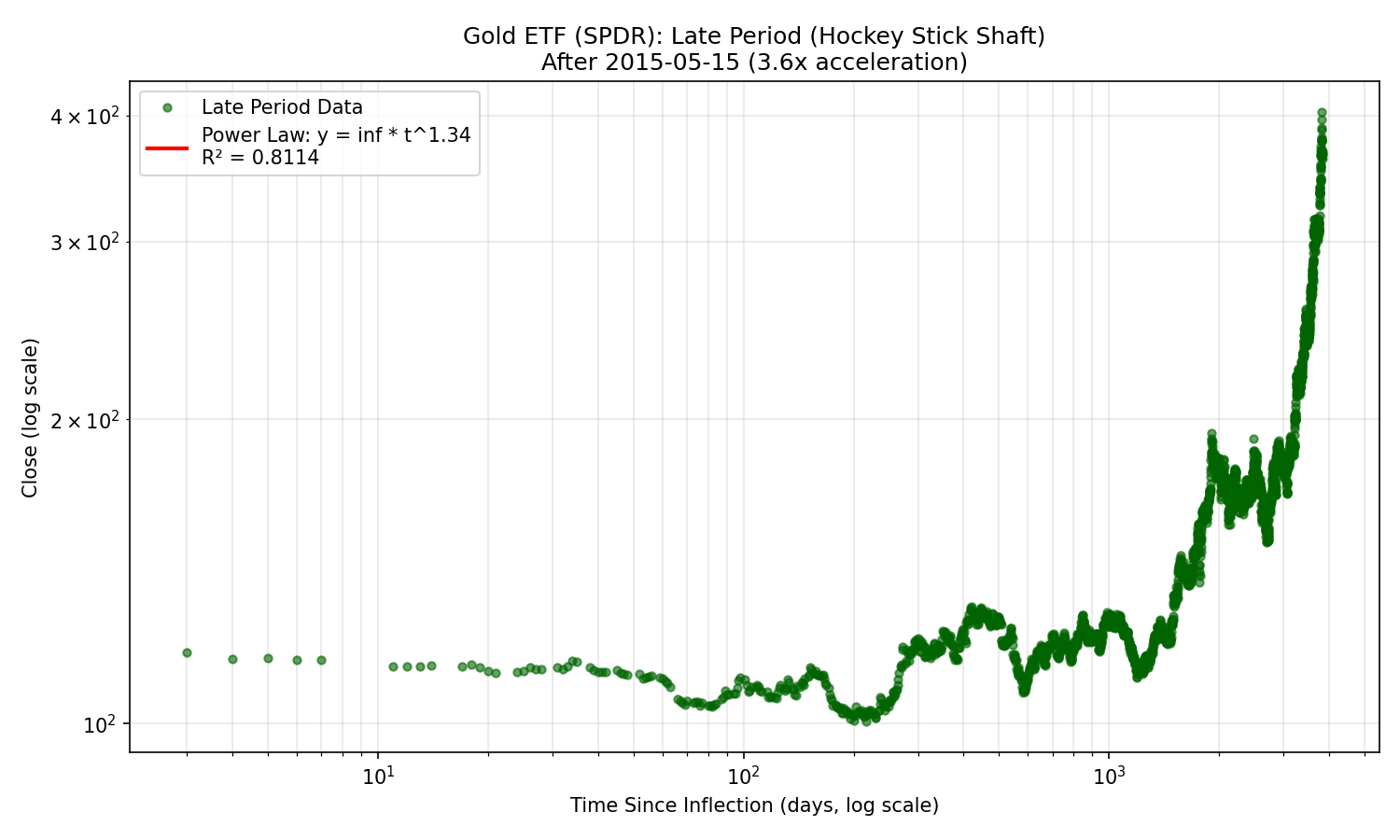

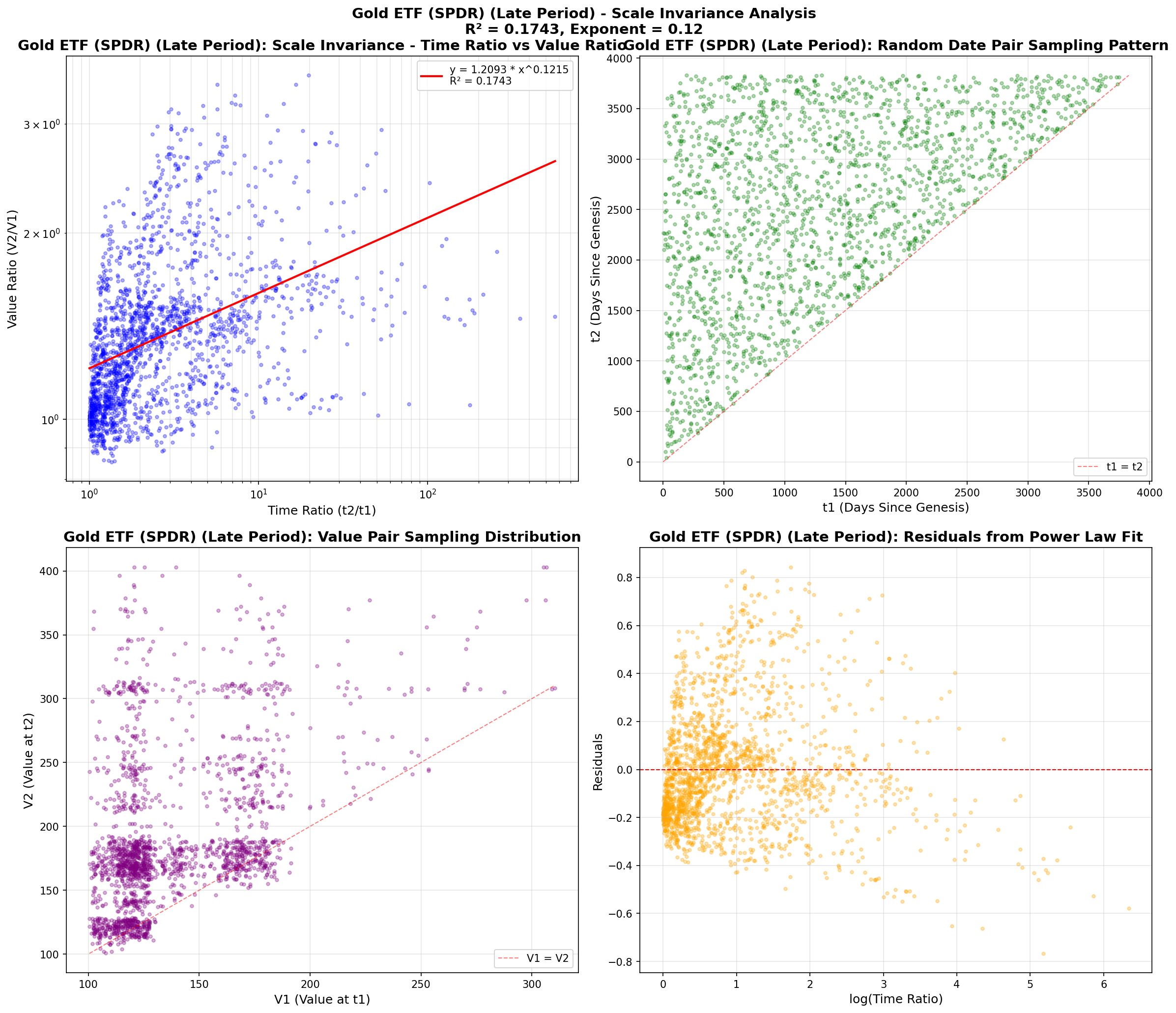

| Gold ETF (SPDR) (Late Period) |

Financial Asset - Split |

0.1743 |

0.12 |

🔹 Late |

2638 |

2015-05-15 to 2025-11-07 |

2015-05-15 (Hockey Stick Inflection) |

Yahoo Finance API (yfinance Python library) |

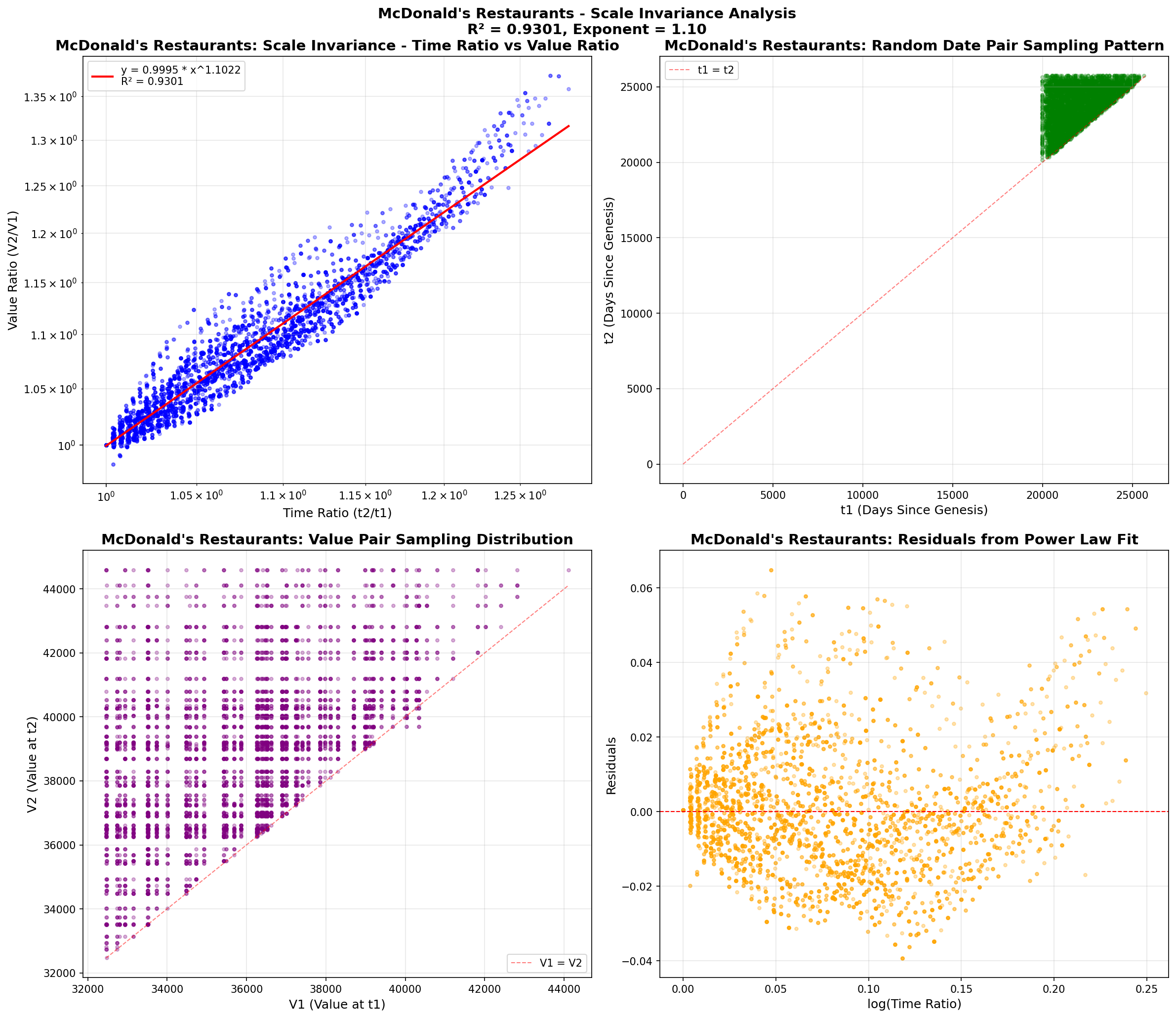

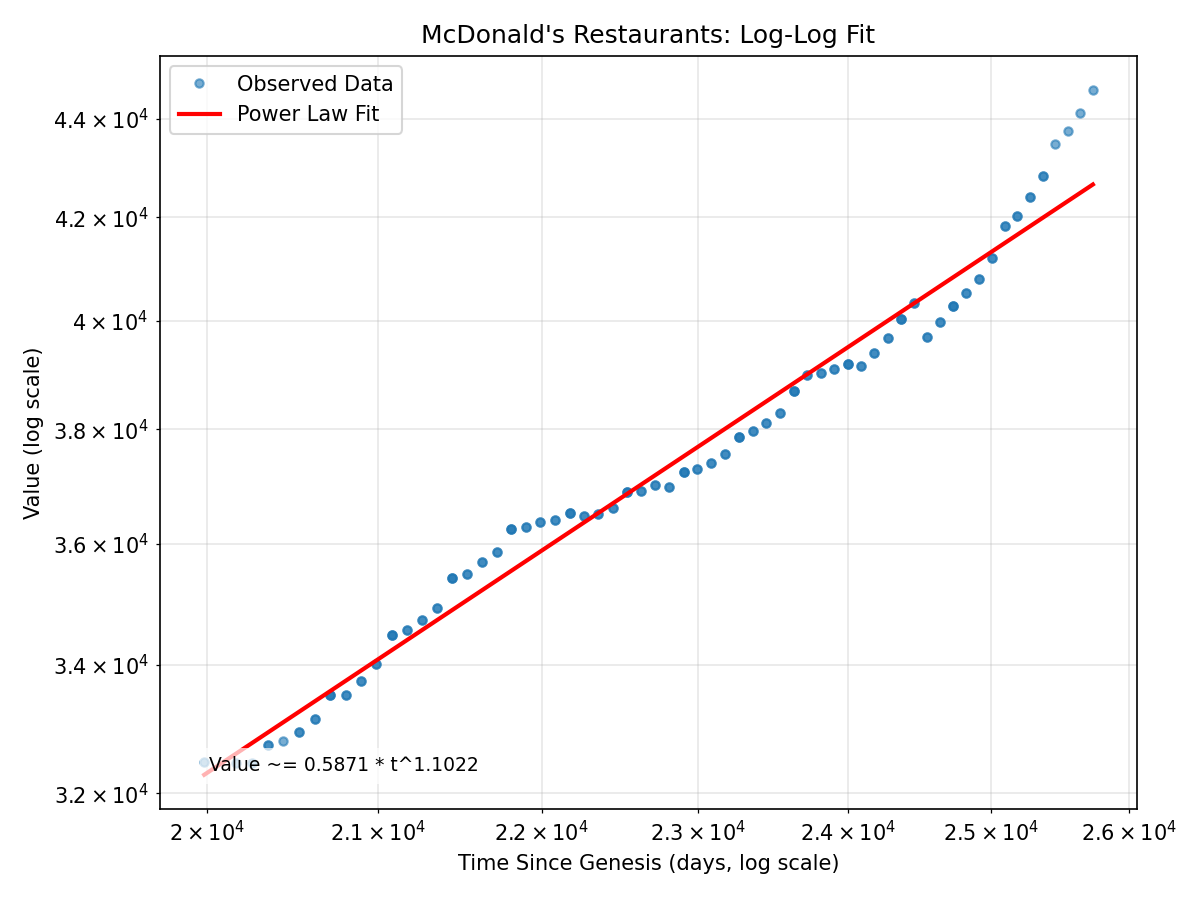

Business

McDonald's Restaurants

**R² (Scale Invariance):** 0.9301

**Power Law Exponent:** 1.10

**Data Points:** 130

**Date Range:** 2009-12-31 to 2025-09-30

**Log Residual Std Dev:** 0.0117

**Data Source:** Downloaded from SEC EDGAR (CIK: 0000063908), us

**Genesis Date:** 1955-04-15 (Provided)

**Power Law Fit:** Value ~= 0.5871 * t^1.1022

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.9767 vs Linear R²: 0.9729

**Current Value:** 0.0% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

Financial Asset

Bitcoin

**R² (Scale Invariance):** 0.9079

**Power Law Exponent:** 5.74

**Data Points:** 5,566

**Date Range:** 2010-07-18 to 2025-11-09

**Log Residual Std Dev:** 0.6935

**Data Source:** btcpricehistory.csv (repository data)

**Genesis Date:** 2009-01-03 (Provided)

**Power Law Fit:** Value ~= 2.143e-17 * t^5.7385

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.8811 vs Linear R²: 0.6086

**Current Value:** 0.0% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

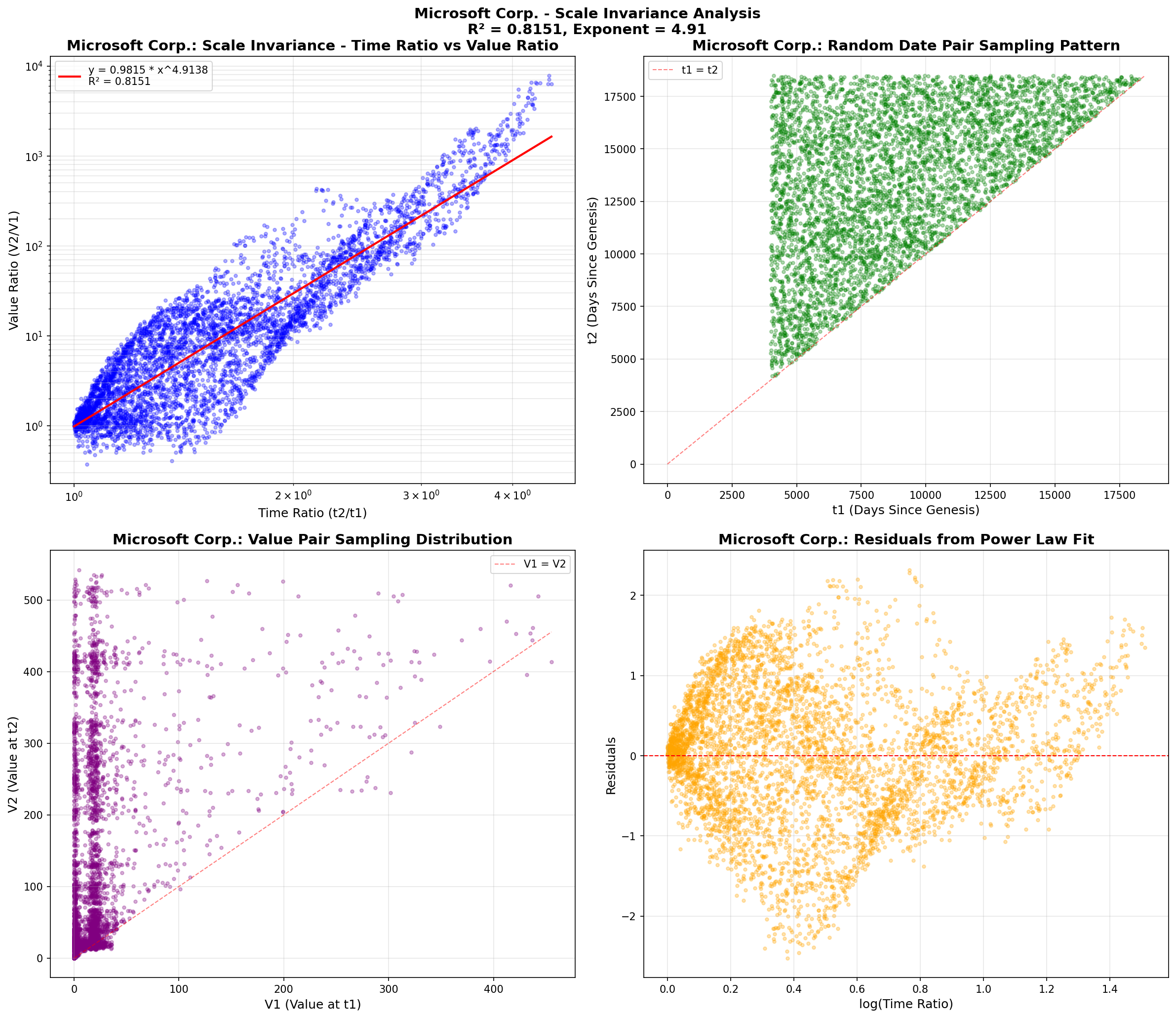

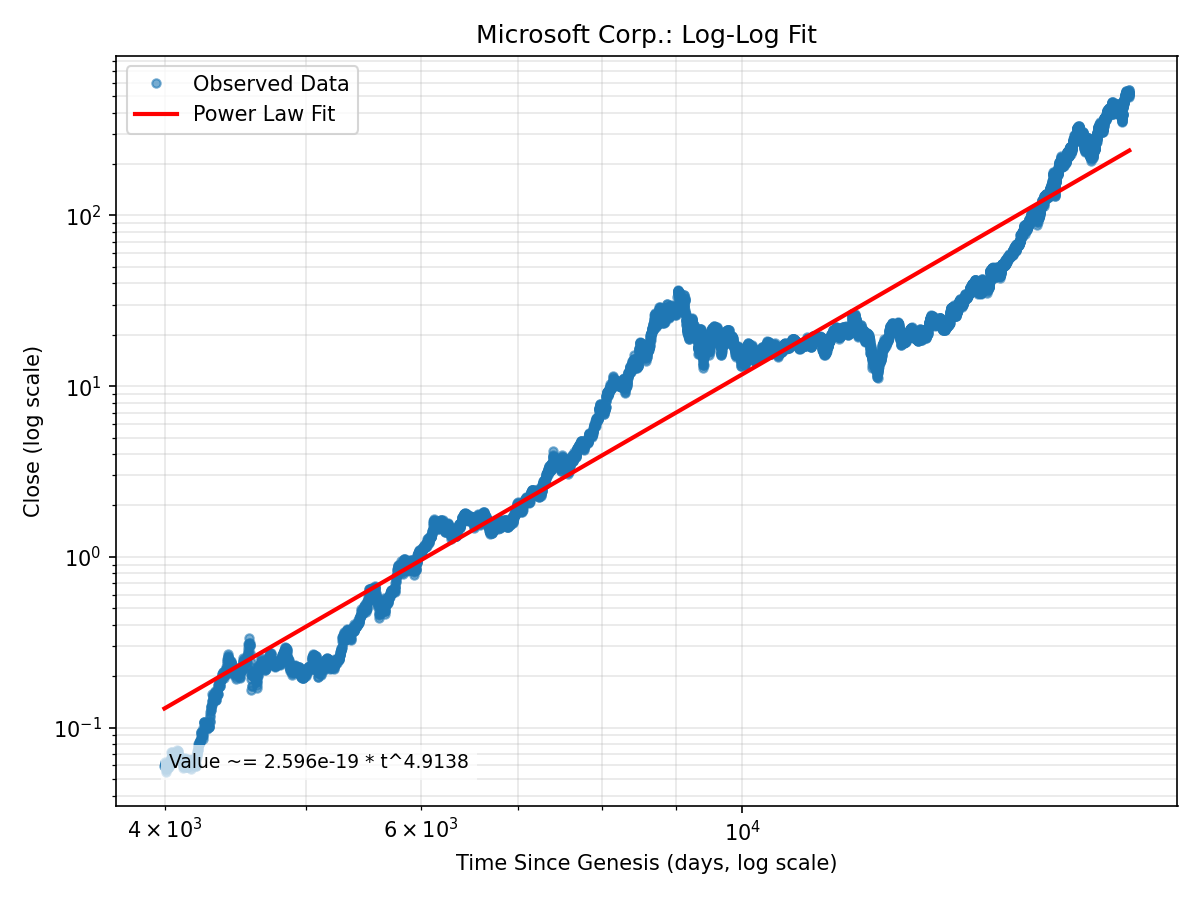

Microsoft Corp.

**R² (Scale Invariance):** 0.8151

**Power Law Exponent:** 4.91

**Data Points:** 9,993

**Date Range:** 1986-03-13 to 2025-11-07

**Log Residual Std Dev:** 0.5848

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 1975-04-04 (Provided)

**Power Law Fit:** Value ~= 2.596e-19 * t^4.9138

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.9792 vs Linear R²: 0.5089

**Current Value:** 67.9% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

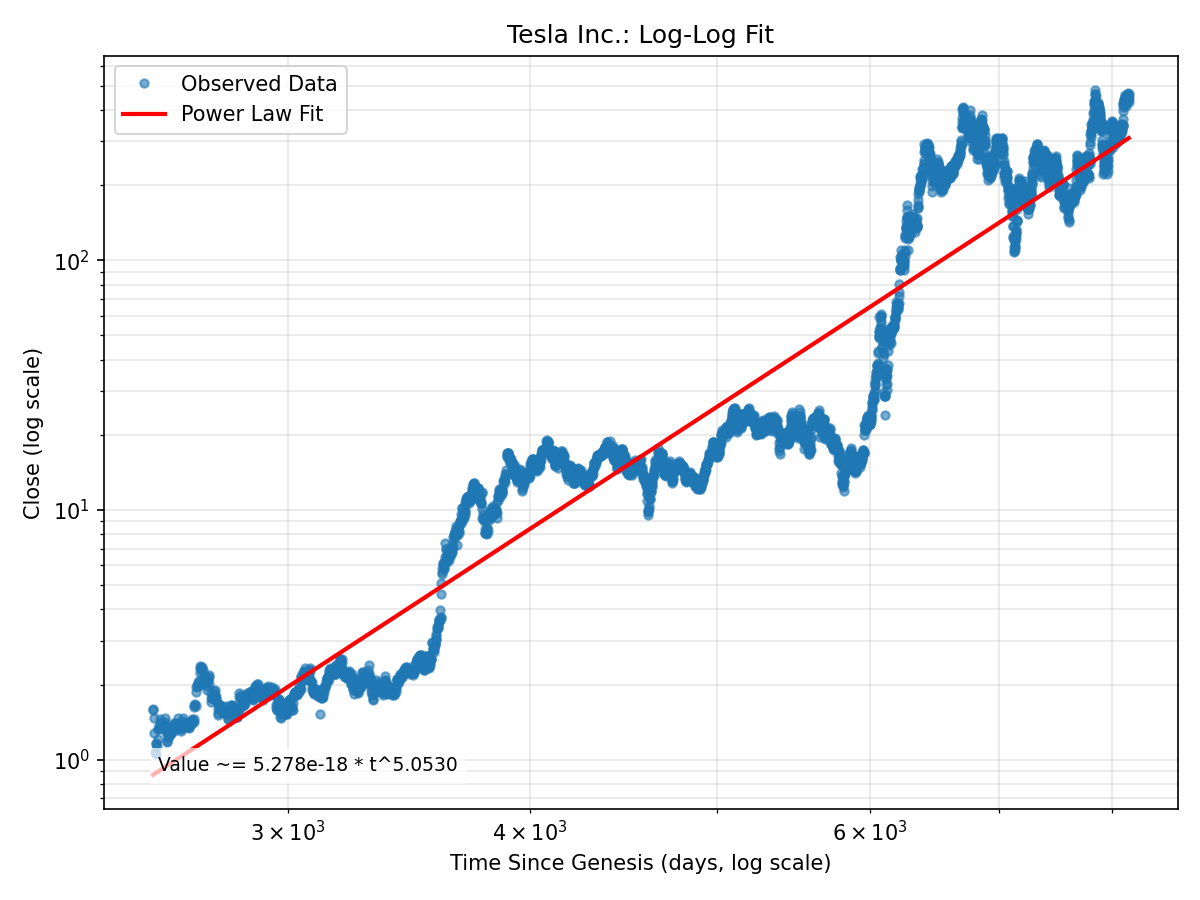

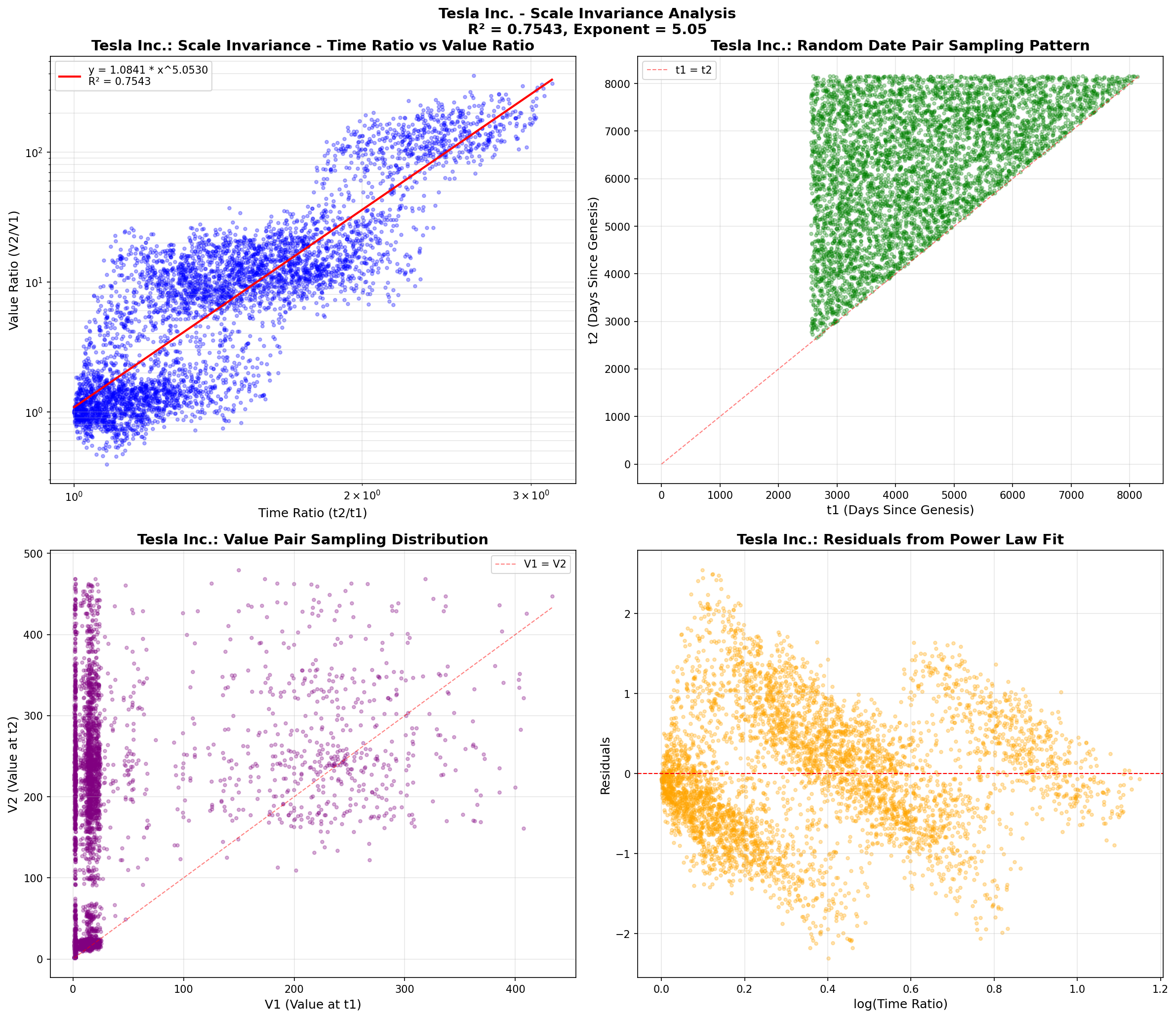

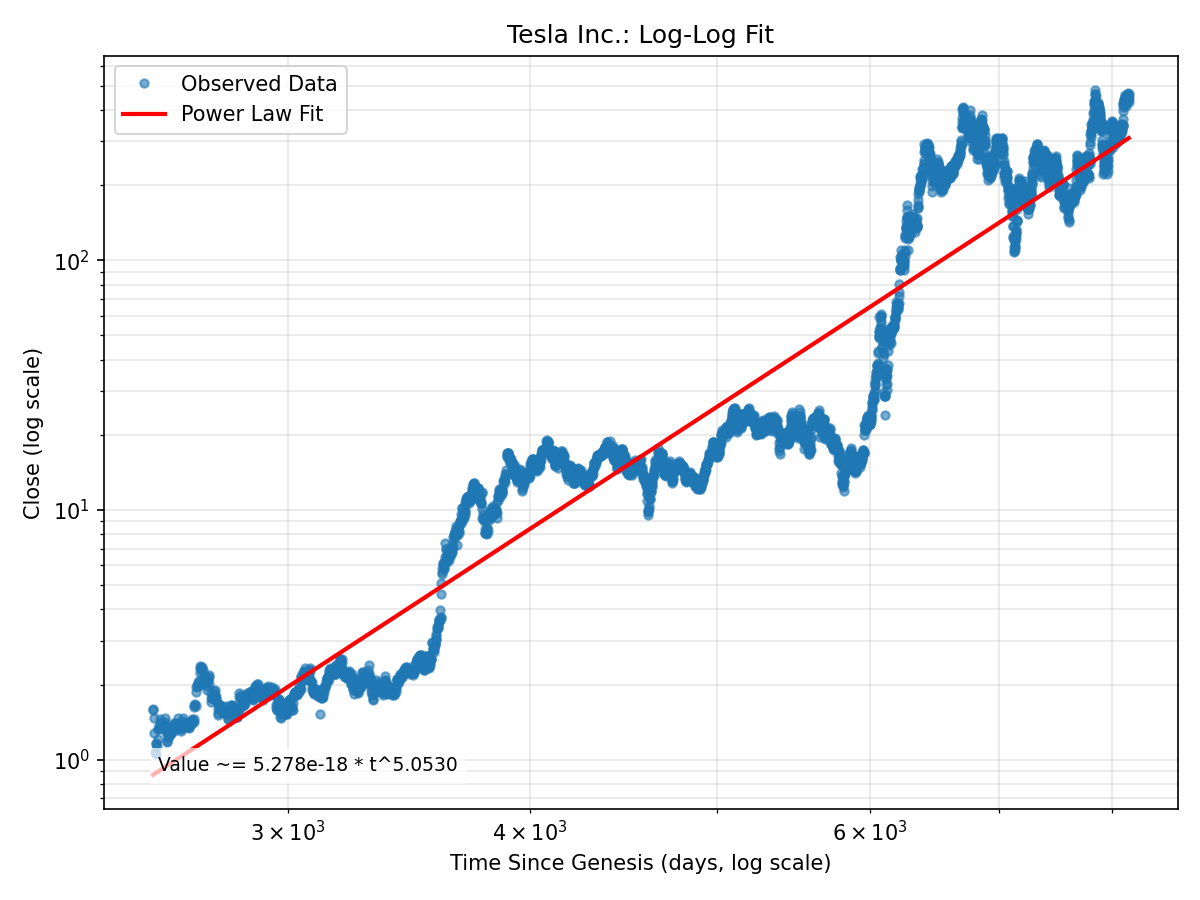

Tesla Inc.

**R² (Scale Invariance):** 0.7543

**Power Law Exponent:** 5.05

**Data Points:** 3,866

**Date Range:** 2010-06-29 to 2025-11-07

**Log Residual Std Dev:** 0.5591

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 2003-07-01 (Provided)

**Power Law Fit:** Value ~= 5.278e-18 * t^5.0530

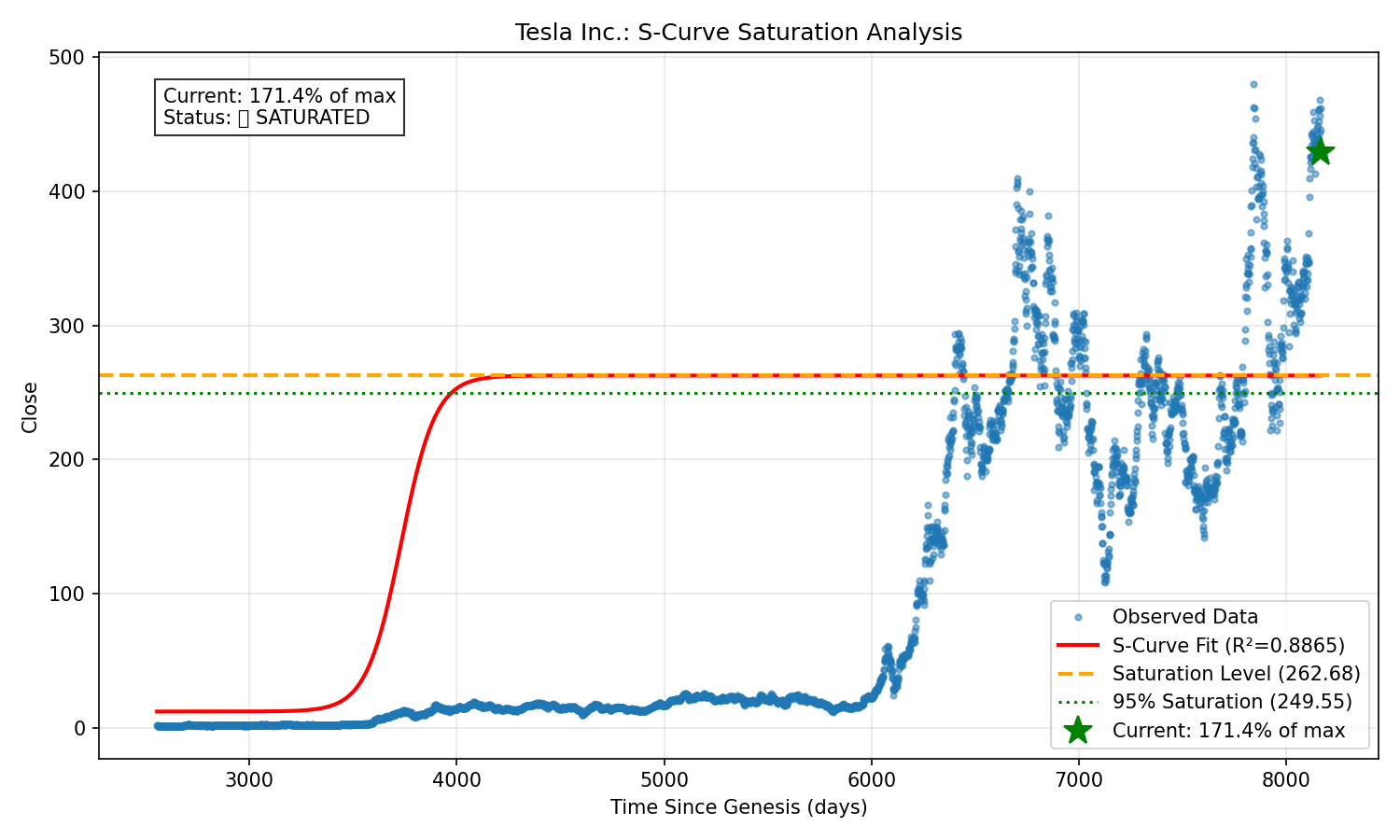

Saturation Analysis (S-Curve Detection):

**📈 S-CURVE DETECTED** (Sigmoid R² = 0.8865 vs Linear R² = 0.6847)

**Current Progress:** 171.4% of estimated maximum

**Saturation Level:** 2.51e+02 (estimated carrying capacity)

**✅ HAS REACHED SATURATION** (≥95% of maximum)

**Growth Pattern:** Decelerating (-244.1% slowdown in recent period)

Alphabet Inc.

**R² (Scale Invariance):** 0.7494

**Power Law Exponent:** 2.18

**Data Points:** 5,341

**Date Range:** 2004-08-19 to 2025-11-07

**Log Residual Std Dev:** 0.3312

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 1998-09-04 (Provided)

**Power Law Fit:** Value ~= 2.253e-07 * t^2.1758

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.9511 vs Linear R²: 0.7689

**Current Value:** 0.0% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

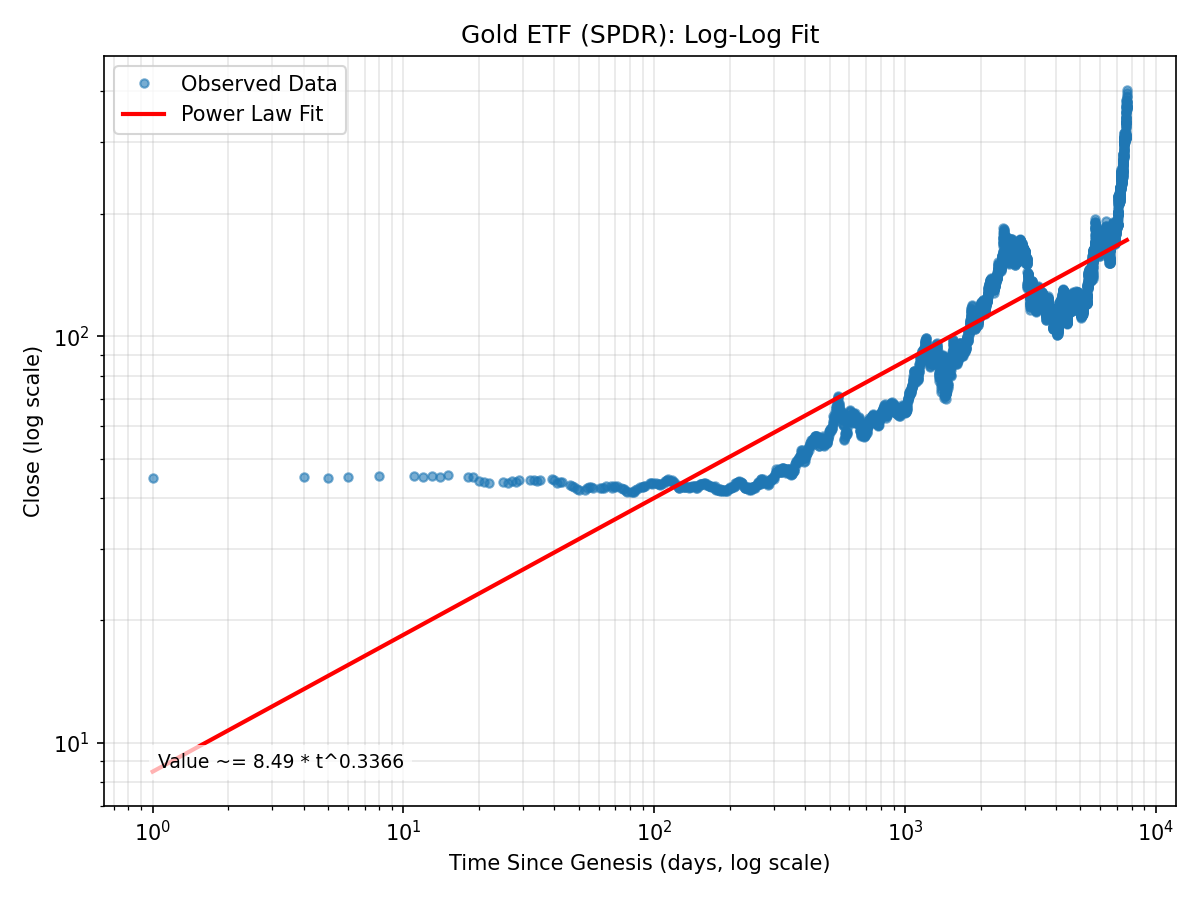

Gold ETF (SPDR)

**R² (Scale Invariance):** 0.5594

**Power Law Exponent:** 0.34

**Data Points:** 5,277

**Date Range:** 2004-11-18 to 2025-11-07

**Log Residual Std Dev:** 0.2191

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 2004-11-18 (Provided)

**Power Law Fit:** Value ~= 8.49 * t^0.3366

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.7333 vs Linear R²: 0.6669

**Current Value:** 0.0% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

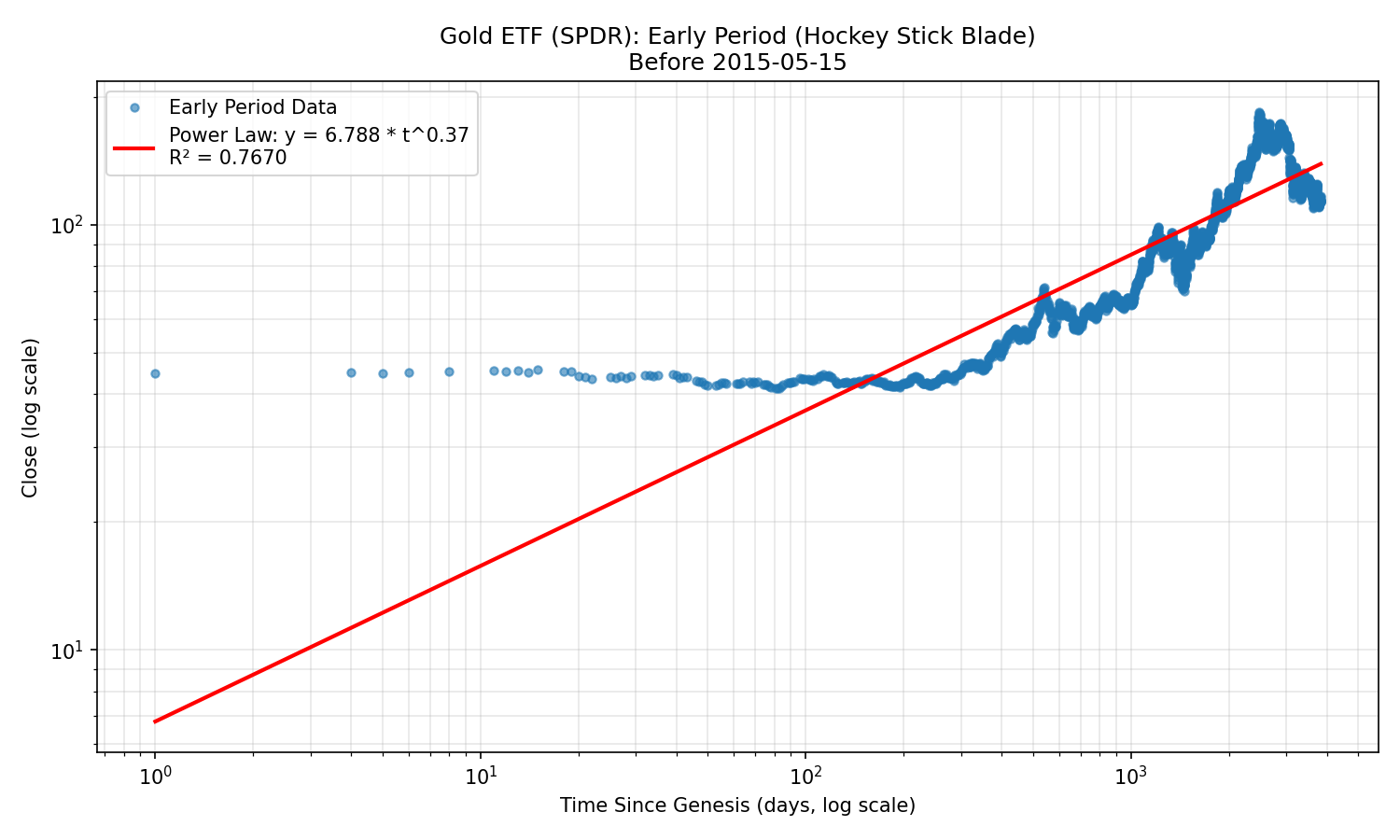

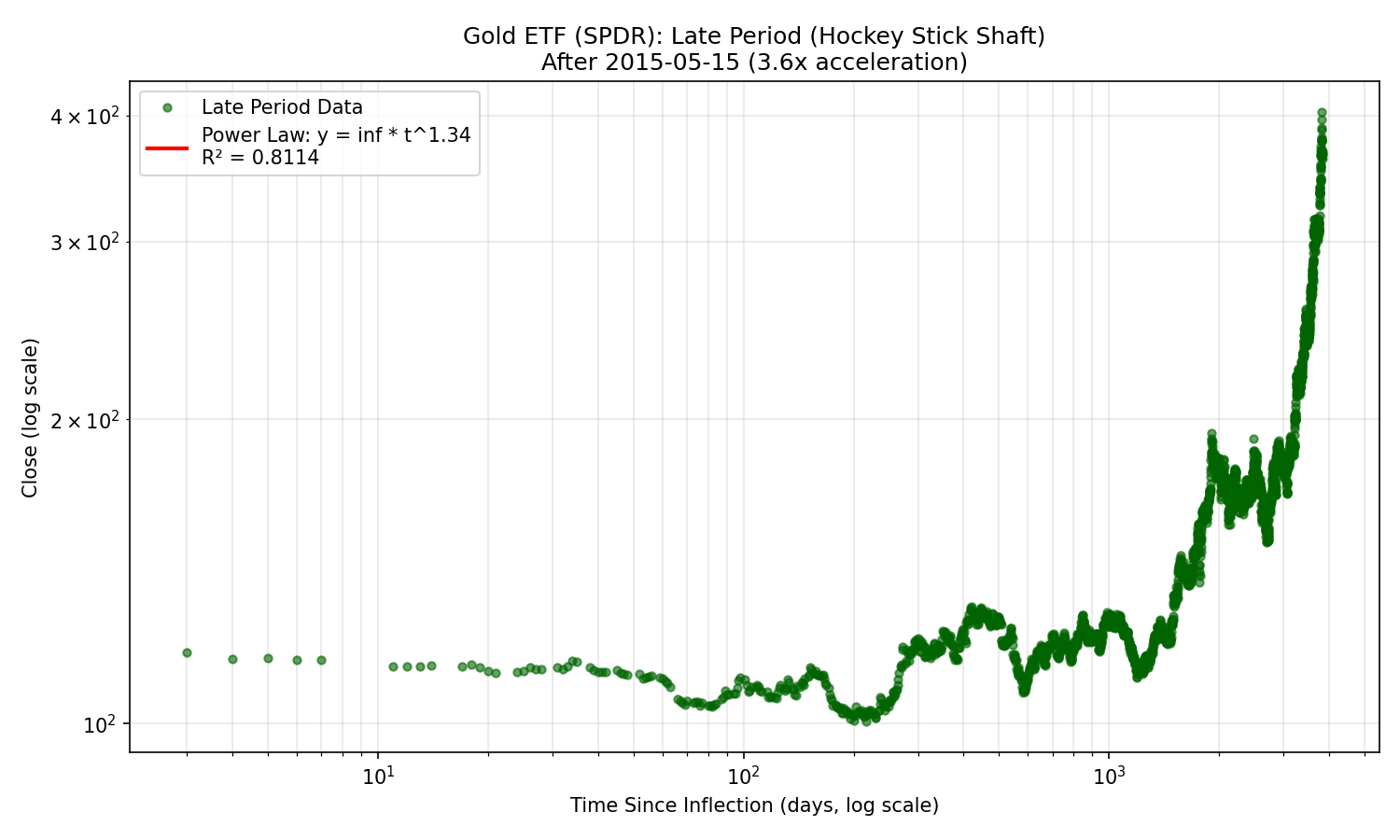

Hockey Stick Pattern Detected:

**🏒 INFLECTION POINT:** 2015-05-15

**Early Period (Blade):**

- R² = 0.7670

- Exponent = 0.37

- Data points = 2638

**Late Period (Shaft):**

- R² = 0.8114

- Exponent = 1.34

- Data points = 2638

**Growth Acceleration:** 3.6x faster in late period

**Model Improvement:** Split model R² = 0.8504 vs Single R² = 0.7523 (+0.0981)

**Analysis:** Asset shows distinct regime change - early slow growth followed by acceleration

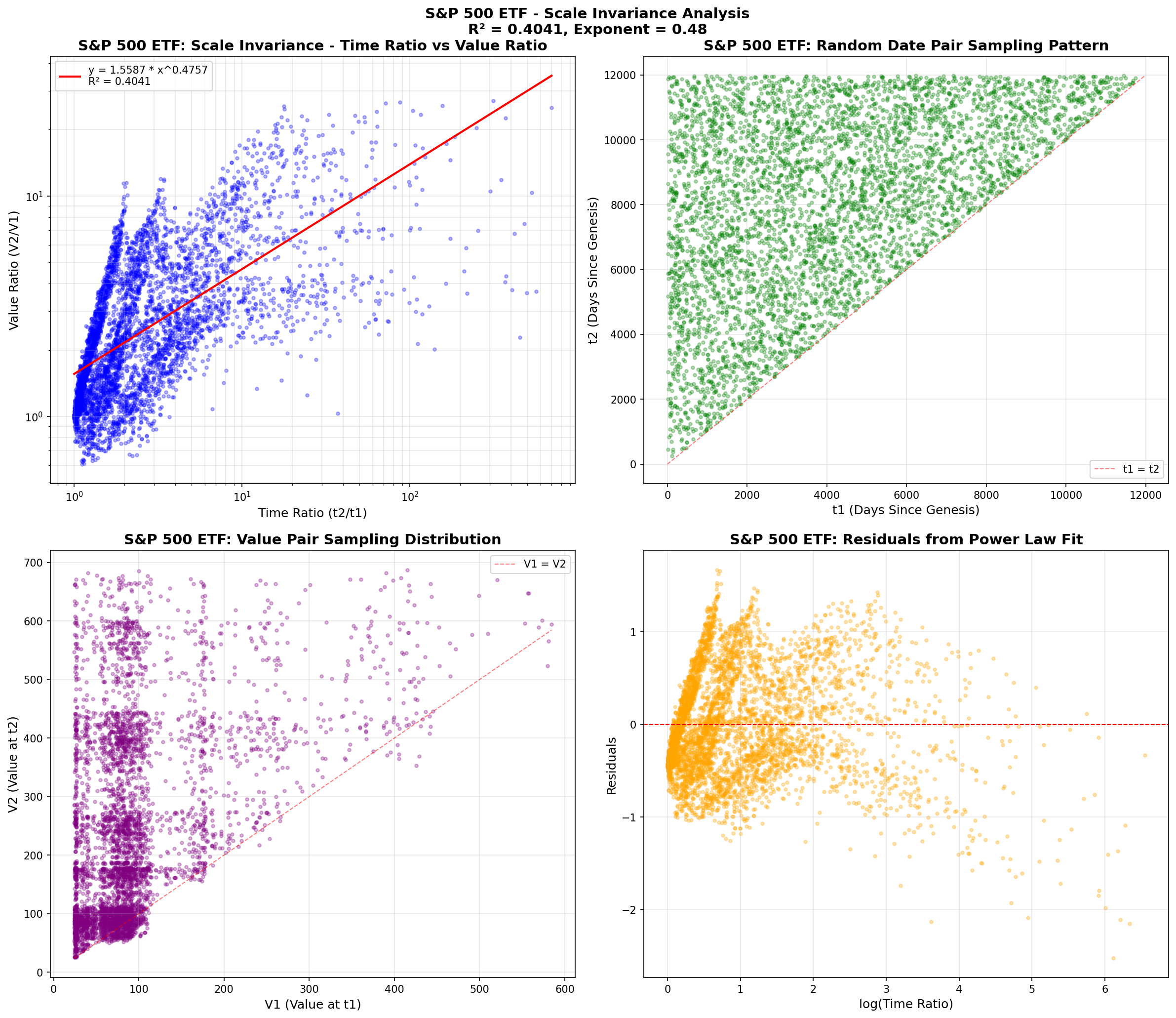

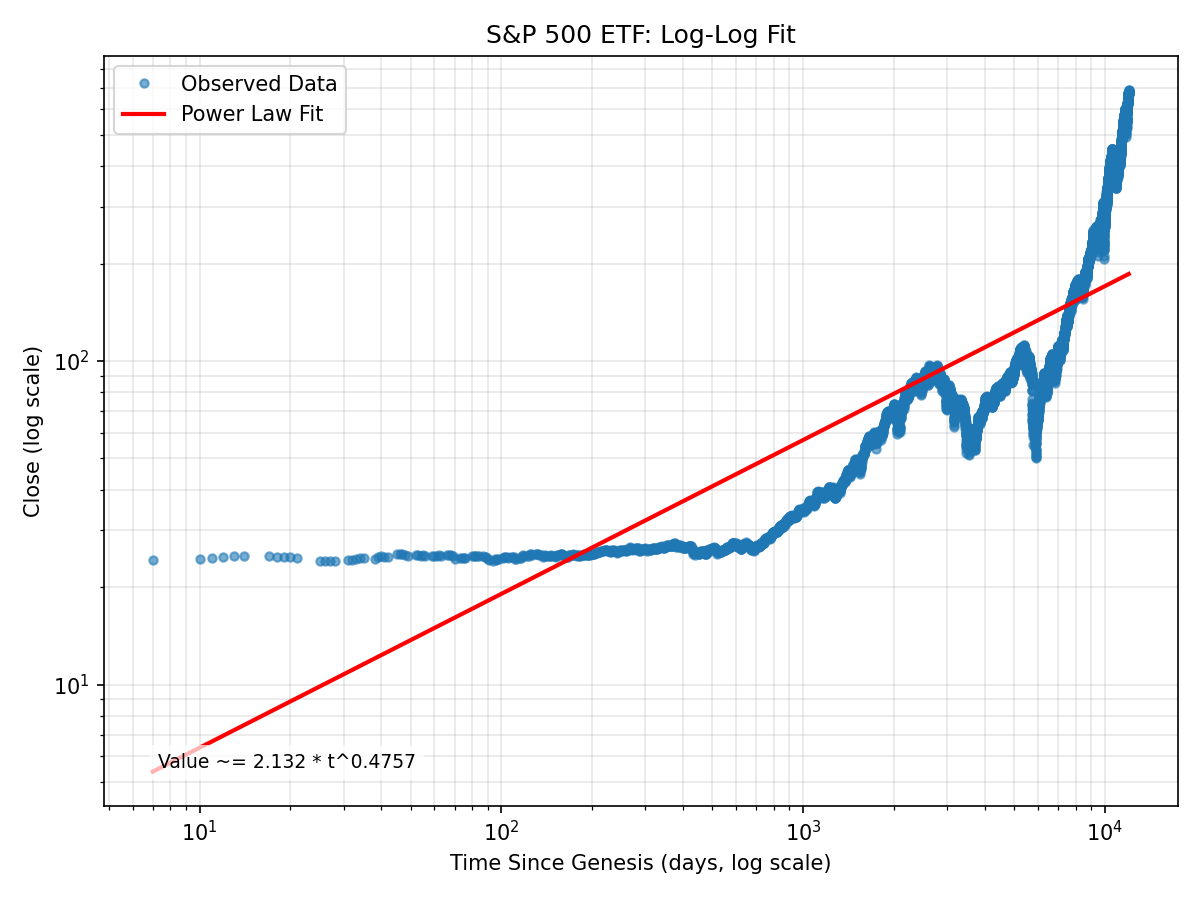

S&P 500 ETF

**R² (Scale Invariance):** 0.4041

**Power Law Exponent:** 0.48

**Data Points:** 8,252

**Date Range:** 1993-01-29 to 2025-11-07

**Log Residual Std Dev:** 0.5001

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 1993-01-22 (Provided)

**Power Law Fit:** Value ~= 2.132 * t^0.4757

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.9778 vs Linear R²: 0.7296

**Current Value:** 0.0% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

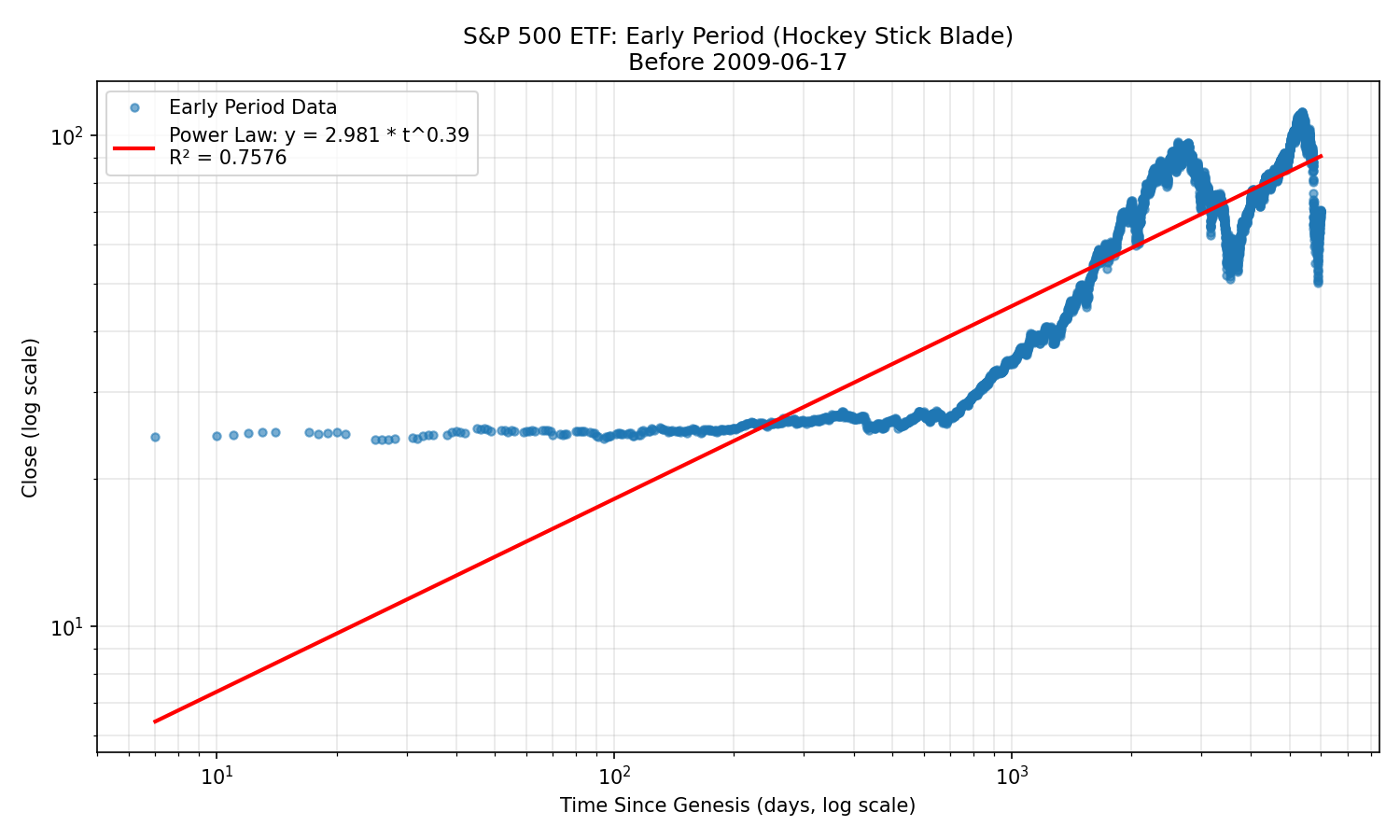

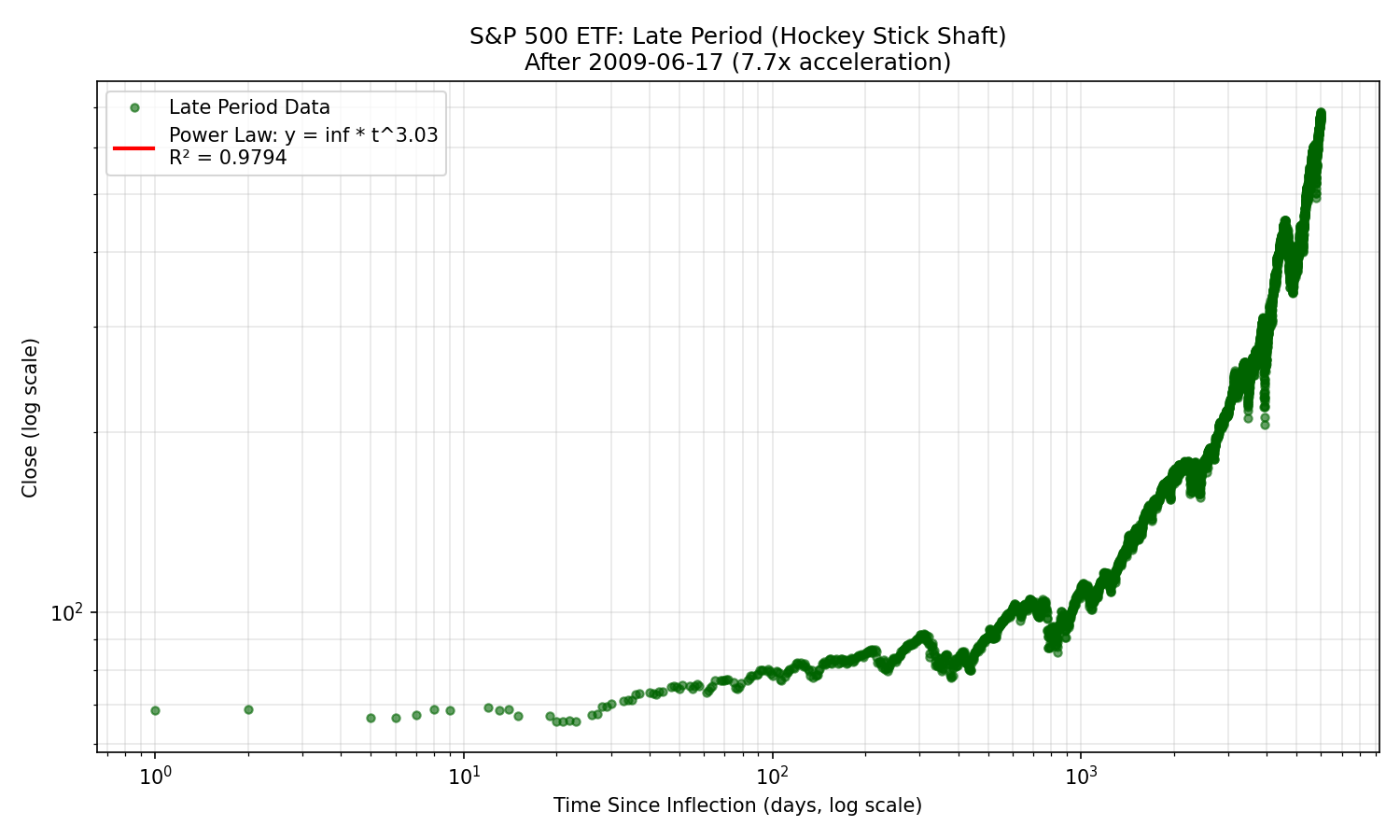

Hockey Stick Pattern Detected:

**🏒 INFLECTION POINT:** 2009-06-17

**Early Period (Blade):**

- R² = 0.7576

- Exponent = 0.39

- Data points = 4126

**Late Period (Shaft):**

- R² = 0.9794

- Exponent = 3.03

- Data points = 4126

**Growth Acceleration:** 7.7x faster in late period

**Model Improvement:** Split model R² = 0.9600 vs Single R² = 0.7052 (+0.2547)

**Analysis:** Asset shows distinct regime change - early slow growth followed by acceleration

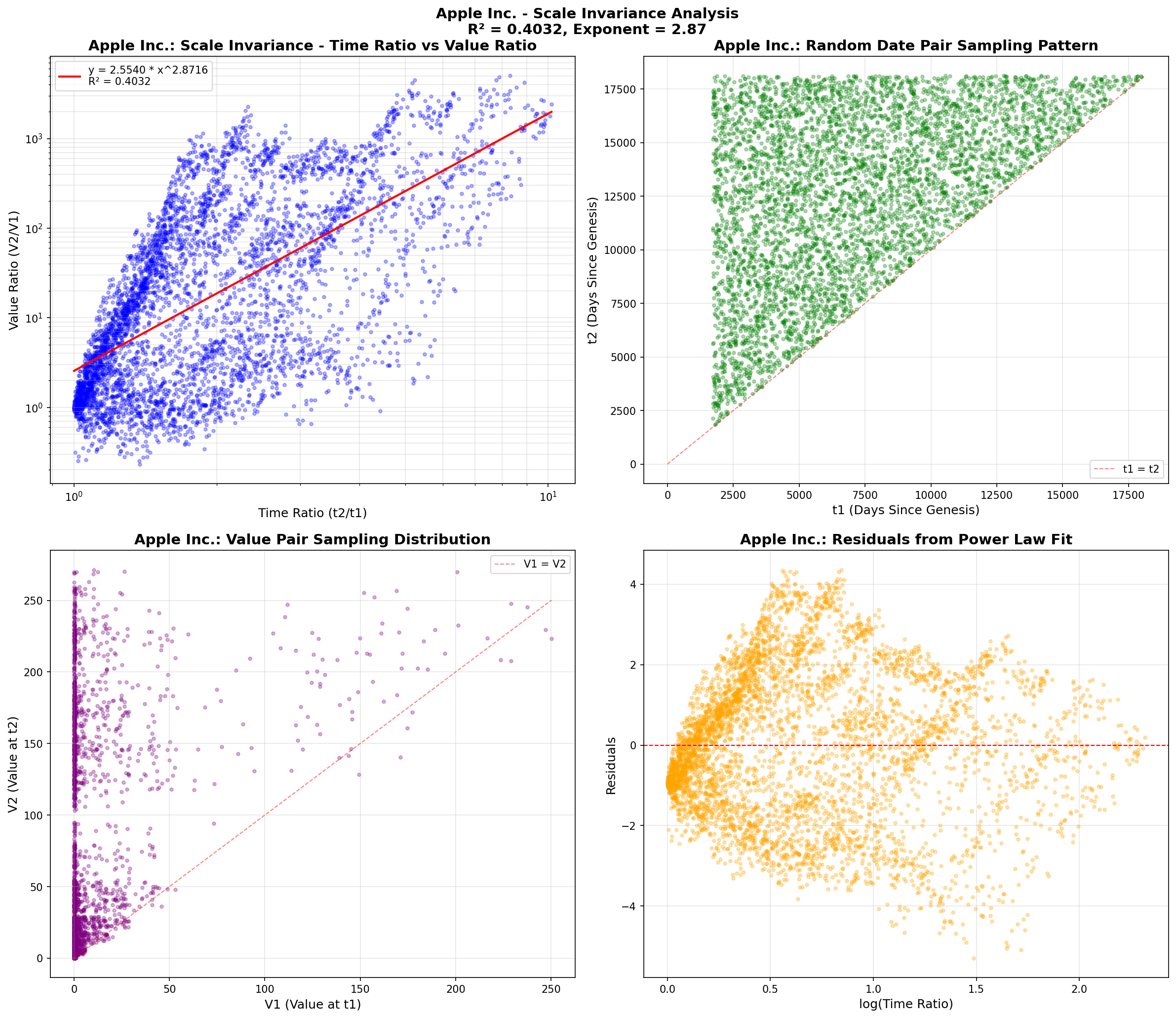

Apple Inc.

**R² (Scale Invariance):** 0.4032

**Power Law Exponent:** 2.87

**Data Points:** 11,319

**Date Range:** 1980-12-12 to 2025-11-07

**Log Residual Std Dev:** 1.4324

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 1976-04-01 (Provided)

**Power Law Fit:** Value ~= 9.735e-12 * t^2.8716

Saturation Analysis (S-Curve Detection):

**📈 S-CURVE DETECTED** (Sigmoid R² = 0.9805 vs Linear R² = 0.4632)

**Current Progress:** 88.7% of estimated maximum

**Saturation Level:** 3.03e+02 (estimated carrying capacity)

**Estimated Time to 95% Saturation:** ~4.1 years

**Growth Pattern:** Decelerating (-5078.8% slowdown in recent period)

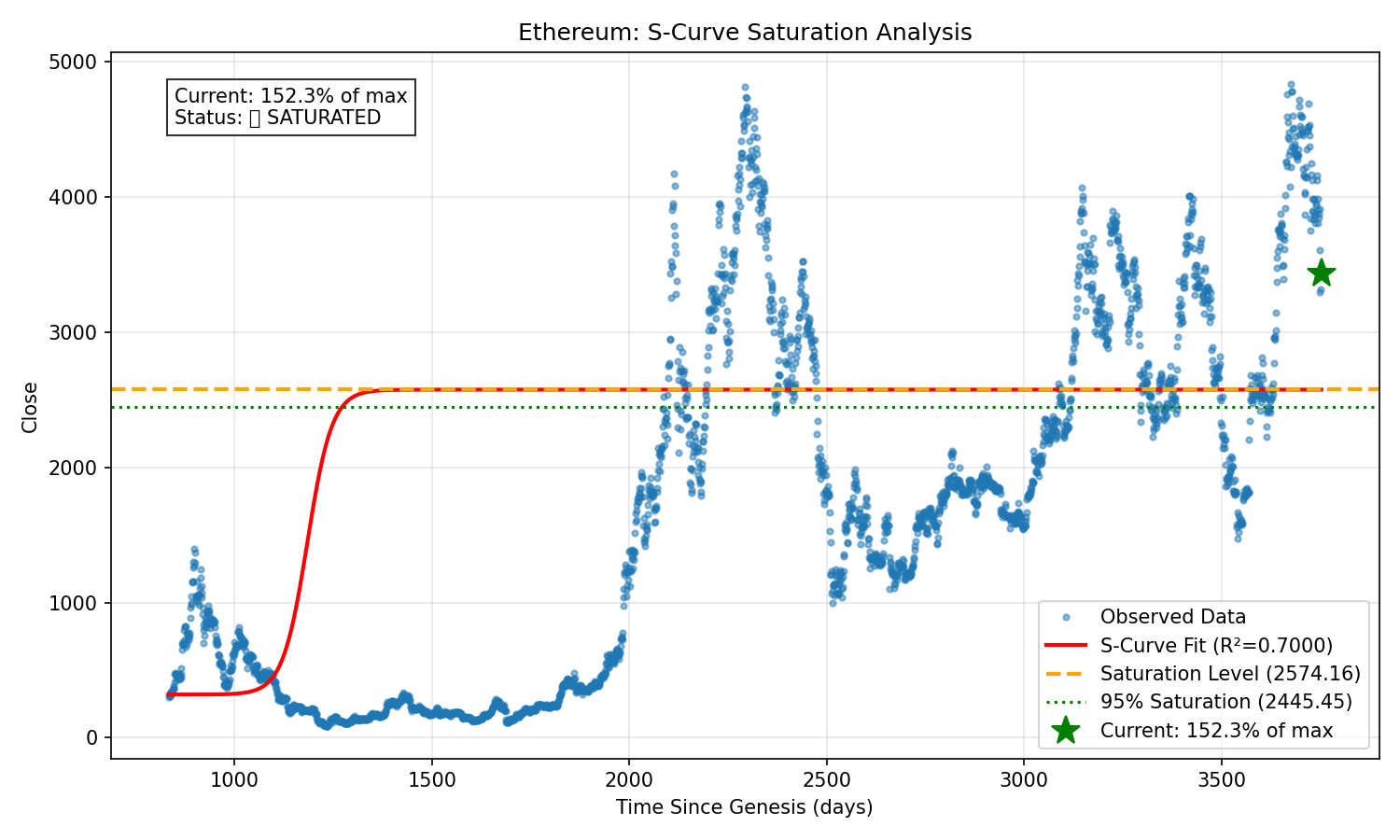

Ethereum

**R² (Scale Invariance):** 0.2740

**Power Law Exponent:** 1.90

**Data Points:** 2,921

**Date Range:** 2017-11-09 to 2025-11-07

**Log Residual Std Dev:** 0.7583

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 2015-07-30 (Provided)

**Power Law Fit:** Value ~= 0.0004909 * t^1.8979

Saturation Analysis (S-Curve Detection):

**📈 S-CURVE DETECTED** (Sigmoid R² = 0.7000 vs Linear R² = 0.5743)

**Current Progress:** 152.3% of estimated maximum

**Saturation Level:** 2.26e+03 (estimated carrying capacity)

**✅ HAS REACHED SATURATION** (≥95% of maximum)

**Growth Pattern:** Decelerating (22.3% slowdown in recent period)

Financial Asset - Split

Gold ETF (SPDR) (Early Period)

**R² (Scale Invariance):** 0.5747

**Power Law Exponent:** 0.33

**Data Points:** 2,639

**Date Range:** 2004-11-18 to 2015-05-14

**Log Residual Std Dev:** 0.2031

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 2004-11-18 (Provided)

**Power Law Fit:** Value ~= 9.028 * t^0.3268

S&P 500 ETF (Early Period)

**R² (Scale Invariance):** 0.5739

**Power Law Exponent:** 0.36

**Data Points:** 4,126

**Date Range:** 1993-01-29 to 2009-06-16

**Log Residual Std Dev:** 0.2184

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 1993-01-22 (Provided)

**Power Law Fit:** Value ~= 3.759 * t^0.3627

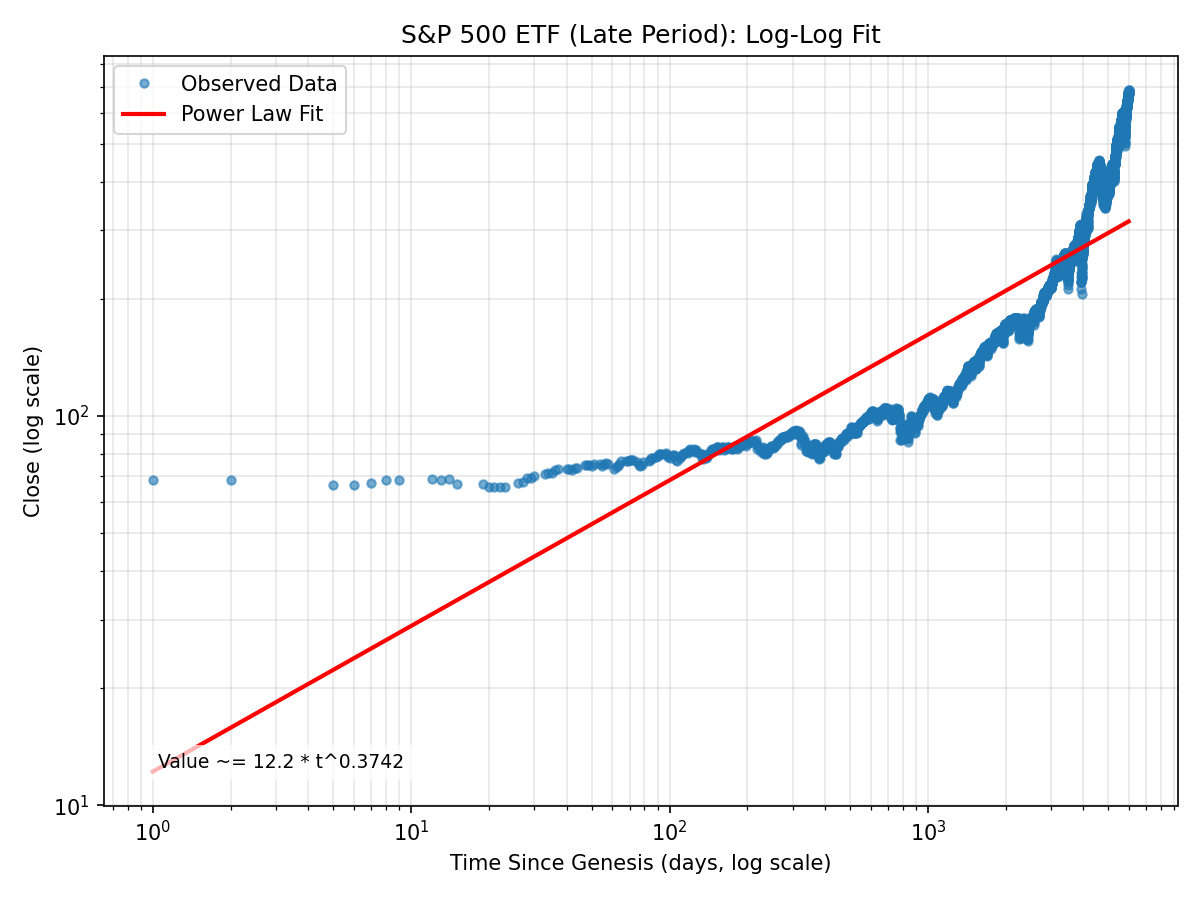

S&P 500 ETF (Late Period)

**R² (Scale Invariance):** 0.5422

**Power Law Exponent:** 0.37

**Data Points:** 4,126

**Date Range:** 2009-06-17 to 2025-11-07

**Log Residual Std Dev:** 0.3355

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 2009-06-17 (Hockey Stick Inflection)

**Power Law Fit:** Value ~= 12.2 * t^0.3742

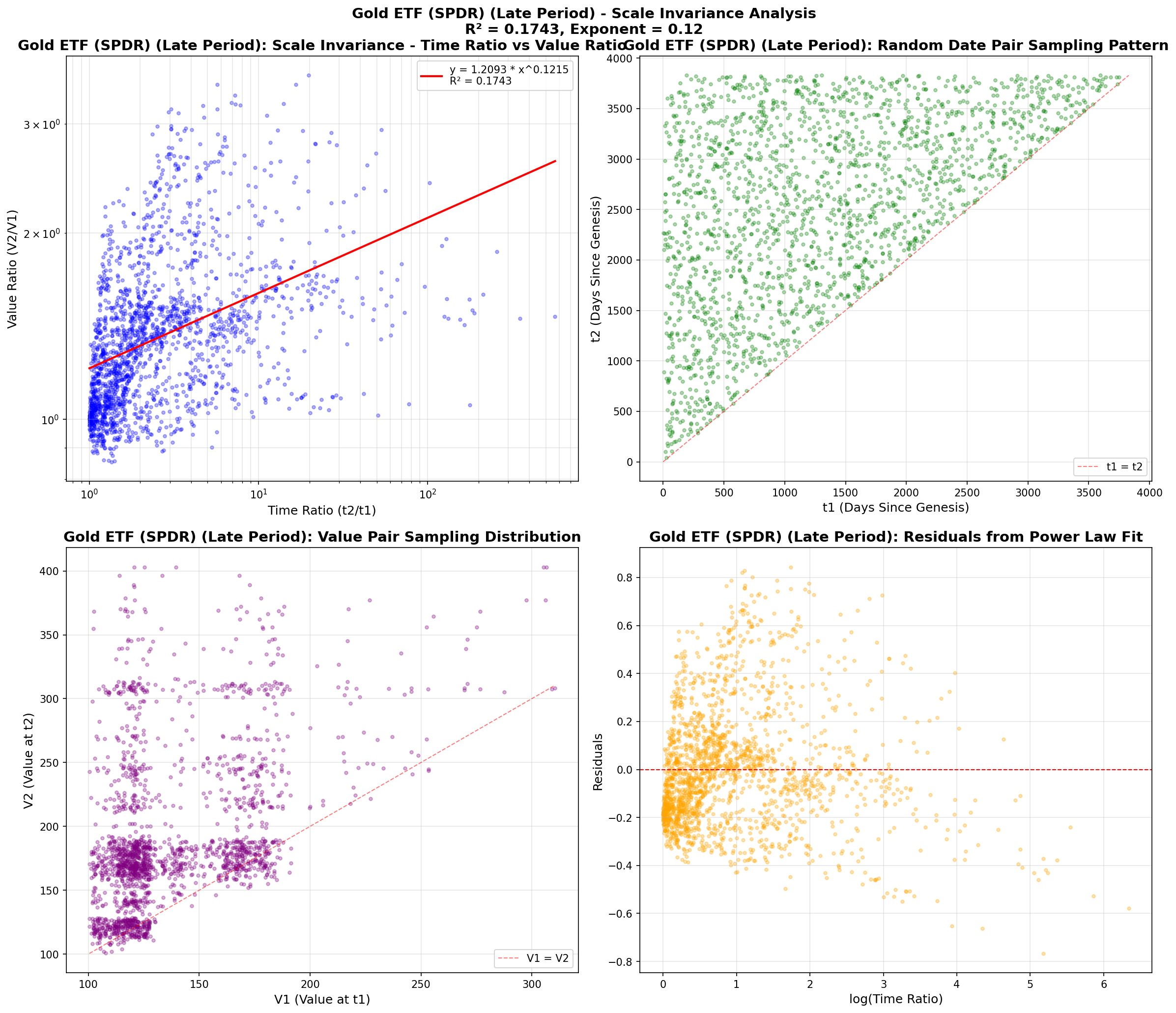

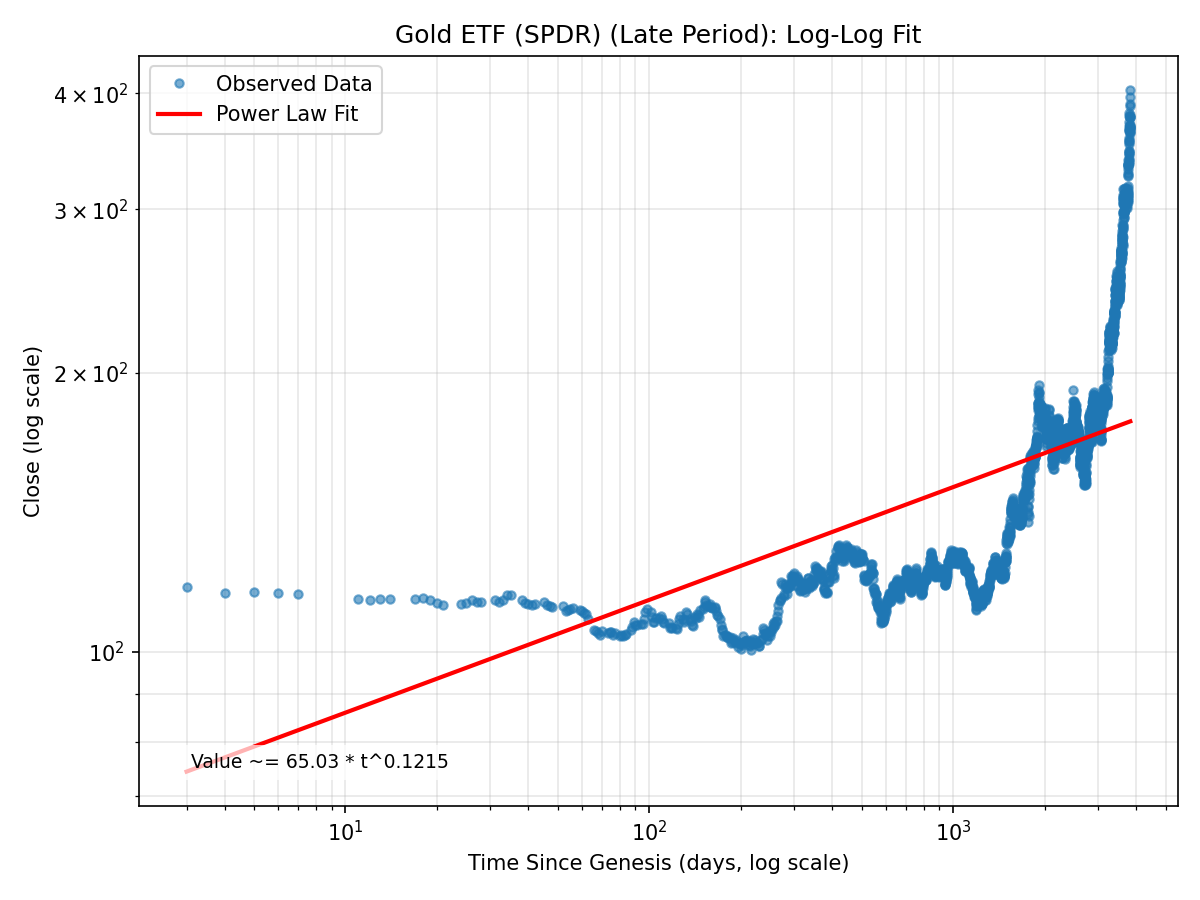

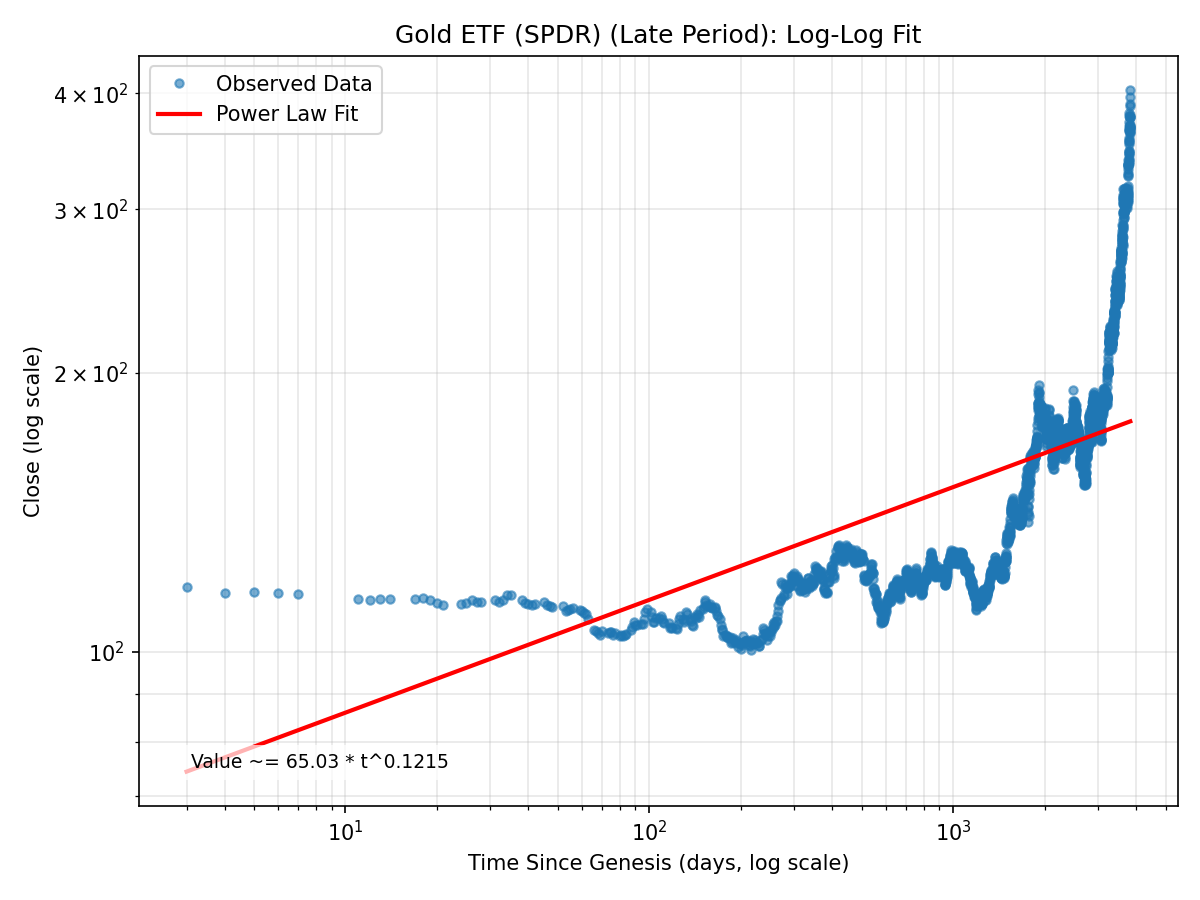

Gold ETF (SPDR) (Late Period)

**R² (Scale Invariance):** 0.1743

**Power Law Exponent:** 0.12

**Data Points:** 2,638

**Date Range:** 2015-05-15 to 2025-11-07

**Log Residual Std Dev:** 0.2204

**Data Source:** Yahoo Finance API (yfinance Python library)

**Genesis Date:** 2015-05-15 (Hockey Stick Inflection)

**Power Law Fit:** Value ~= 65.03 * t^0.1215

Health

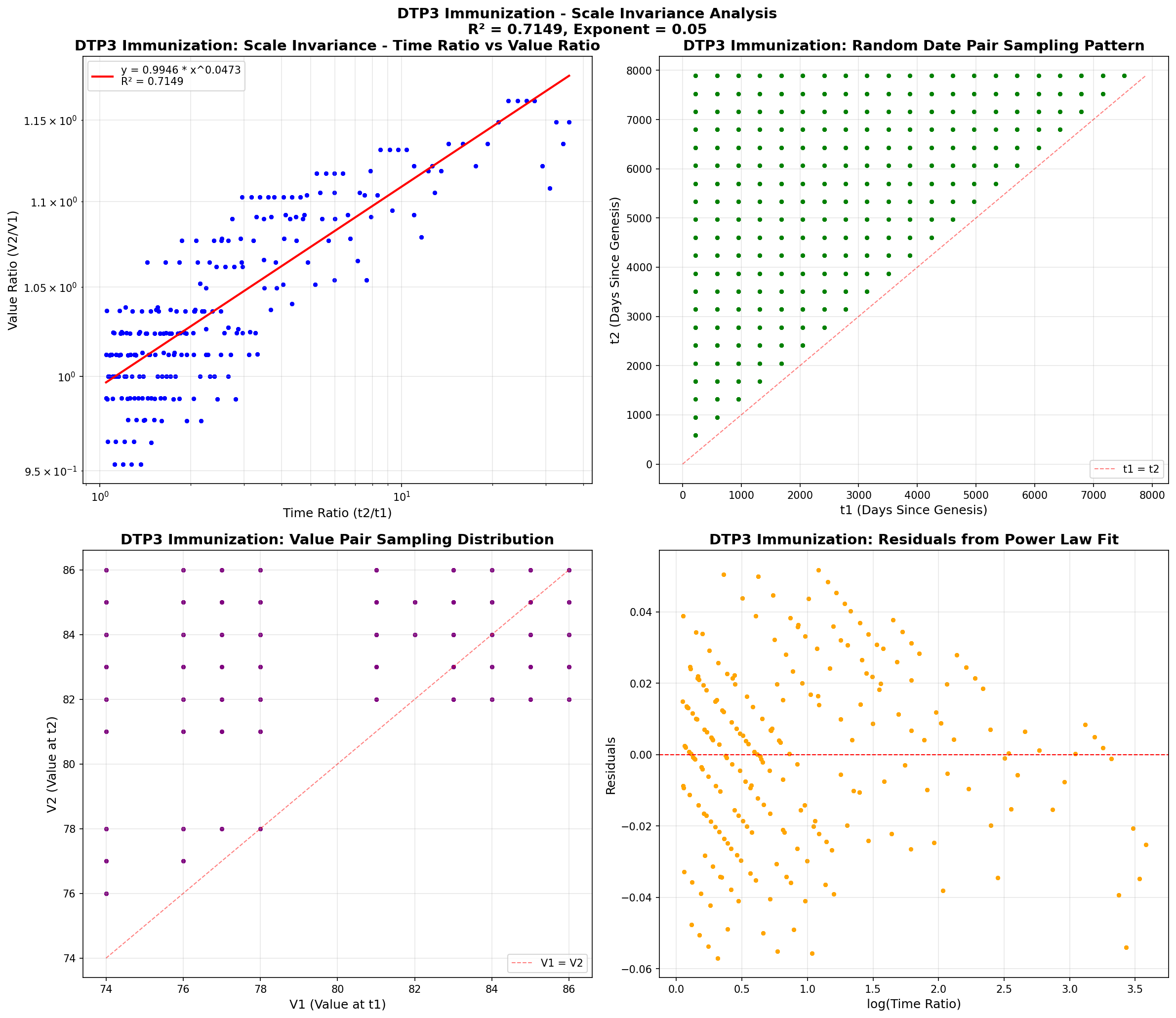

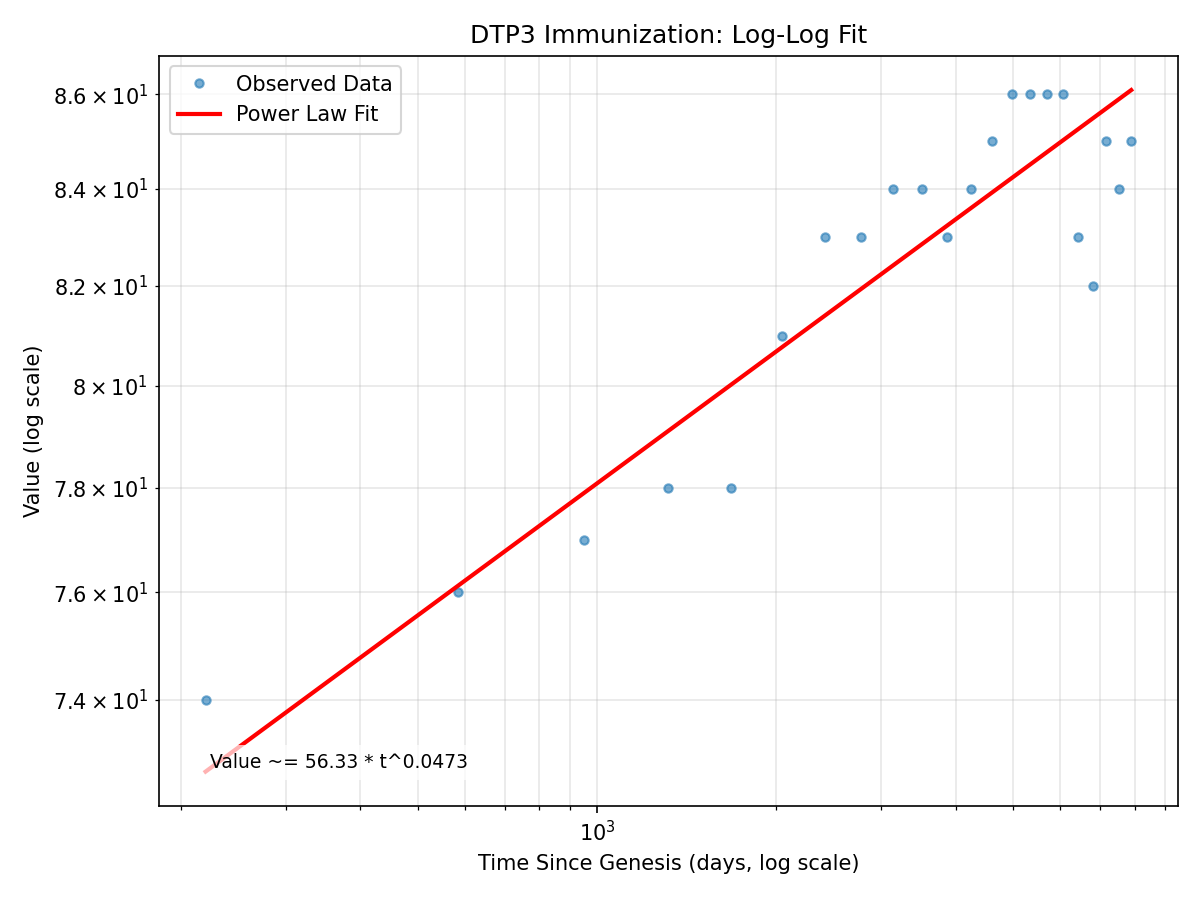

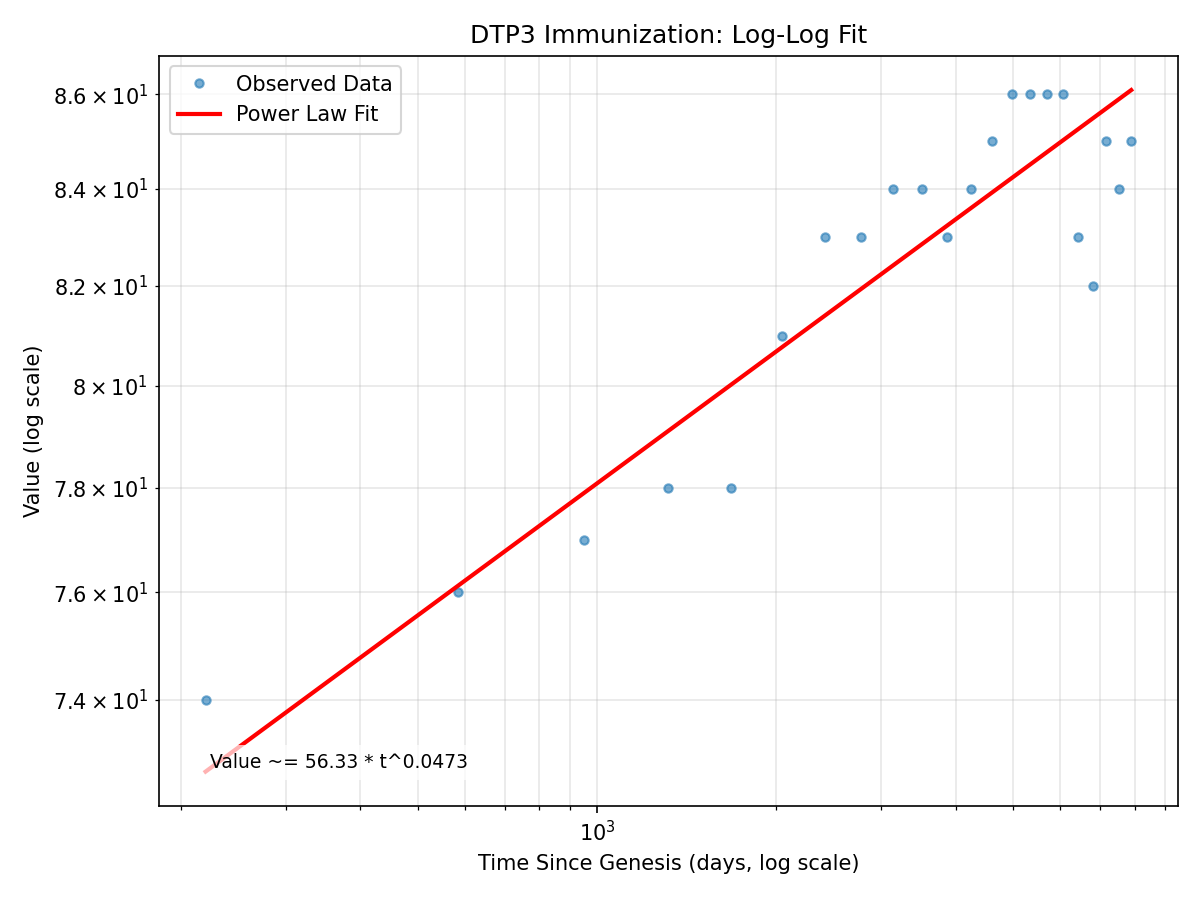

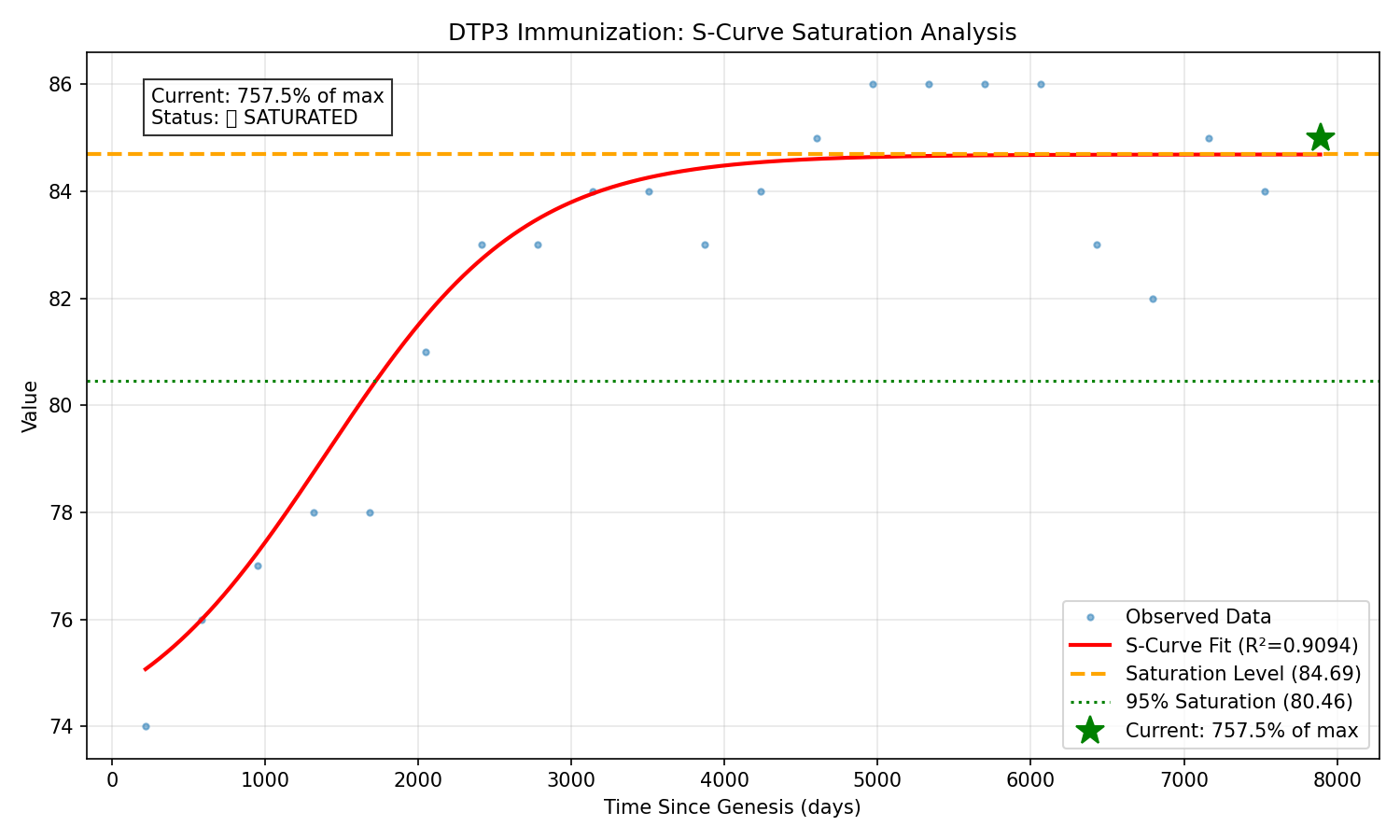

DTP3 Immunization

**R² (Scale Invariance):** 0.7149

**Power Law Exponent:** 0.05

**Data Points:** 22

**Date Range:** 2003-01-01 to 2024-01-01

**Log Residual Std Dev:** 0.0177

**Data Source:** WHO API (WHS4_100)

**Genesis Date:** 2002-05-26 (Optimized vs published)

**Power Law Fit:** Value ~= 56.33 * t^0.0473

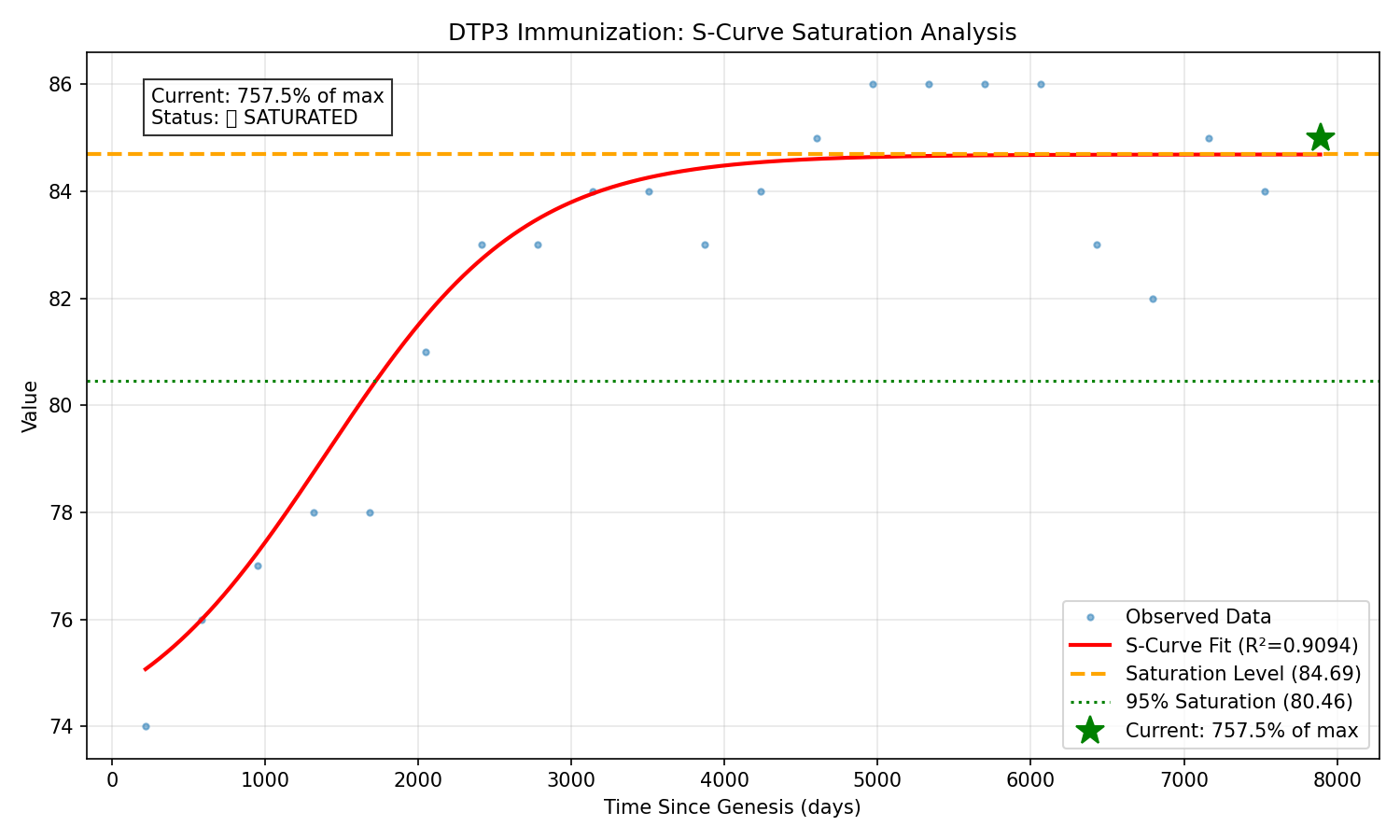

Saturation Analysis (S-Curve Detection):

**📈 S-CURVE DETECTED** (Sigmoid R² = 0.9094 vs Linear R² = 0.6163)

**Current Progress:** 757.5% of estimated maximum

**Saturation Level:** 1.12e+01 (estimated carrying capacity)

**✅ HAS REACHED SATURATION** (≥95% of maximum)

**Growth Pattern:** Decelerating (17.9% slowdown in recent period)

Genesis Date Optimization:

**Optimal Genesis:** 2002-05-26 (R² = 0.7195)

**Note:** No published genesis date available for comparison

**Tested:** 11 candidate dates across range 2002-05-26 to 2004-11-11

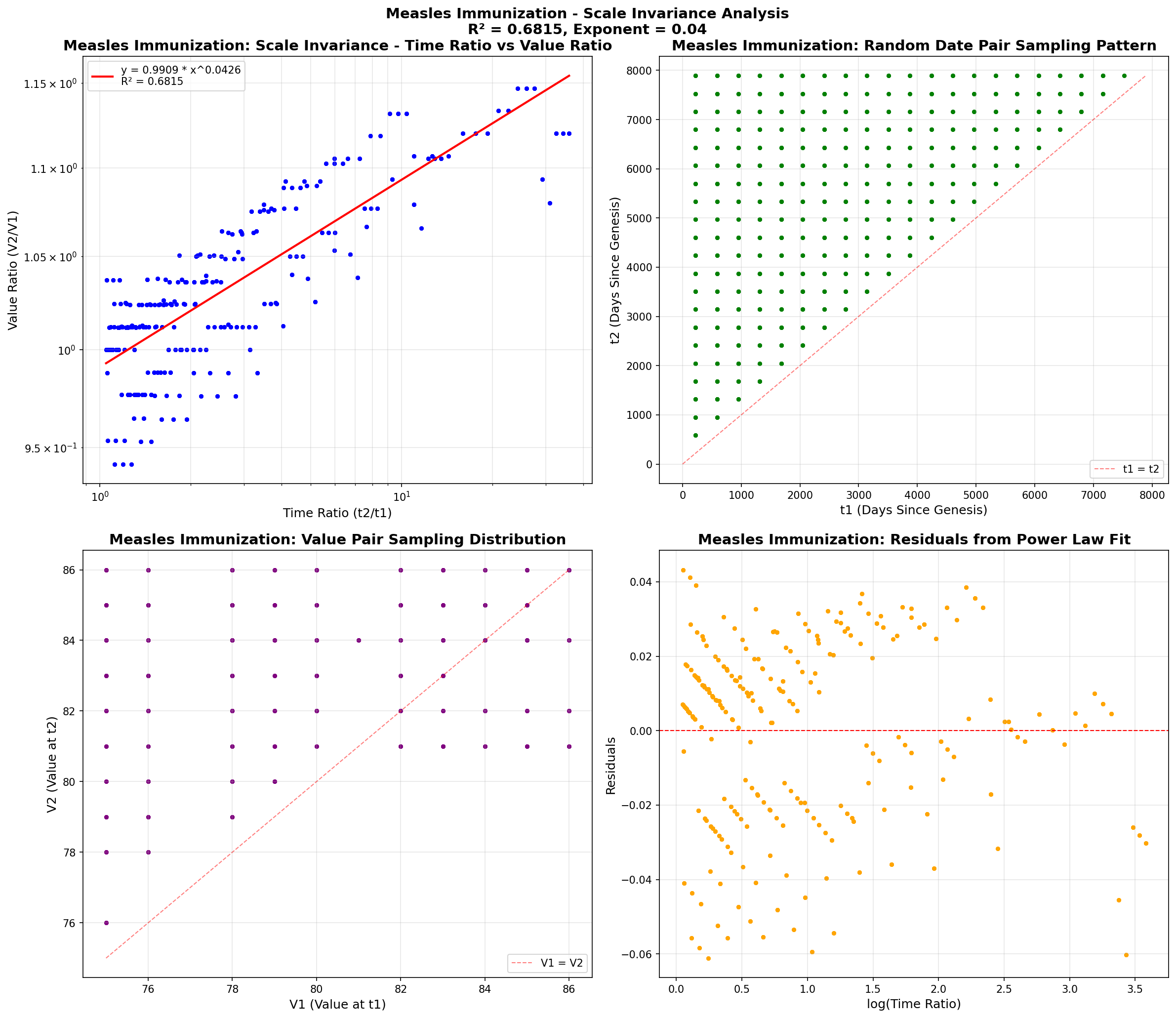

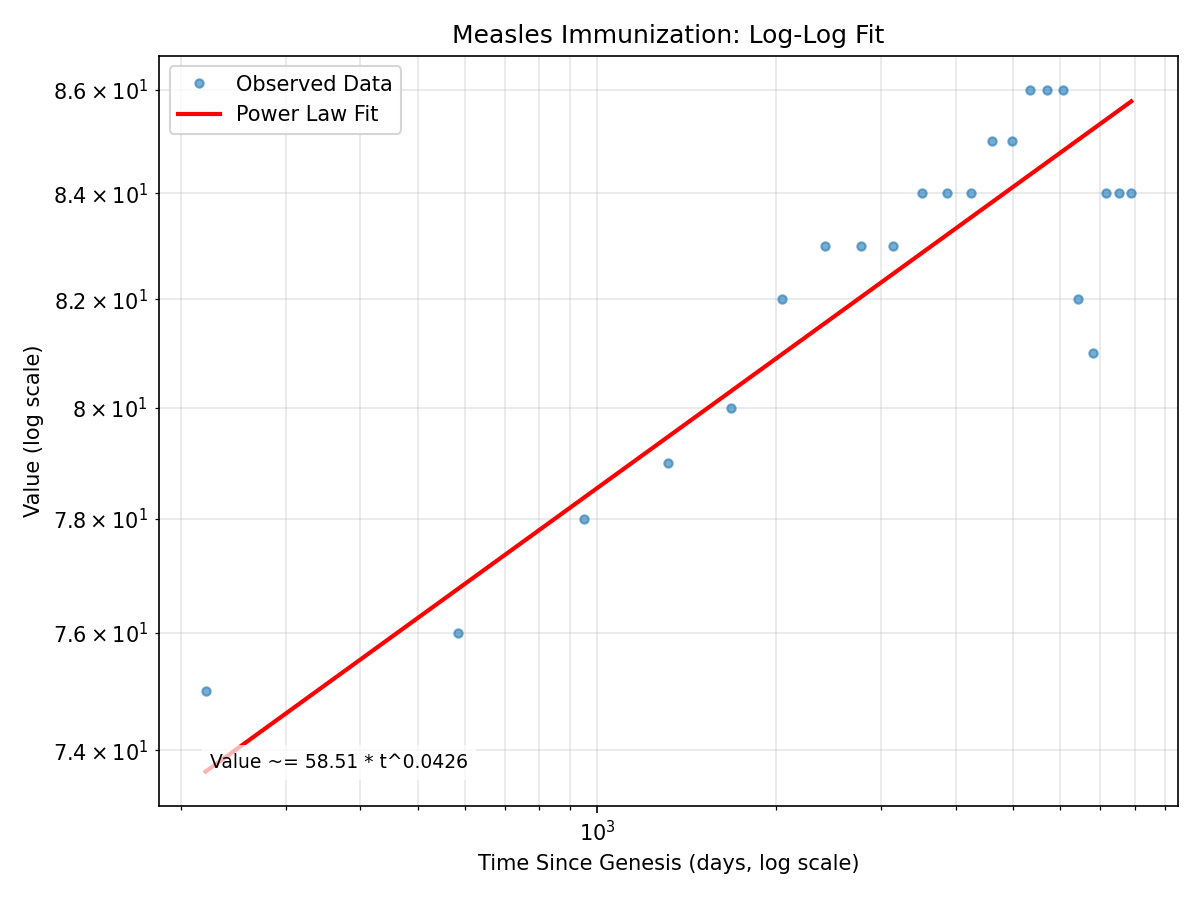

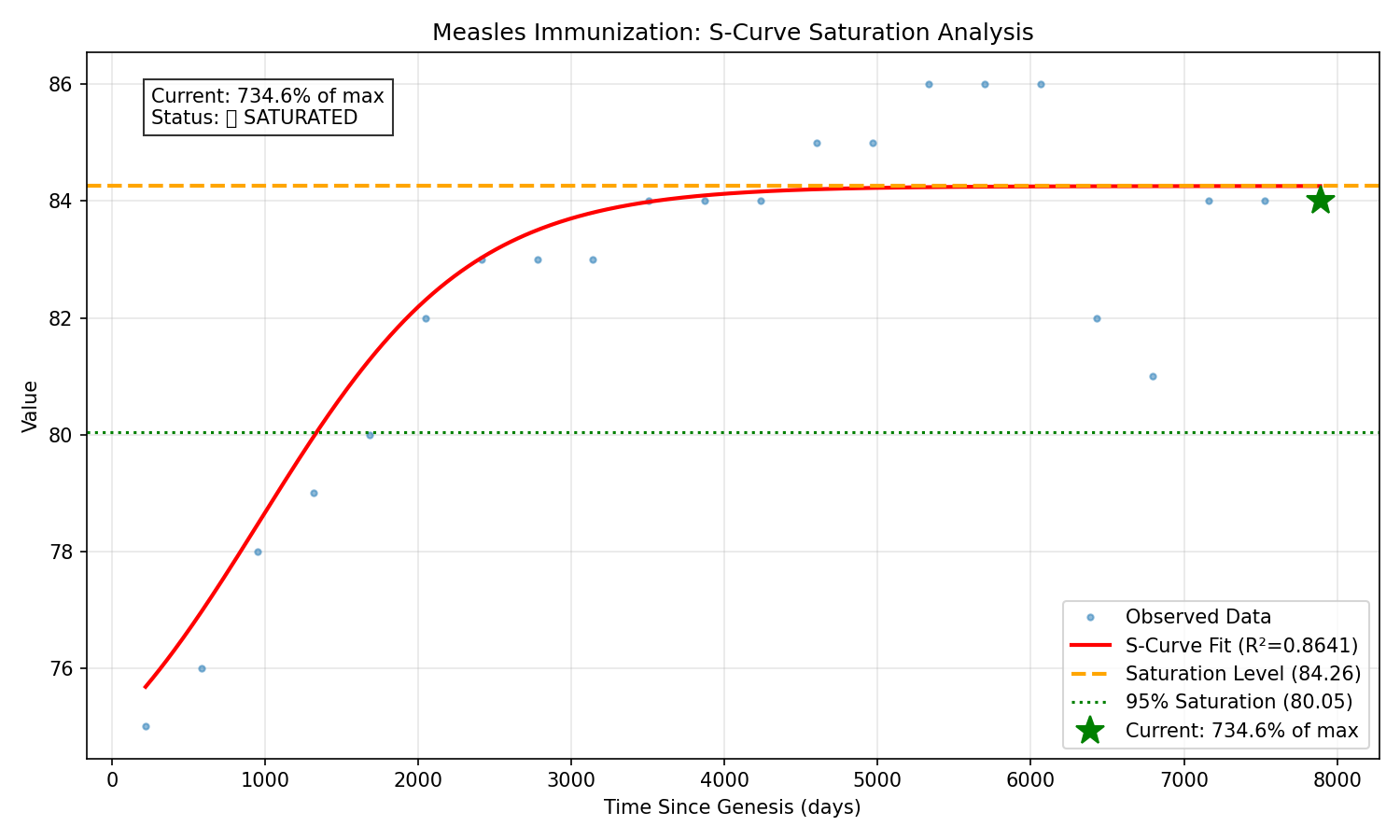

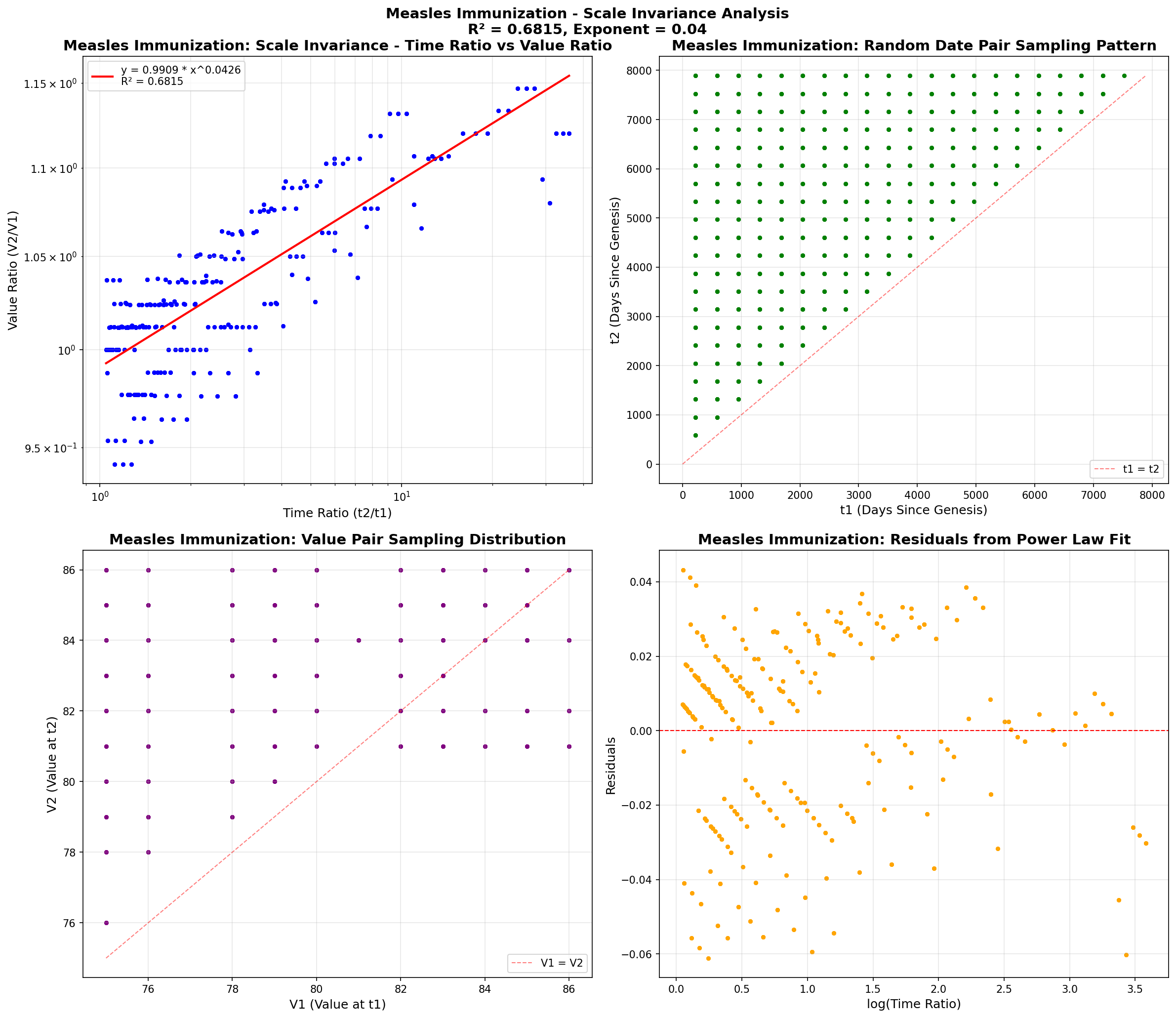

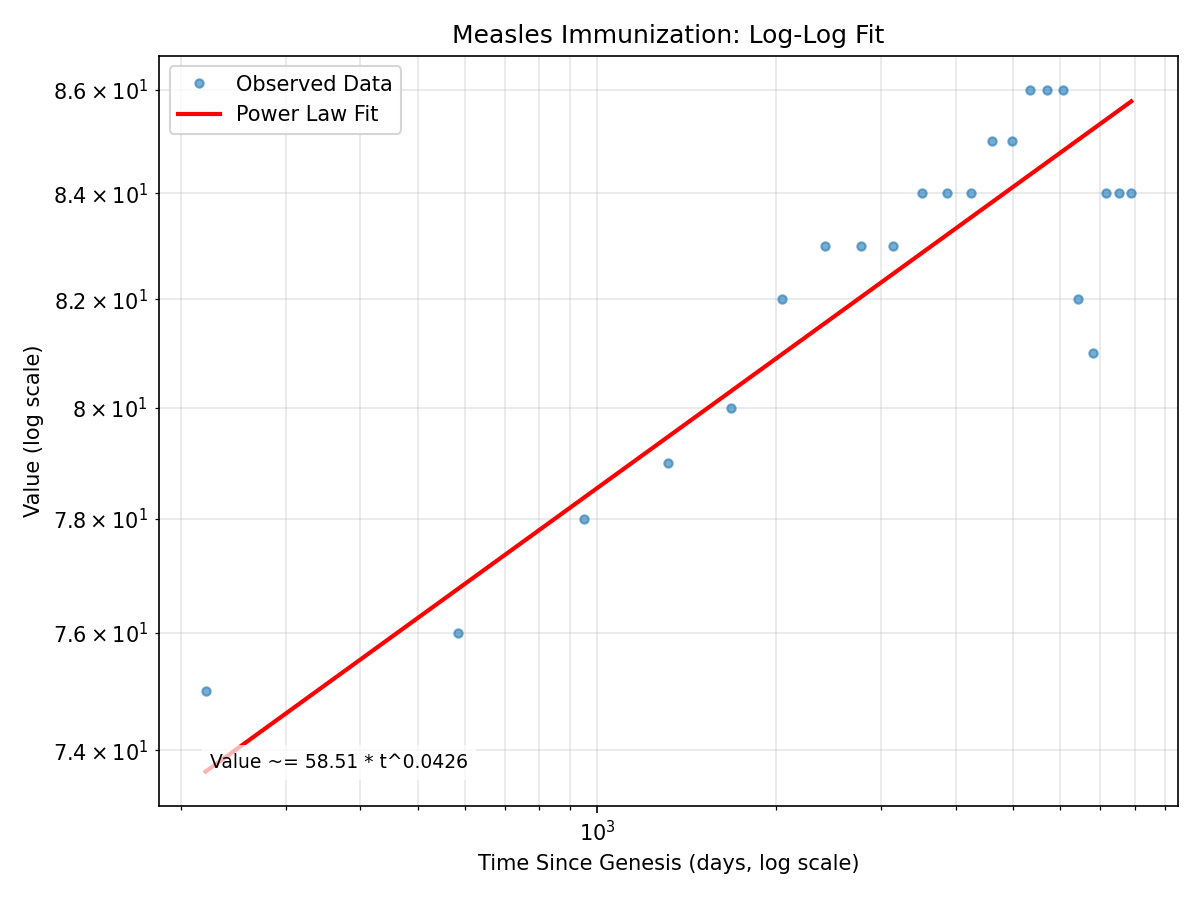

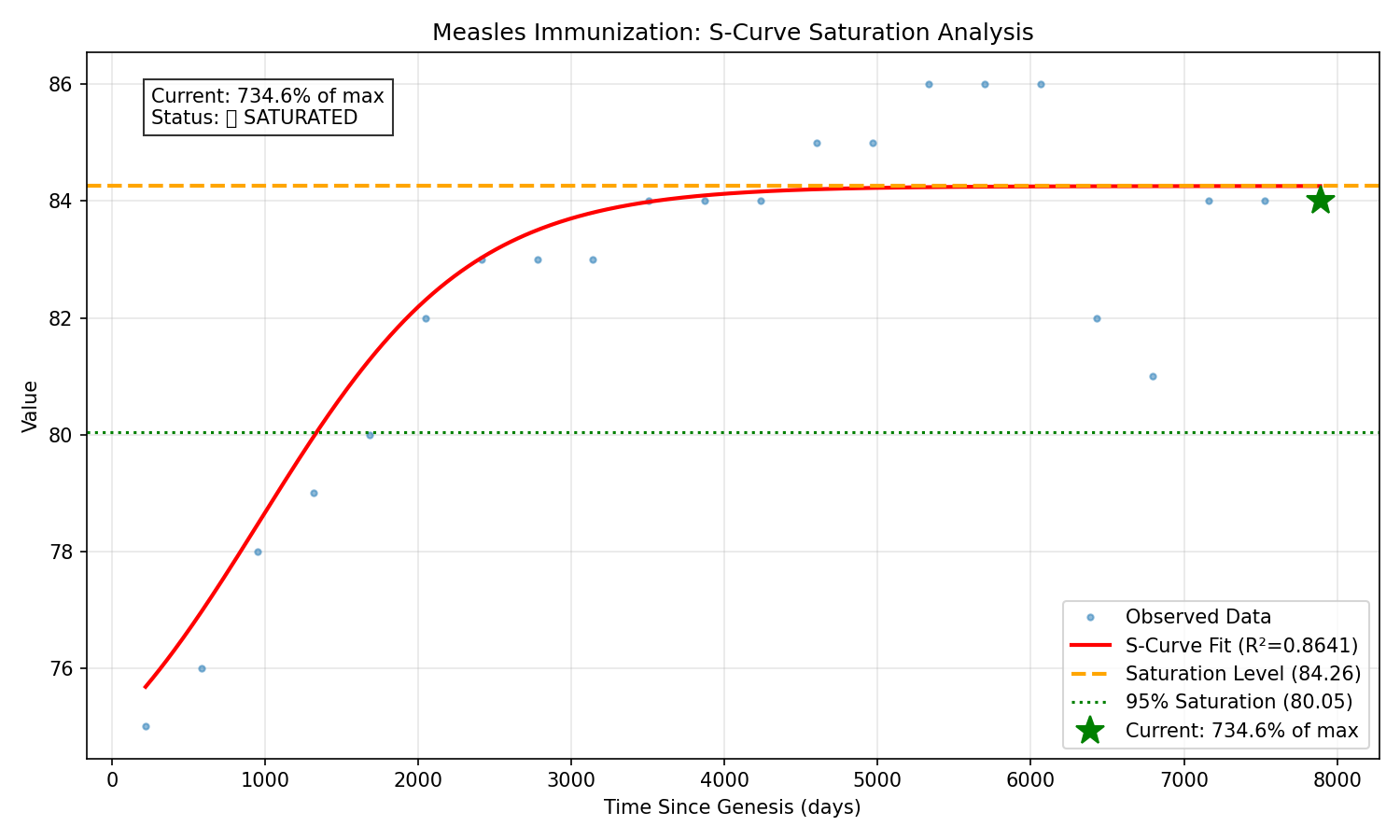

Measles Immunization

**R² (Scale Invariance):** 0.6815

**Power Law Exponent:** 0.04

**Data Points:** 22

**Date Range:** 2003-01-01 to 2024-01-01

**Log Residual Std Dev:** 0.0186

**Data Source:** WHO API (WHS4_544)

**Genesis Date:** 2002-05-26 (Optimized vs published)

**Power Law Fit:** Value ~= 58.51 * t^0.0426

Saturation Analysis (S-Curve Detection):

**📈 S-CURVE DETECTED** (Sigmoid R² = 0.8641 vs Linear R² = 0.5063)

**Current Progress:** 734.6% of estimated maximum

**Saturation Level:** 1.14e+01 (estimated carrying capacity)

**✅ HAS REACHED SATURATION** (≥95% of maximum)

**Growth Pattern:** Decelerating (-7.8% slowdown in recent period)

Genesis Date Optimization:

**Optimal Genesis:** 2002-05-26 (R² = 0.6767)

**Note:** No published genesis date available for comparison

**Tested:** 11 candidate dates across range 2002-05-26 to 2004-11-11

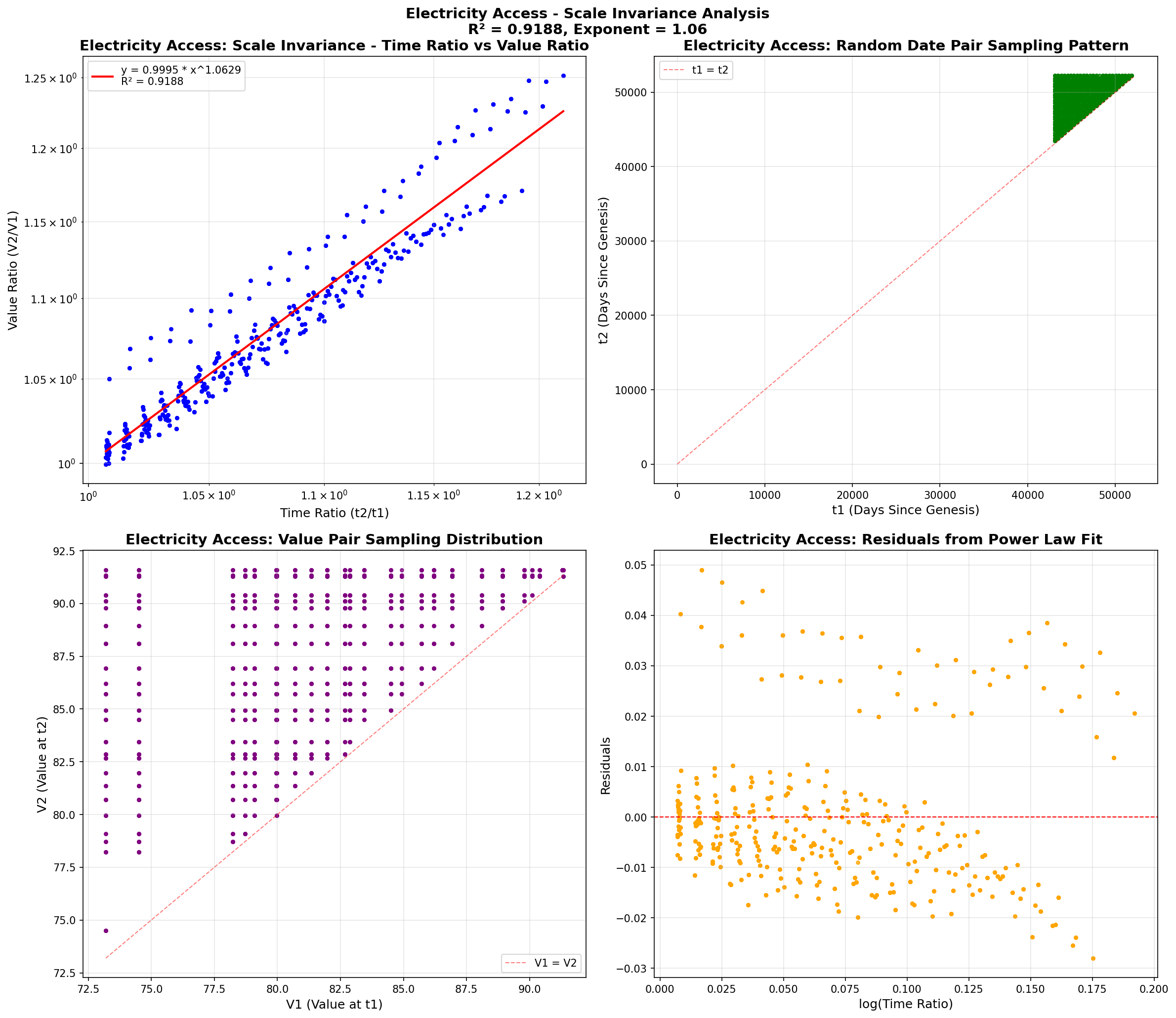

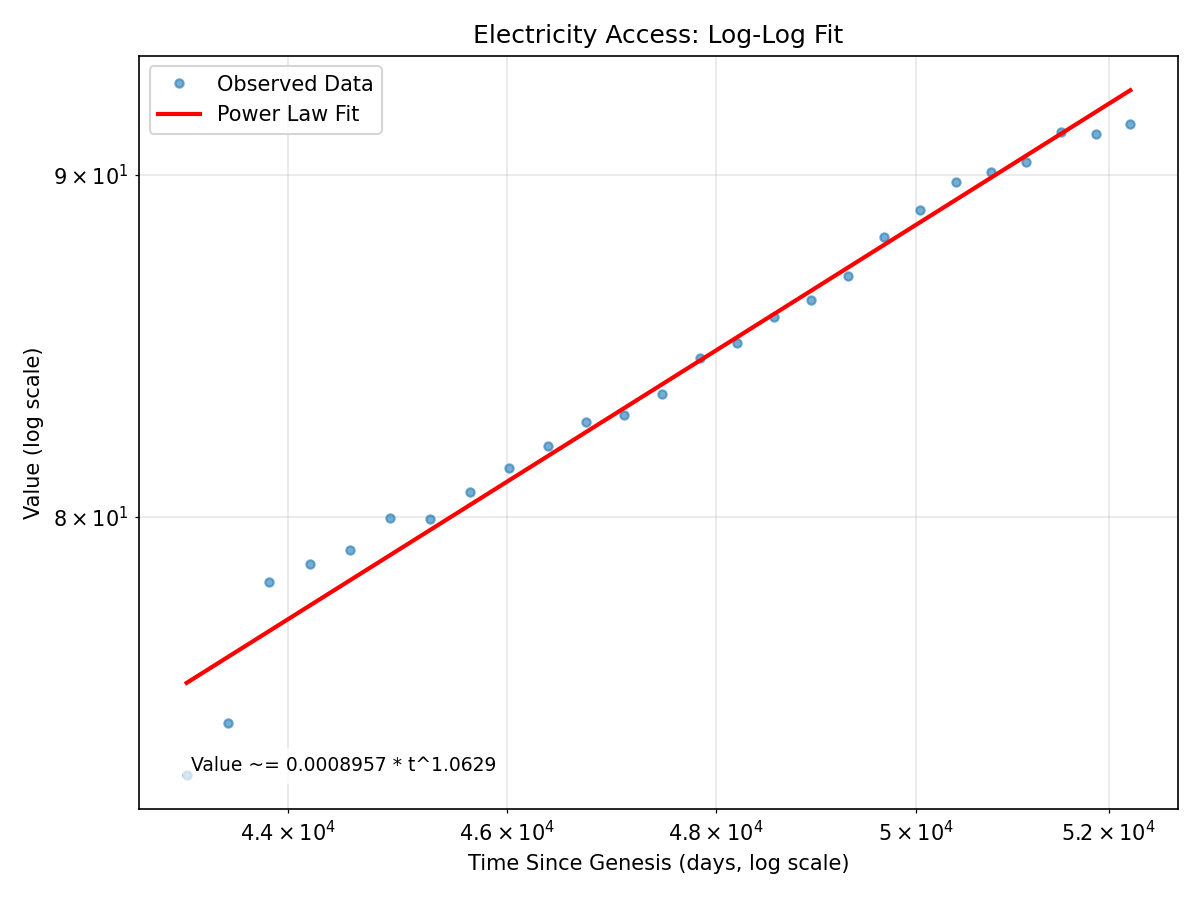

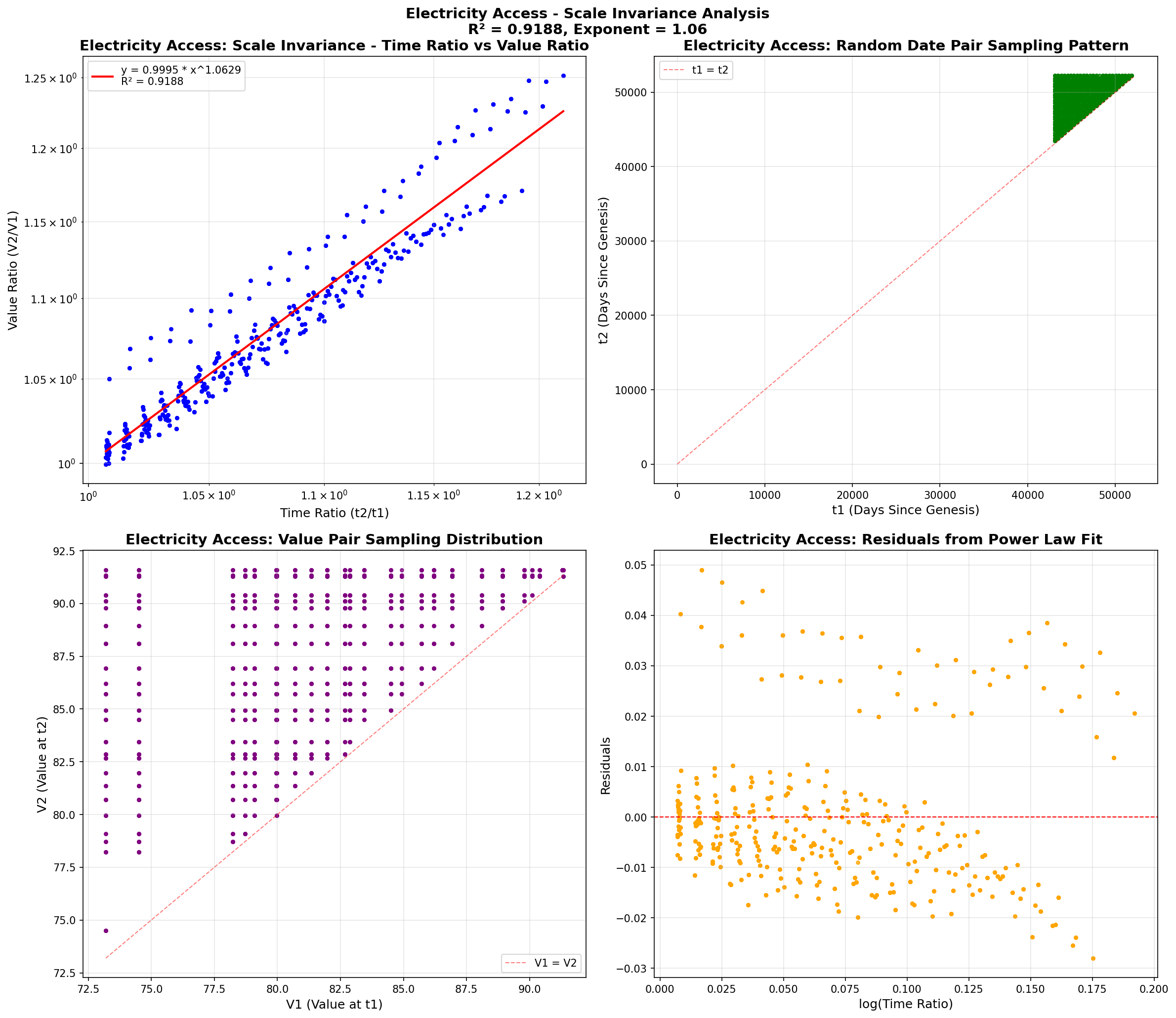

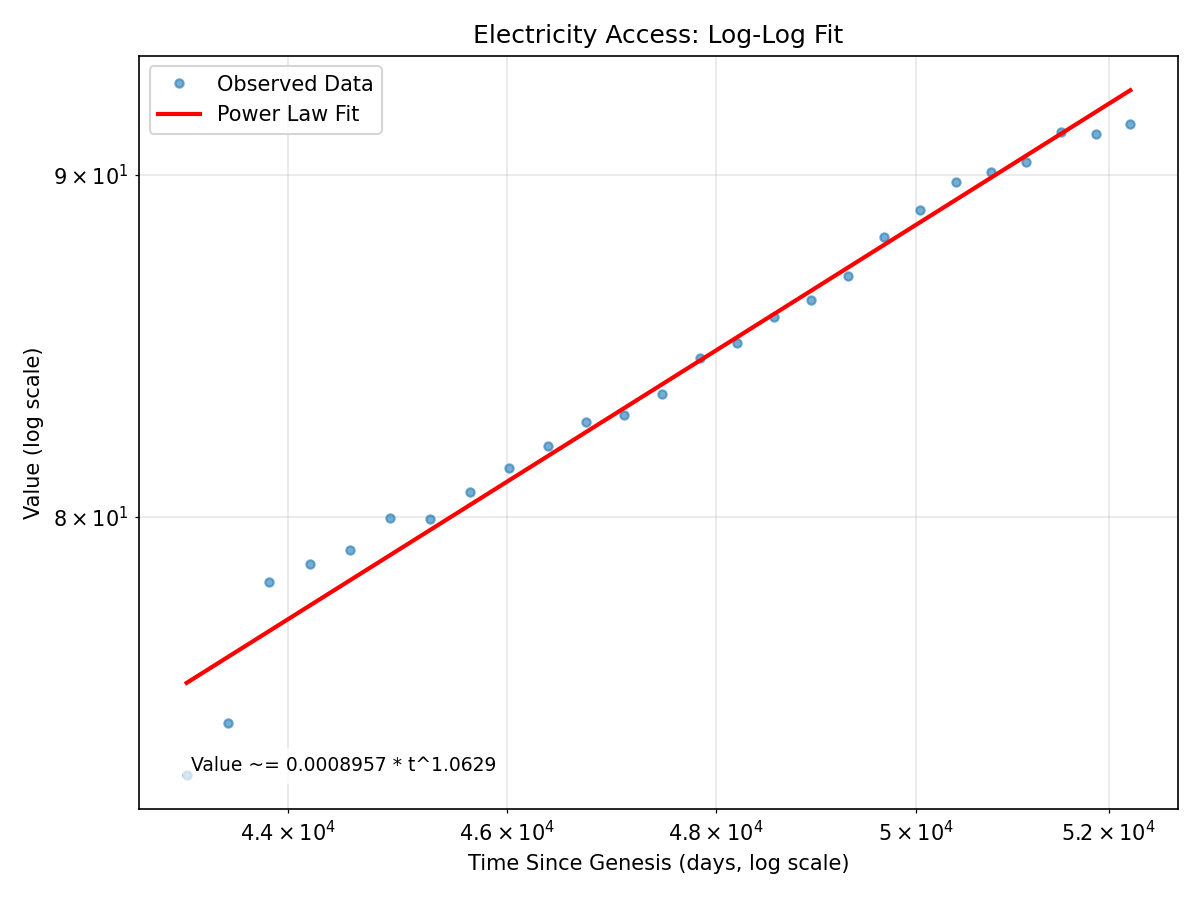

Infrastructure

Electricity Access

**R² (Scale Invariance):** 0.9188

**Power Law Exponent:** 1.06

**Data Points:** 26

**Date Range:** 1998-01-01 to 2023-01-01

**Log Residual Std Dev:** 0.0102

**Data Source:** World Bank API (EG.ELC.ACCS.ZS)

**Genesis Date:** 1880-01-01 (Provided)

**Power Law Fit:** Value ~= 0.0008957 * t^1.0629

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.9805 vs Linear R²: 0.9766

**Current Value:** 0.5% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

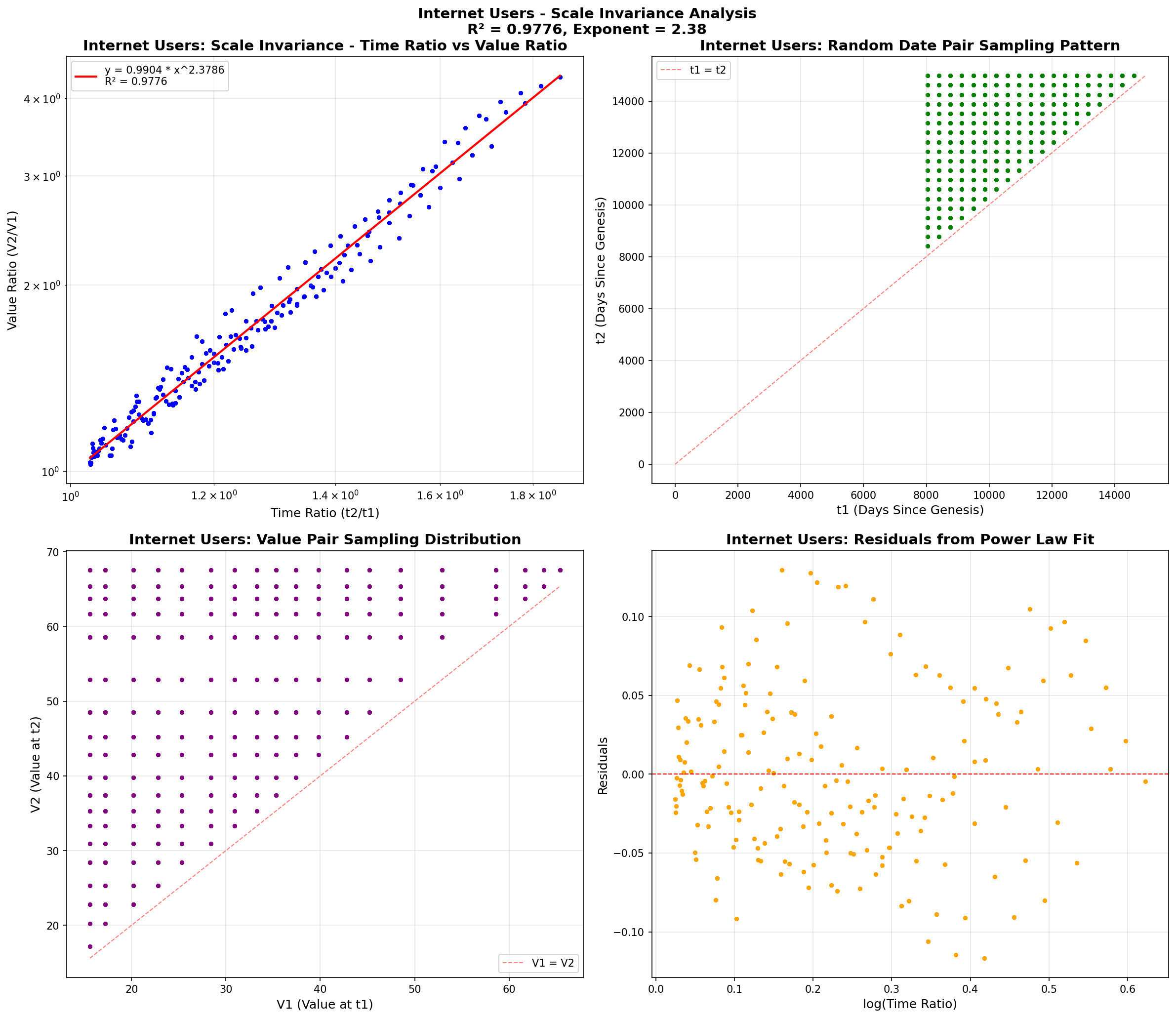

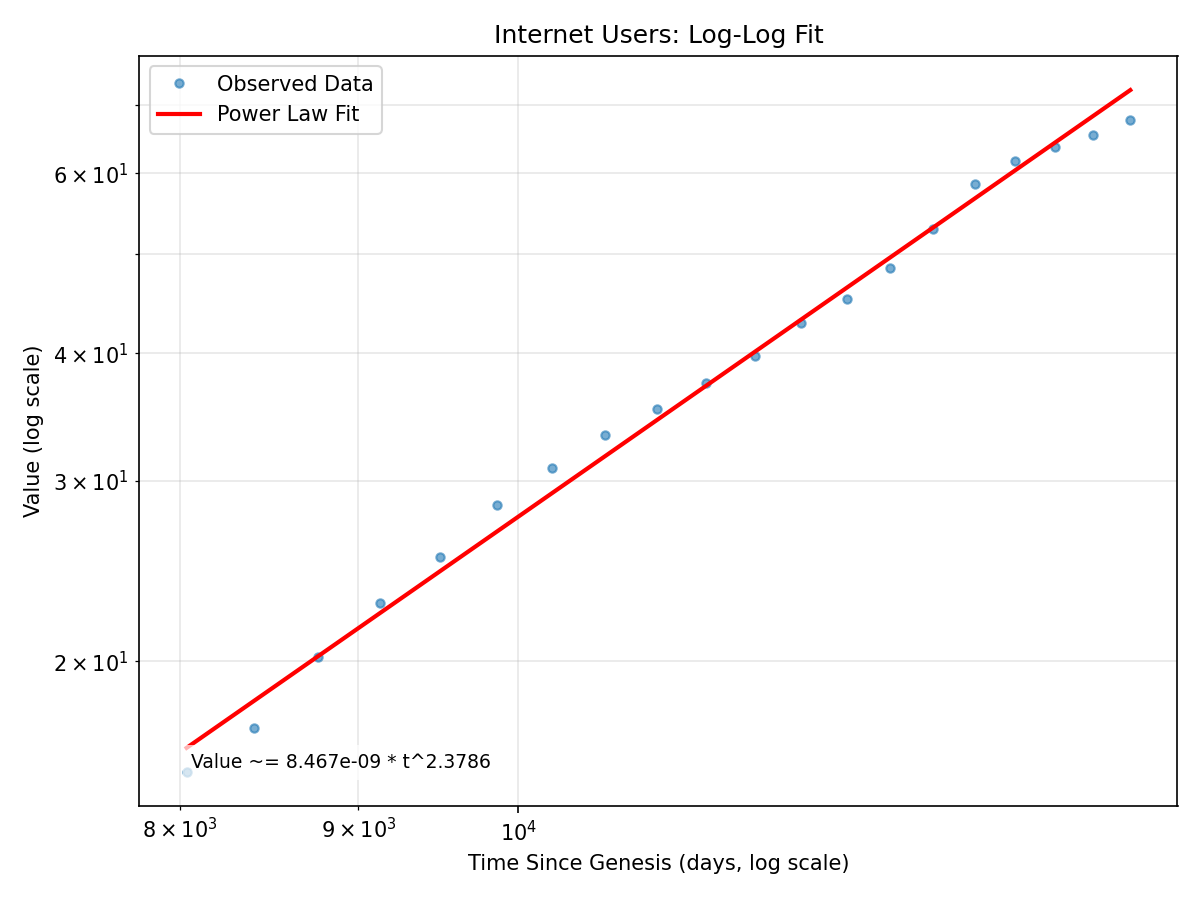

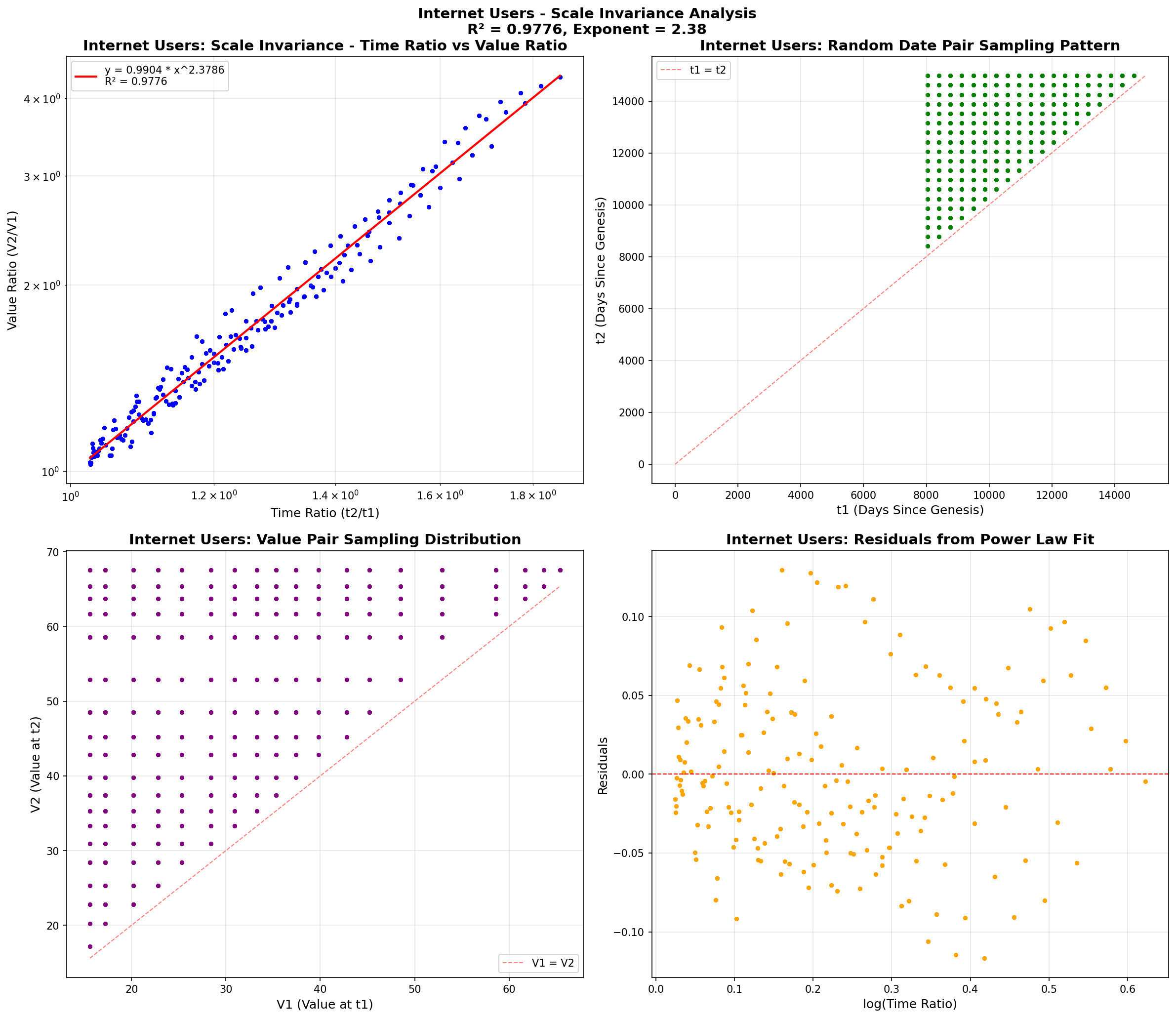

Technology

Internet Users

**R² (Scale Invariance):** 0.9776

**Power Law Exponent:** 2.38

**Data Points:** 20

**Date Range:** 2005-01-01 to 2024-01-01

**Log Residual Std Dev:** 0.0368

**Data Source:** World Bank API (IT.NET.USER.ZS)

**Genesis Date:** 1983-01-01 (Provided)

**Power Law Fit:** Value ~= 8.467e-09 * t^2.3786

Saturation Analysis (S-Curve Detection):

**⚡ POWER-LAW GROWTH** (Not saturating)

**Sigmoid R²:** 0.9951 vs Linear R²: 0.9913

**Current Value:** 40.4% of sigmoid model maximum

**Assessment:** No evidence of saturation or S-curve behavior

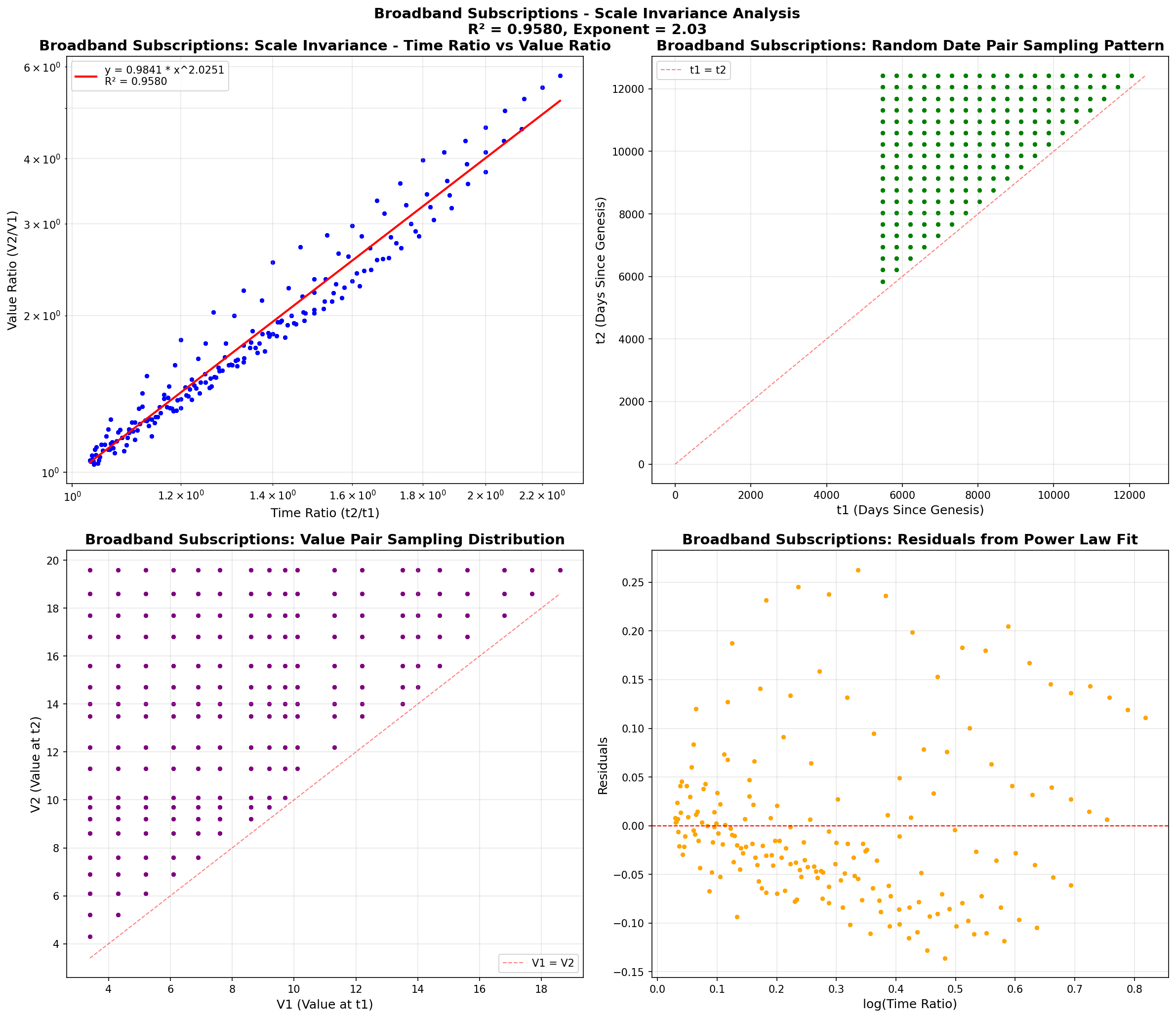

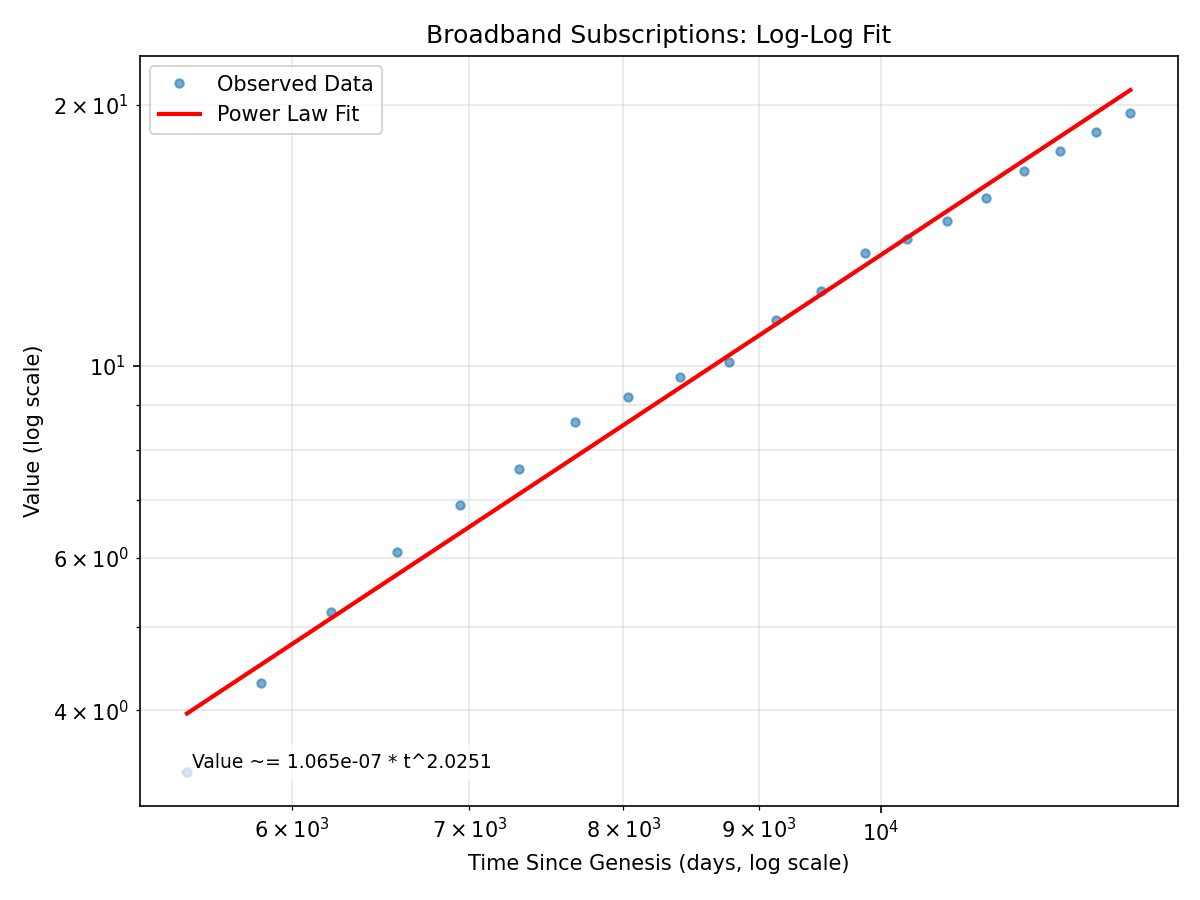

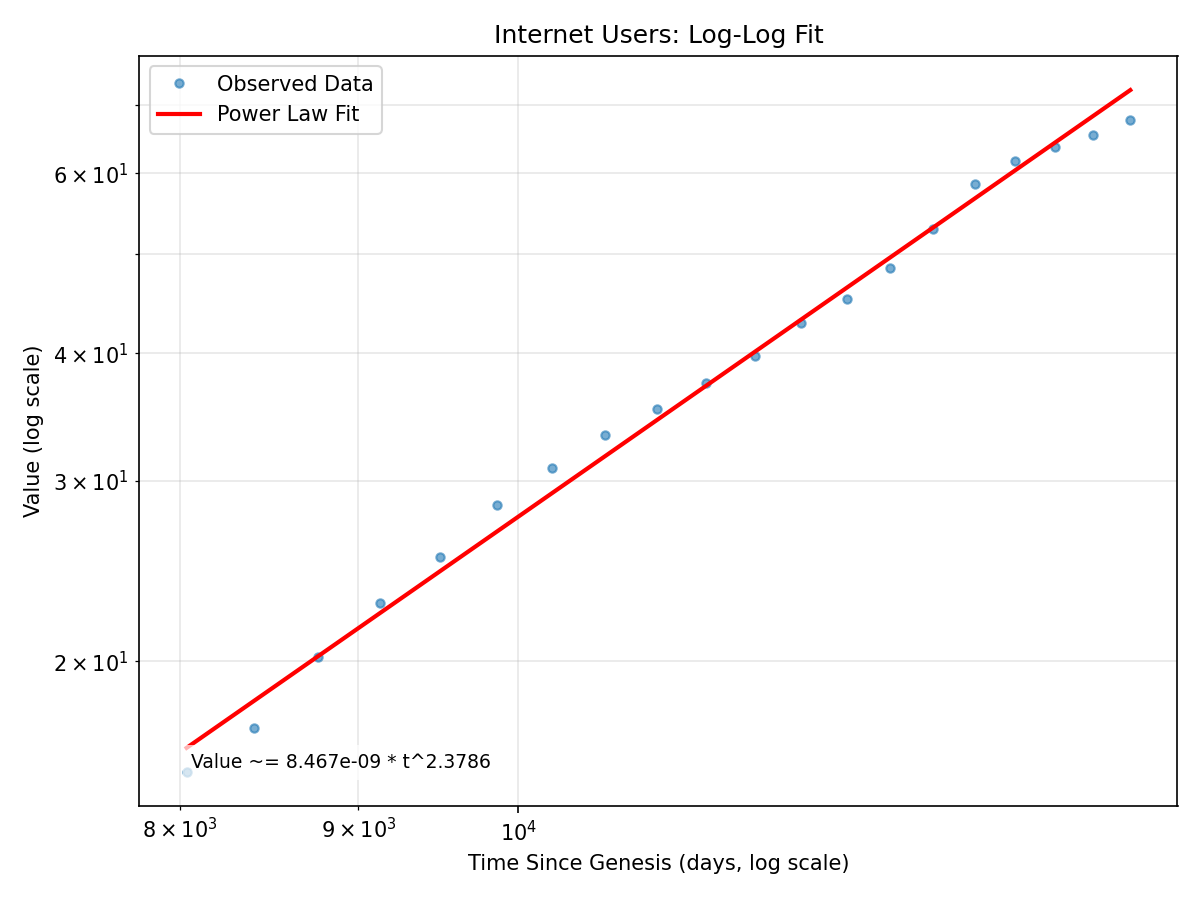

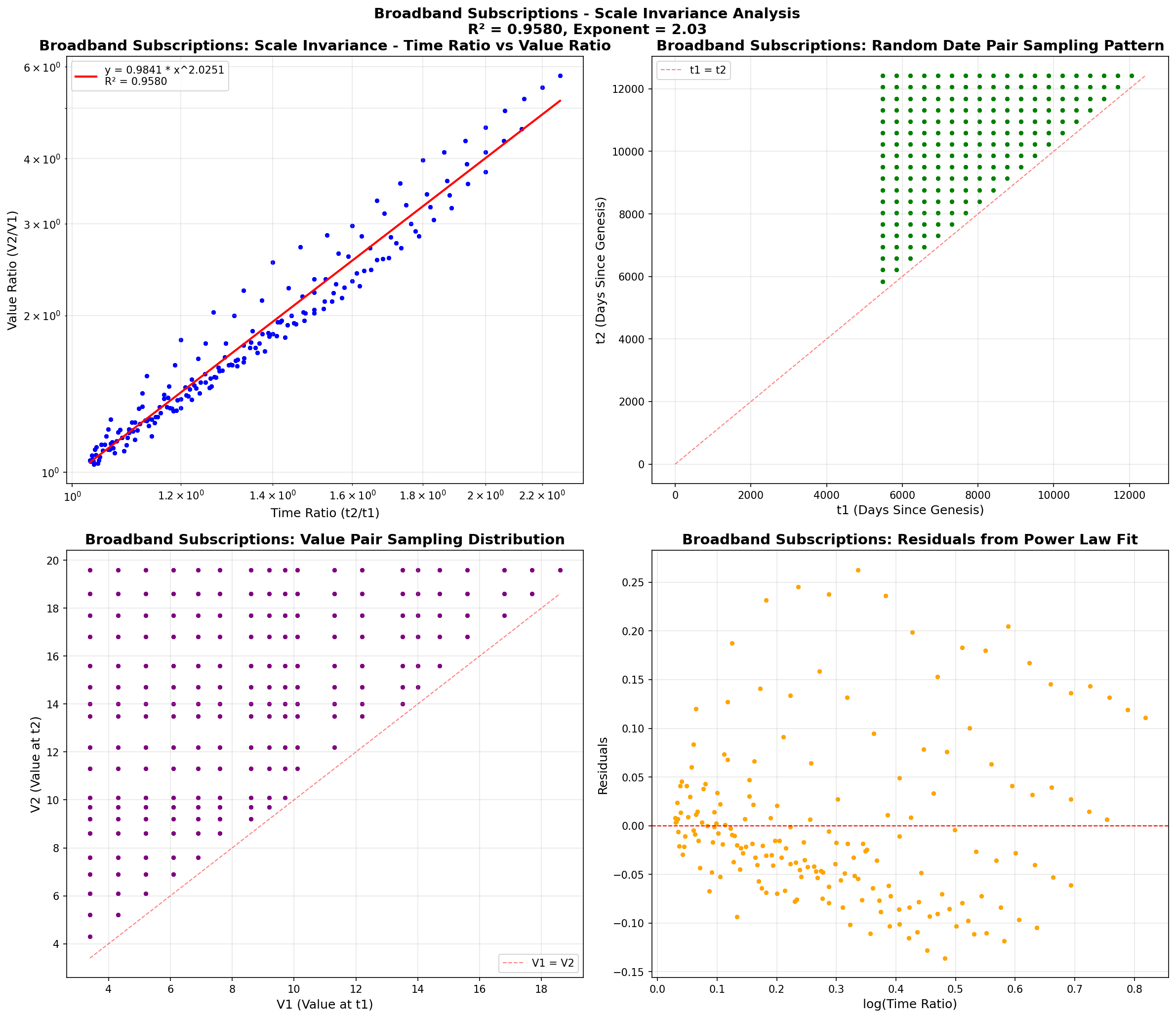

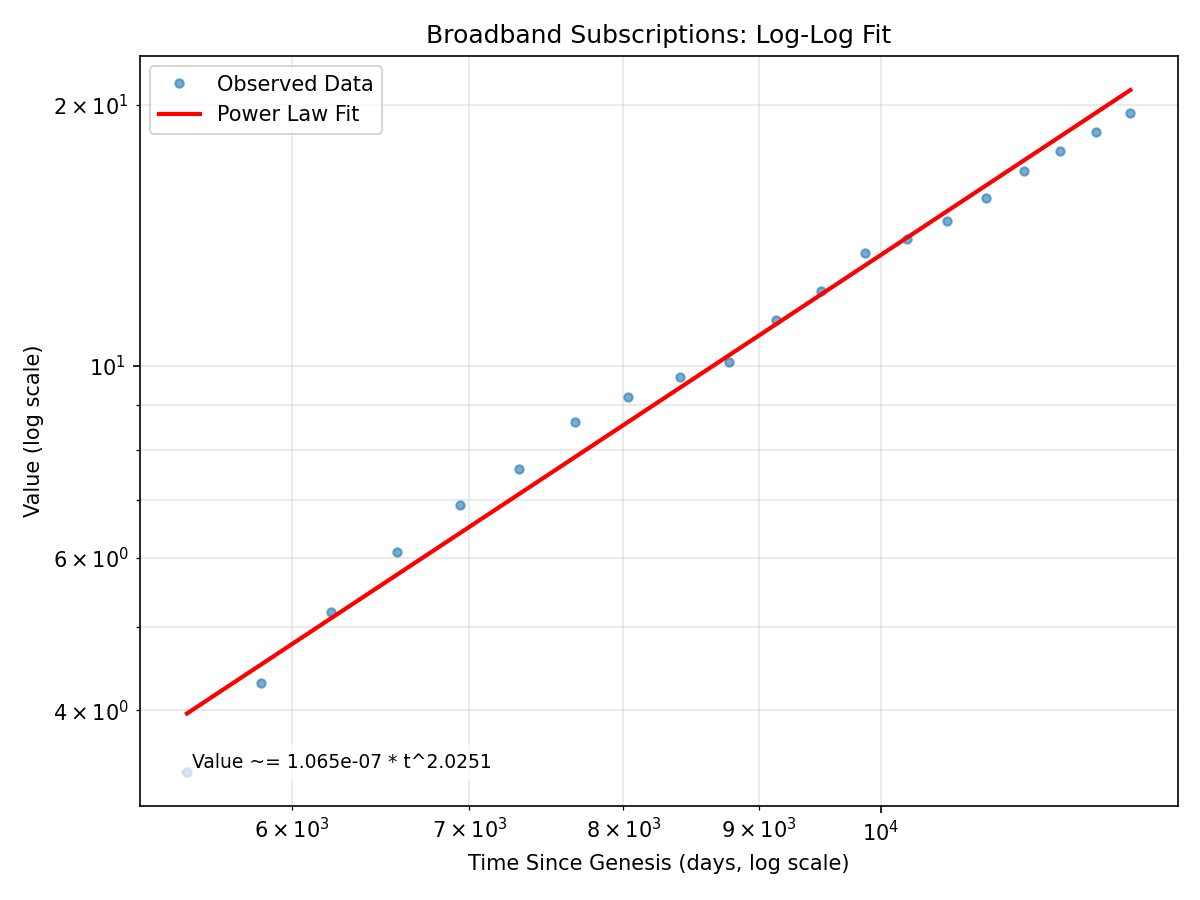

Broadband Subscriptions

**R² (Scale Invariance):** 0.9580

**Power Law Exponent:** 2.03

**Data Points:** 20

**Date Range:** 2005-01-01 to 2024-01-01

**Log Residual Std Dev:** 0.0575

**Data Source:** World Bank API (IT.NET.BBND.P2)

**Genesis Date:** 1990-01-01 (Provided)

**Power Law Fit:** Value ~= 1.065e-07 * t^2.0251

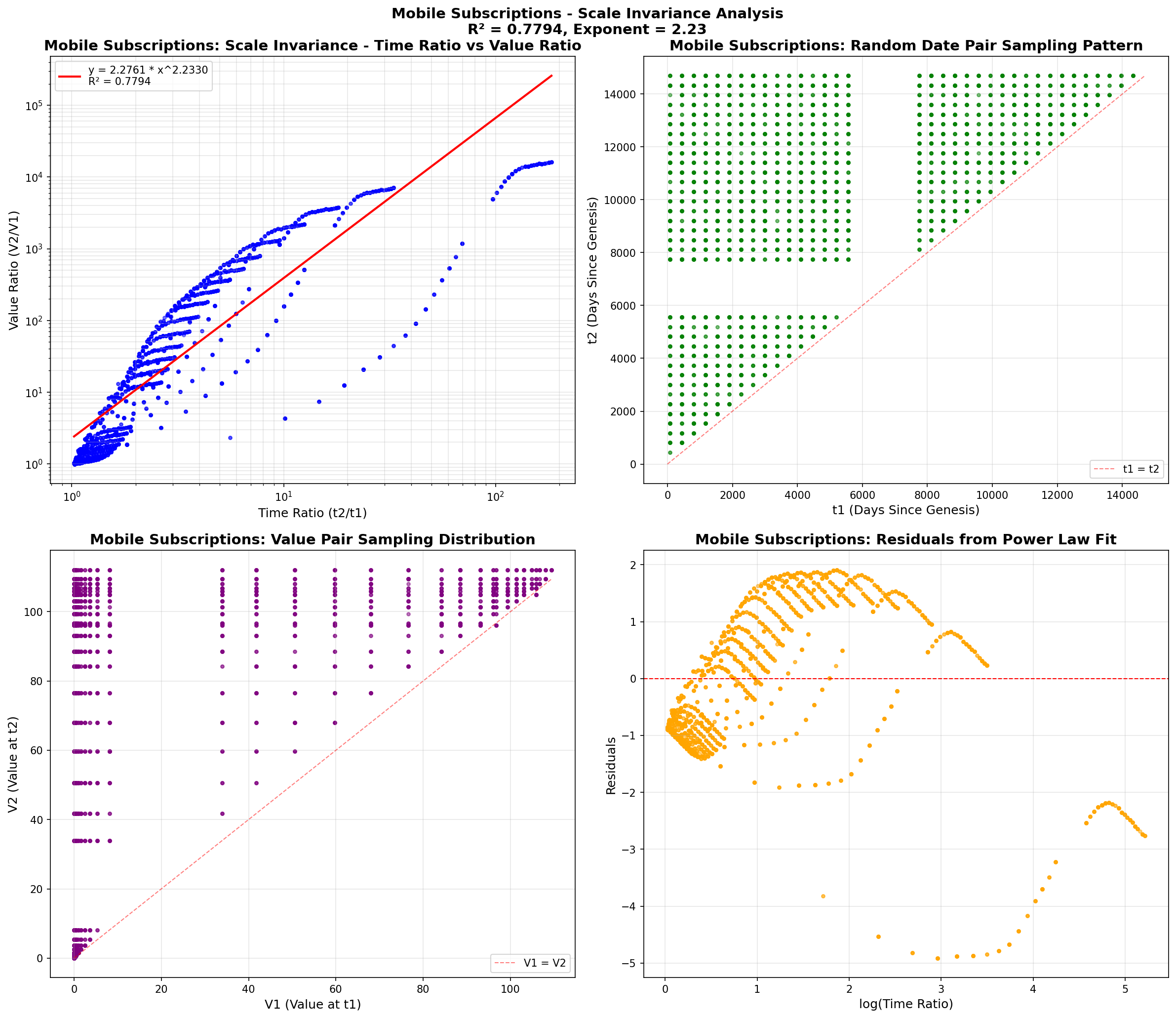

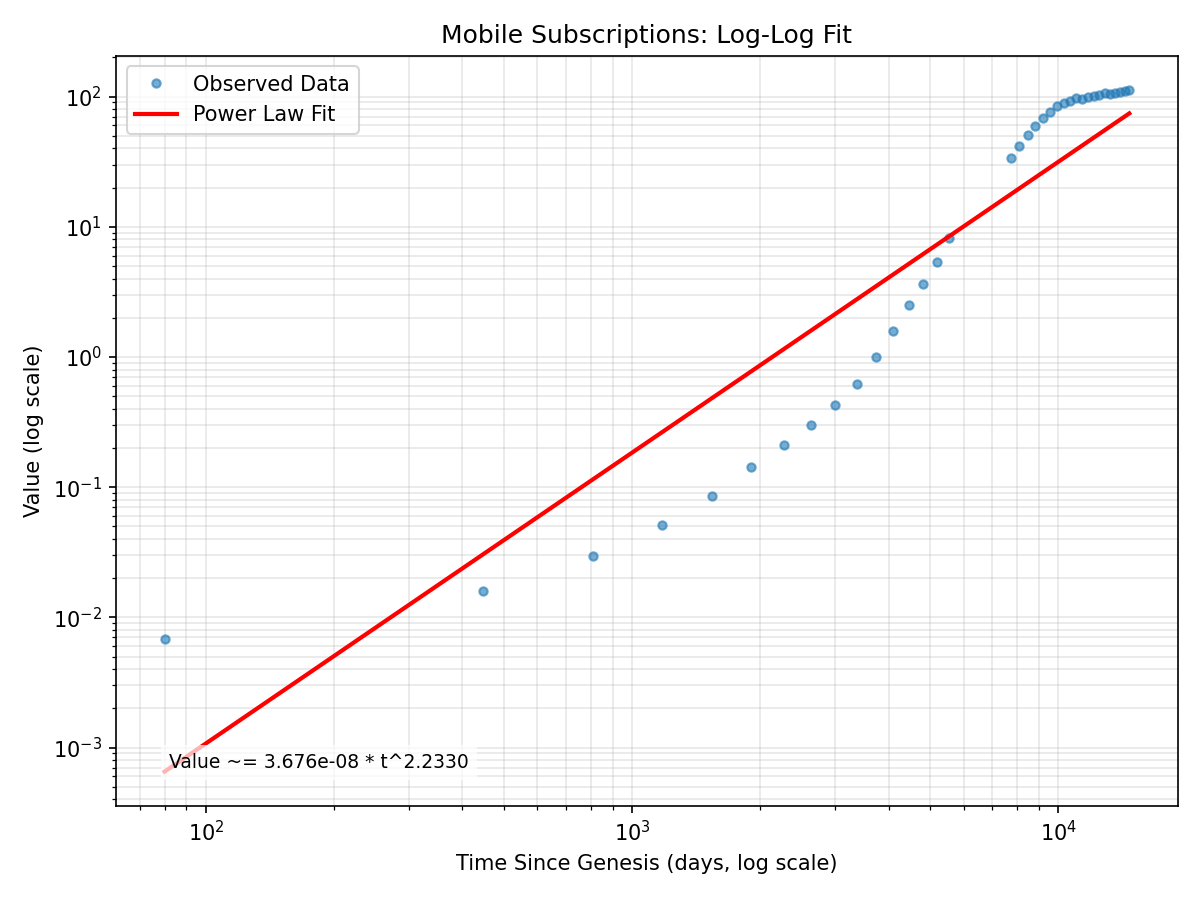

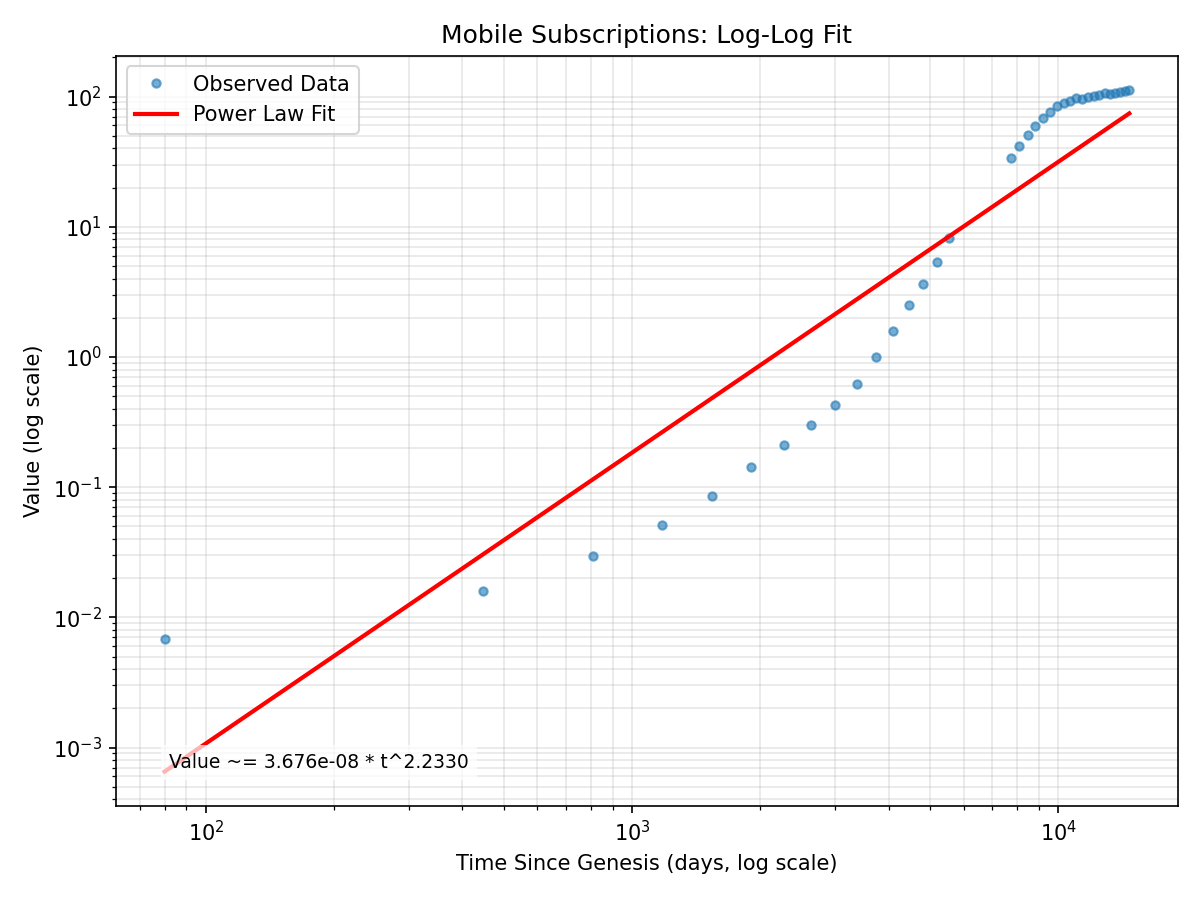

Mobile Subscriptions

**R² (Scale Invariance):** 0.7794

**Power Law Exponent:** 2.23

**Data Points:** 36

**Date Range:** 1984-01-01 to 2024-01-01

**Log Residual Std Dev:** 1.0850

**Data Source:** World Bank API (IT.CEL.SETS.P2)

**Genesis Date:** 1983-10-13 (Provided)

**Power Law Fit:** Value ~= 3.676e-08 * t^2.2330

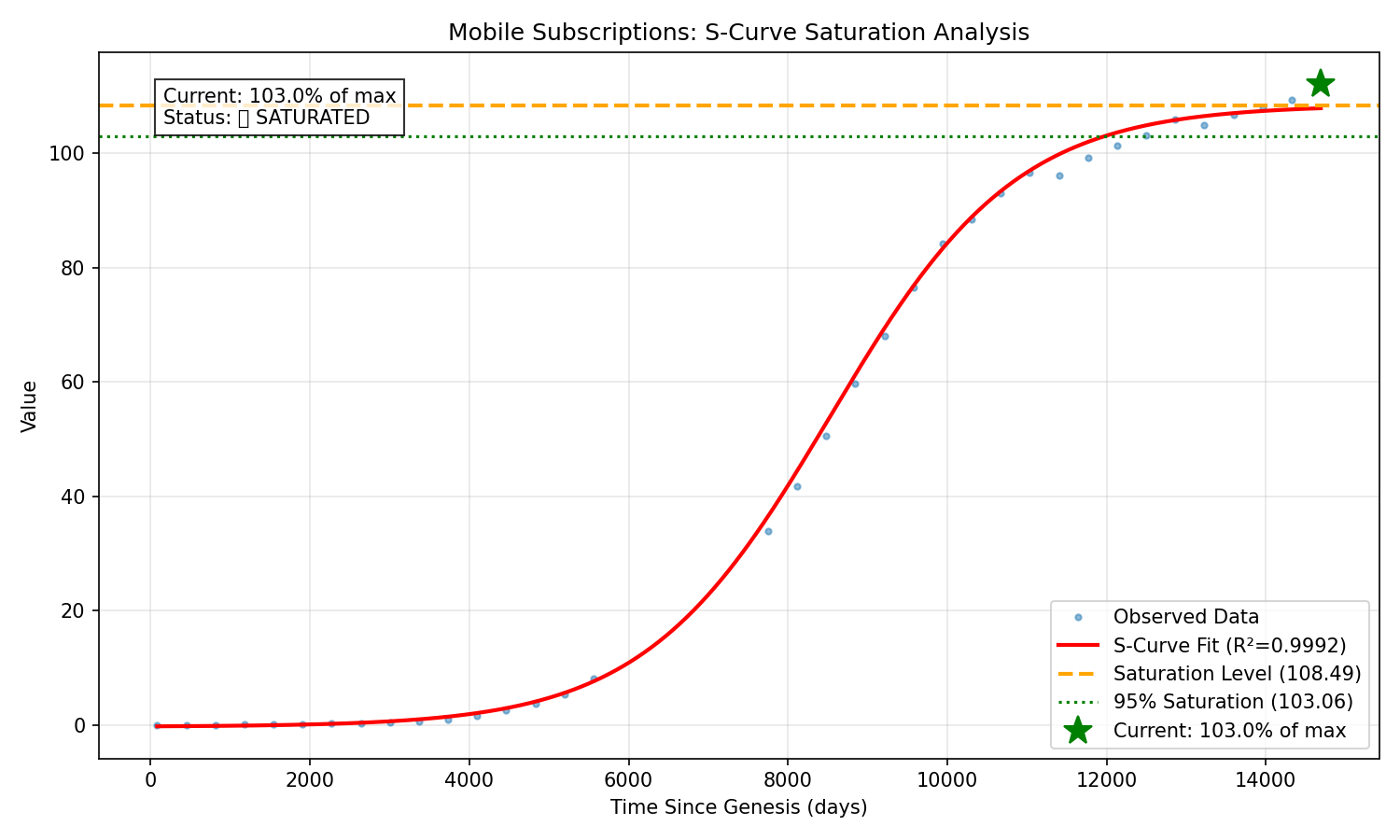

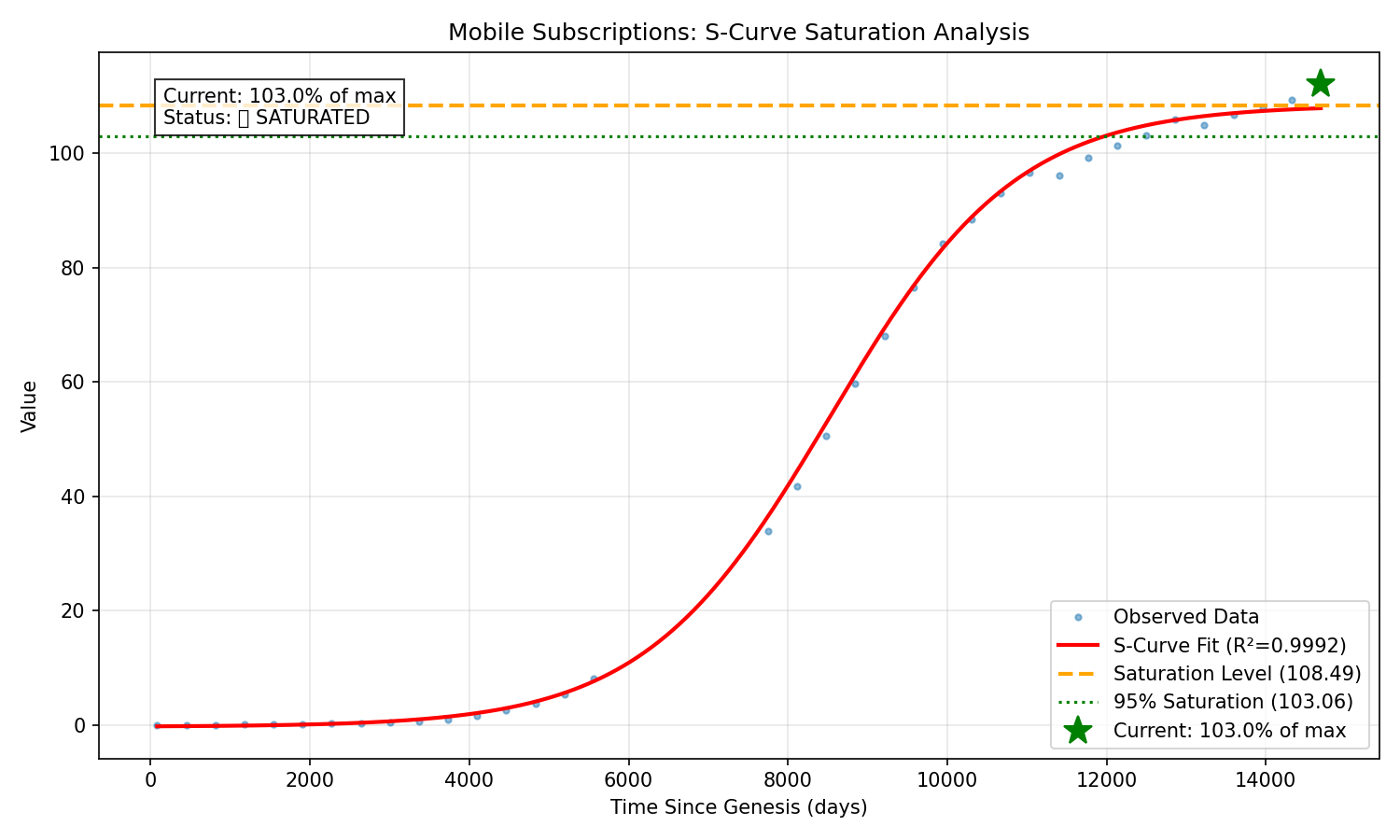

Saturation Analysis (S-Curve Detection):

**📈 S-CURVE DETECTED** (Sigmoid R² = 0.9992 vs Linear R² = 0.9330)

**Current Progress:** 103.0% of estimated maximum

**Saturation Level:** 1.09e+02 (estimated carrying capacity)

**✅ HAS REACHED SATURATION** (≥95% of maximum)

**Growth Pattern:** Decelerating (61.4% slowdown in recent period)

Data Sources

All data downloaded from live APIs:

**Yahoo Finance API**: Financial assets (stocks, crypto, ETFs)

Data cached in `data_cache/` directory

Each cache file includes metadata with source URL and download date

Methodology

Scale invariance is measured by:

1. Selecting random pairs of dates (t₁, t₂)

2. Computing time_ratio = (t₂ - t₀) / (t₁ - t₀)

3. Computing value_ratio = V(t₂) / V(t₁)

4. Fitting power law in log-log space

5. Measuring R² (goodness of fit)

High R² (>0.95) indicates true scale invariance and power law behavior.